Portal Ct Gov DRS DRS FormsUnrelated Returns Ct 2021

What is the Portal ct gov DRS DRS FormsUnrelated Returns Ct

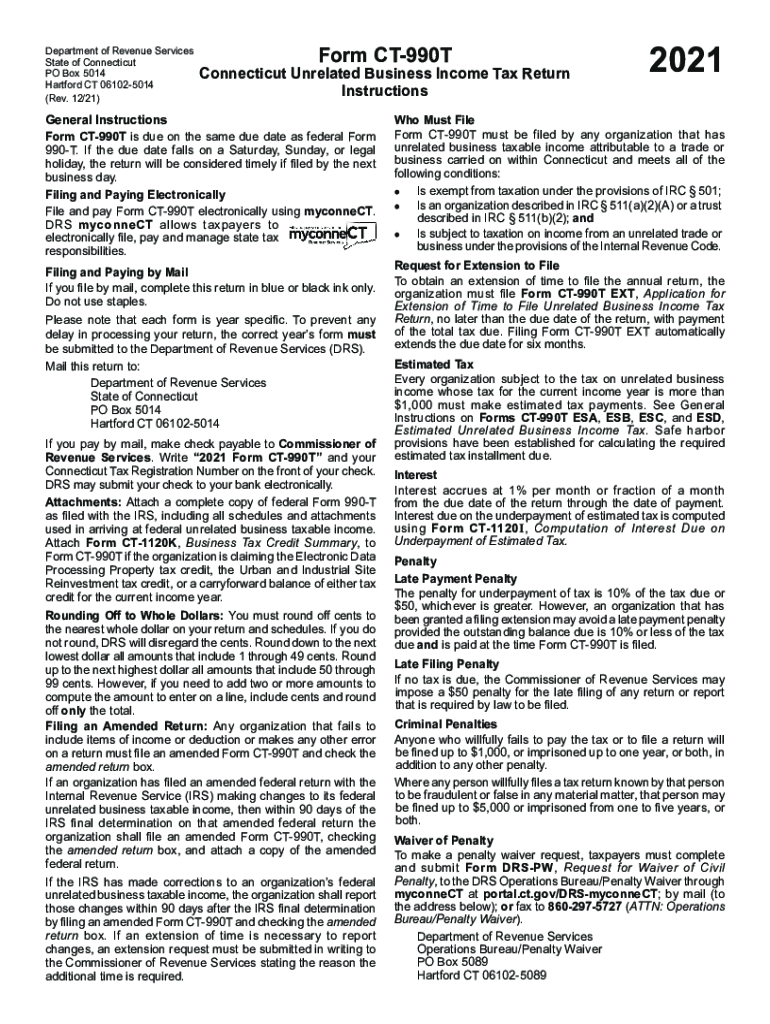

The Portal ct gov DRS DRS FormsUnrelated Returns Ct is a specific form used by taxpayers in Connecticut to report unrelated business income. This form is essential for organizations, such as nonprofits, that generate income not related to their primary purpose. Understanding this form helps ensure compliance with state tax regulations and avoids potential penalties.

How to use the Portal ct gov DRS DRS FormsUnrelated Returns Ct

Using the Portal ct gov DRS DRS FormsUnrelated Returns Ct involves several steps. First, access the form through the Connecticut Department of Revenue Services website. Next, gather the necessary financial information related to the unrelated business income. Complete the form by providing accurate details about the income, expenses, and any applicable deductions. Finally, submit the form electronically or via mail, ensuring all required signatures are included.

Steps to complete the Portal ct gov DRS DRS FormsUnrelated Returns Ct

Completing the Portal ct gov DRS DRS FormsUnrelated Returns Ct requires careful attention to detail. Follow these steps:

- Access the form from the official Connecticut DRS website.

- Collect all relevant financial documents, including income statements and expense reports.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Legal use of the Portal ct gov DRS DRS FormsUnrelated Returns Ct

The legal use of the Portal ct gov DRS DRS FormsUnrelated Returns Ct is crucial for compliance with state tax laws. This form must be filed correctly to avoid penalties and ensure that any unrelated business income is reported appropriately. Organizations must adhere to the guidelines set forth by the Connecticut Department of Revenue Services to maintain their tax-exempt status while reporting any taxable income accurately.

Required Documents

To complete the Portal ct gov DRS DRS FormsUnrelated Returns Ct, certain documents are required. These typically include:

- Financial statements detailing unrelated business income.

- Expense records related to the income-generating activities.

- Previous tax returns, if applicable, for reference.

Filing Deadlines / Important Dates

Filing deadlines for the Portal ct gov DRS DRS FormsUnrelated Returns Ct are critical for compliance. Generally, the form is due on the fifteenth day of the fourth month following the end of the organization's fiscal year. It is essential to check the Connecticut DRS website for any updates or changes to deadlines to avoid late filing penalties.

Quick guide on how to complete portalctgov drs drs formsunrelated returns ct

Complete Portal ct gov DRS DRS FormsUnrelated Returns Ct effortlessly on any device

Web-based document administration has become favored by companies and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage Portal ct gov DRS DRS FormsUnrelated Returns Ct on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign Portal ct gov DRS DRS FormsUnrelated Returns Ct with ease

- Obtain Portal ct gov DRS DRS FormsUnrelated Returns Ct and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Portal ct gov DRS DRS FormsUnrelated Returns Ct and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct portalctgov drs drs formsunrelated returns ct

Create this form in 5 minutes!

People also ask

-

What is the portal ct gov drs?

The portal ct gov drs is an online platform that allows users to access various services related to the Department of Revenue Services in Connecticut. It provides tools for managing taxes, reporting, and accessing official documentation efficiently.

-

How does airSlate SignNow integrate with portal ct gov drs?

airSlate SignNow offers seamless integration with the portal ct gov drs, allowing users to eSign and send necessary documents directly from their accounts. This integration enhances compliance and speeds up the documentation process for state-related transactions.

-

What are the pricing plans for using airSlate SignNow with portal ct gov drs?

airSlate SignNow provides flexible pricing plans to cater to different business needs. Customers can choose from monthly or annual subscriptions, ensuring that all users can access the portal ct gov drs functionalities at a cost-effective rate.

-

What features does airSlate SignNow offer for portal ct gov drs users?

airSlate SignNow offers a range of features for portal ct gov drs users, including easy eSign capabilities, document templates, and secure cloud storage. These features help streamline workflows and ensure that all documentation meets state requirements.

-

Can I use portal ct gov drs for my small business?

Absolutely! The portal ct gov drs is designed to accommodate businesses of all sizes, including small businesses. With tools like airSlate SignNow, you can manage your documents and tax-related filing effectively, ensuring compliance without the hassle.

-

What are the benefits of using airSlate SignNow with portal ct gov drs?

Using airSlate SignNow with portal ct gov drs provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. This combination allows businesses to complete official processes quickly while maintaining a high level of compliance.

-

Is there customer support available for airSlate SignNow and portal ct gov drs users?

Yes, airSlate SignNow offers comprehensive customer support to assist users navigating the portal ct gov drs. Whether you have technical questions or need help with document management, the support team is ready to help you.

Get more for Portal ct gov DRS DRS FormsUnrelated Returns Ct

- Satisfaction release or cancellation of mortgage by corporation florida form

- Satisfaction release or cancellation of mortgage by individual florida form

- Partial release of property from mortgage for corporation florida form

- Partial release of property from mortgage by individual holder florida form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy florida form

- Warranty deed for parent to child reserving life estates to parent florida form

- Florida separate form

- Warranty deed to separate property of one spouse to both as joint tenants florida form

Find out other Portal ct gov DRS DRS FormsUnrelated Returns Ct

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document