FORM CT 990T FTP Directory Listing 2022-2026

What is the FORM CT 990T FTP Directory Listing

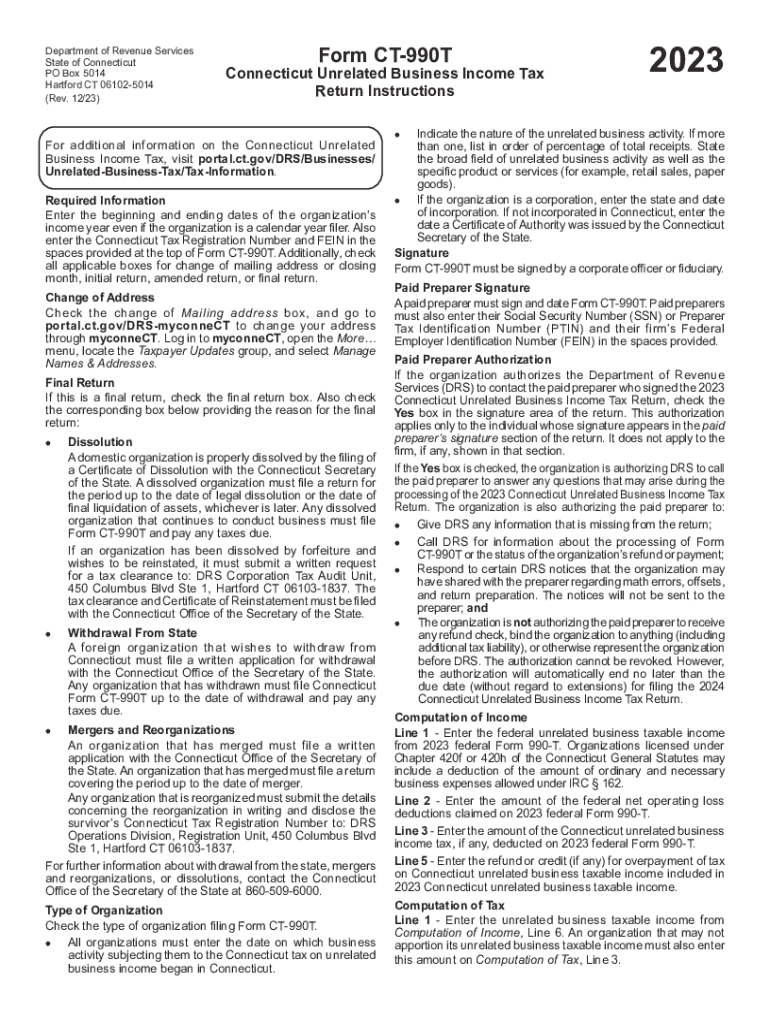

The FORM CT 990T FTP Directory Listing is a specific tax form used by organizations in the United States to report unrelated business income. This form is primarily relevant for tax-exempt entities, such as charities and non-profits, that engage in business activities not directly related to their exempt purpose. The purpose of this form is to ensure compliance with IRS regulations regarding the taxation of income generated from activities that do not align with the entity's primary mission.

How to use the FORM CT 990T FTP Directory Listing

Using the FORM CT 990T FTP Directory Listing involves several steps. First, organizations must determine if they have any unrelated business income that needs to be reported. If applicable, they should gather the necessary financial information related to this income. The form requires detailed reporting of revenue, expenses, and the nature of the business activities. Once completed, the form can be submitted electronically or by mail, depending on the organization's preference and IRS guidelines.

Steps to complete the FORM CT 990T FTP Directory Listing

Completing the FORM CT 990T FTP Directory Listing involves a systematic approach:

- Identify unrelated business income sources.

- Collect financial records related to these income sources.

- Fill out the form with accurate revenue and expense figures.

- Review the form for completeness and accuracy.

- Submit the form by the designated deadline, either electronically or by mail.

Filing Deadlines / Important Dates

Filing deadlines for the FORM CT 990T FTP Directory Listing are crucial for compliance. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this typically means a May 15 deadline. It is important to check for any extensions or specific state requirements that may affect the filing date.

