Federal State Employment Taxes FSET IDES Illinois Gov 2022

Understanding the Federal State Employment Taxes FSET

The Federal State Employment Taxes (FSET) are essential for employers operating in Illinois. These taxes are collected to fund various state and federal programs, including unemployment insurance and social security. Employers must understand their obligations under these tax regulations to ensure compliance and avoid penalties. The Illinois Department of Employment Security (IDES) oversees the collection and management of these taxes.

Steps to Complete the Federal State Employment Taxes FSET

Completing the FSET involves several key steps to ensure accuracy and compliance. First, employers must gather necessary information, including employee wages and hours worked. Next, they should calculate the appropriate tax amounts based on current rates. Once calculations are complete, employers can fill out the required forms, ensuring all information is accurate. Finally, submit the forms to the IDES by the specified deadlines, either online or via mail.

Legal Use of the Federal State Employment Taxes FSET

Employers must adhere to legal requirements when dealing with FSET. This includes timely payment of taxes and accurate reporting of employee wages. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is crucial for employers to stay informed about any changes in tax laws or rates to maintain compliance.

Filing Deadlines and Important Dates

Filing deadlines for the FSET are critical for employers to meet. Typically, these deadlines align with quarterly reporting periods. Employers should mark their calendars for the specific due dates to avoid late submissions. Missing a deadline can lead to penalties, so it is advisable to submit forms well in advance of the due date.

Required Documents for FSET Submission

When submitting the FSET, employers must include specific documents to ensure their filings are complete. This often includes payroll records, employee tax forms, and any additional documentation required by the IDES. Having these documents prepared in advance can streamline the submission process and reduce the likelihood of errors.

Penalties for Non-Compliance with FSET Regulations

Non-compliance with FSET regulations can result in significant penalties for employers. These may include monetary fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance is essential for employers to avoid financial setbacks and maintain good standing with the IDES.

Eligibility Criteria for FSET

To be subject to FSET, employers must meet certain eligibility criteria. This typically includes having employees who are subject to Illinois wage laws and meeting specific revenue thresholds. Employers should review the criteria set forth by the IDES to determine their obligations regarding FSET.

Quick guide on how to complete federal state employment taxes fset ides illinoisgov

Complete Federal State Employment Taxes FSET IDES Illinois gov smoothly on any gadget

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without any hold-ups. Manage Federal State Employment Taxes FSET IDES Illinois gov on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related processes today.

How to modify and eSign Federal State Employment Taxes FSET IDES Illinois gov with ease

- Obtain Federal State Employment Taxes FSET IDES Illinois gov and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Federal State Employment Taxes FSET IDES Illinois gov to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct federal state employment taxes fset ides illinoisgov

Create this form in 5 minutes!

How to create an eSignature for the federal state employment taxes fset ides illinoisgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

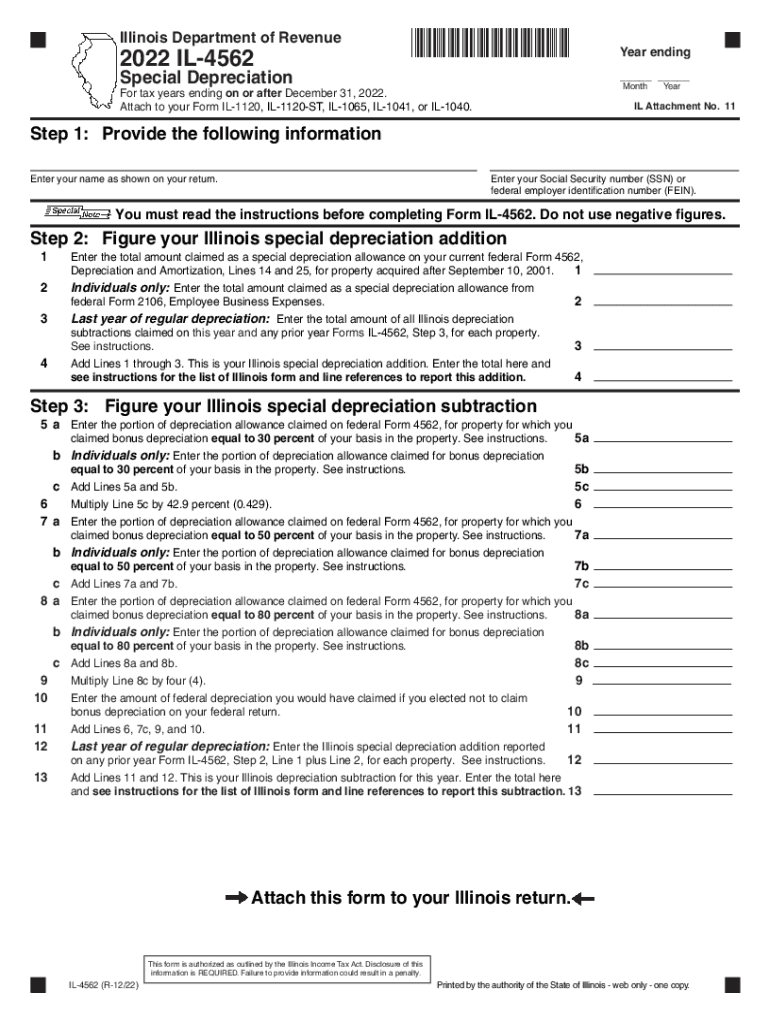

What is the Illinois special form used for?

The Illinois special form is designed to help businesses streamline their document signing processes. It can be utilized for various legal agreements, contracts, and other essential business documents, ensuring compliance with state regulations.

-

How does airSlate SignNow integrate with the Illinois special form?

airSlate SignNow offers seamless integration capabilities for the Illinois special form, making it easy to send and eSign documents. Users can quickly access and manage their forms within the SignNow platform, enhancing efficiency and productivity.

-

What are the pricing options for using the Illinois special form with airSlate SignNow?

airSlate SignNow provides various pricing plans that cater to different business needs, including accessibility to the Illinois special form. These plans are cost-effective, allowing users to choose the option that best fits their budget and requirements.

-

What features does airSlate SignNow offer for the Illinois special form?

With airSlate SignNow, users can enjoy features like document templates, real-time tracking, and secure electronic signatures specifically for the Illinois special form. This ensures a smooth signing experience while maintaining compliance and security.

-

Can I customize the Illinois special form in airSlate SignNow?

Yes, airSlate SignNow allows users to customize the Illinois special form according to their specific needs. You can easily add fields, modify layouts, and ensure that all necessary information is captured efficiently for your business needs.

-

Is the Illinois special form legally binding when signed via airSlate SignNow?

Absolutely! The Illinois special form signed through airSlate SignNow is legally binding, compliant with eSignature laws. This gives businesses peace of mind knowing that their electronically signed documents hold the same legal weight as traditional signatures.

-

What benefits does using airSlate SignNow provide for the Illinois special form?

Using airSlate SignNow for the Illinois special form streamlines the signing process, reducing paperwork and saving time. It enhances collaboration among teams and clients while ensuring that all signatures and documents are stored securely.

Get more for Federal State Employment Taxes FSET IDES Illinois gov

Find out other Federal State Employment Taxes FSET IDES Illinois gov

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document