Required Documents

To successfully complete the FORM CT 990T FTP Directory Listing, organizations need to gather several documents:

- Financial statements detailing unrelated business income.

- Expense records related to the business activities.

- Previous year’s tax returns, if applicable.

- Any additional documentation that supports the income and expense claims.

Penalties for Non-Compliance

Failure to file the FORM CT 990T FTP Directory Listing or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, organizations may risk losing their tax-exempt status if they consistently fail to comply with reporting requirements. It is essential for organizations to adhere to the guidelines to avoid these consequences.

Quick guide on how to complete form ct 990t ftp directory listing

Complete FORM CT 990T FTP Directory Listing effortlessly on any device

Online document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and smoothly. Manage FORM CT 990T FTP Directory Listing on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign FORM CT 990T FTP Directory Listing easily

- Locate FORM CT 990T FTP Directory Listing and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign function, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details, then press the Done button to store your changes.

- Select your preferred method to share your form, whether through email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunts, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign FORM CT 990T FTP Directory Listing to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ct 990t ftp directory listing

Create this form in 5 minutes!

How to create an eSignature for the form ct 990t ftp directory listing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FORM CT 990T FTP Directory Listing?

The FORM CT 990T FTP Directory Listing is a critical document used by organizations to report unrelated business income tax to the state of Connecticut. It provides transparency and helps ensure compliance with tax regulations, allowing businesses to accurately manage their tax obligations.

-

How does airSlate SignNow facilitate the FORM CT 990T FTP Directory Listing process?

airSlate SignNow simplifies the process of handling the FORM CT 990T FTP Directory Listing by enabling users to eSign and send documents securely. With our user-friendly interface, you can easily upload and manage your tax documents, ensuring they are prepared and submitted accurately.

-

What features do airSlate SignNow offer to assist with FORM CT 990T FTP Directory Listing?

airSlate SignNow offers robust features like customizable templates, advanced workflow automation, and secure eSigning capabilities to streamline the FORM CT 990T FTP Directory Listing process. These features enhance your efficiency and help ensure that your tax documents are always compliant.

-

Is airSlate SignNow a cost-effective solution for managing FORM CT 990T FTP Directory Listing?

Yes, airSlate SignNow provides a cost-effective solution for managing your FORM CT 990T FTP Directory Listing. With flexible pricing plans and a range of features tailored for your business needs, you can save both time and money while remaining compliant with tax filing requirements.

-

Can I integrate airSlate SignNow with other software for FORM CT 990T FTP Directory Listing?

Absolutely! airSlate SignNow seamlessly integrates with various software platforms that can help you manage your FORM CT 990T FTP Directory Listing more effectively. This integration capability allows you to streamline your workflows and improve efficiency without disrupting your existing processes.

-

What are the benefits of using airSlate SignNow for FORM CT 990T FTP Directory Listing?

Using airSlate SignNow for your FORM CT 990T FTP Directory Listing comes with numerous benefits, including enhanced productivity, better document security, and easier compliance management. Our digital solution empowers businesses to focus on their core activities while ensuring that tax documents are handled properly.

-

How secure is the data managed through airSlate SignNow for FORM CT 990T FTP Directory Listing?

Data security is a priority at airSlate SignNow. We use industry-leading encryption standards and compliance protocols to ensure that all information related to your FORM CT 990T FTP Directory Listing is protected against unauthorized access, giving you peace of mind while managing sensitive documents.

Get more for FORM CT 990T FTP Directory Listing

- Domestic wire transfer form usalliance financial

- Chase loan modification number 2018 2019 form

- 107453aeschet 0119 page 1 of 12 form

- Direction of signature evantage equity trust company form

- Ira distribution request form wells fargo asset management

- Tsp 17 2015 2019 form

- Entrust group inc 2018 2019 form

- Trust certification form edward jones 2014 2019

Find out other FORM CT 990T FTP Directory Listing

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure