Oregon Income Tax Form or 40 Instructions 2018

What is the Oregon Income Tax Form OR 40 Instructions

The Oregon Income Tax Form OR 40 Instructions provide essential guidance for individuals filing their state income tax returns. This form is specifically designed for residents of Oregon who need to report their income and calculate their tax obligations. The instructions detail the necessary steps to complete the form accurately, ensuring compliance with state tax laws. Understanding these instructions is crucial for taxpayers to avoid errors that could lead to penalties or delayed refunds.

Steps to Complete the Oregon Income Tax Form OR 40 Instructions

Completing the Oregon Income Tax Form OR 40 involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully read through the instructions to understand the specific requirements for each section of the form. Fill out the form by entering your personal information, income details, and applicable deductions. After completing the form, review it for accuracy and ensure all calculations are correct. Finally, sign and date the form before submitting it to the Oregon Department of Revenue.

How to Obtain the Oregon Income Tax Form OR 40 Instructions

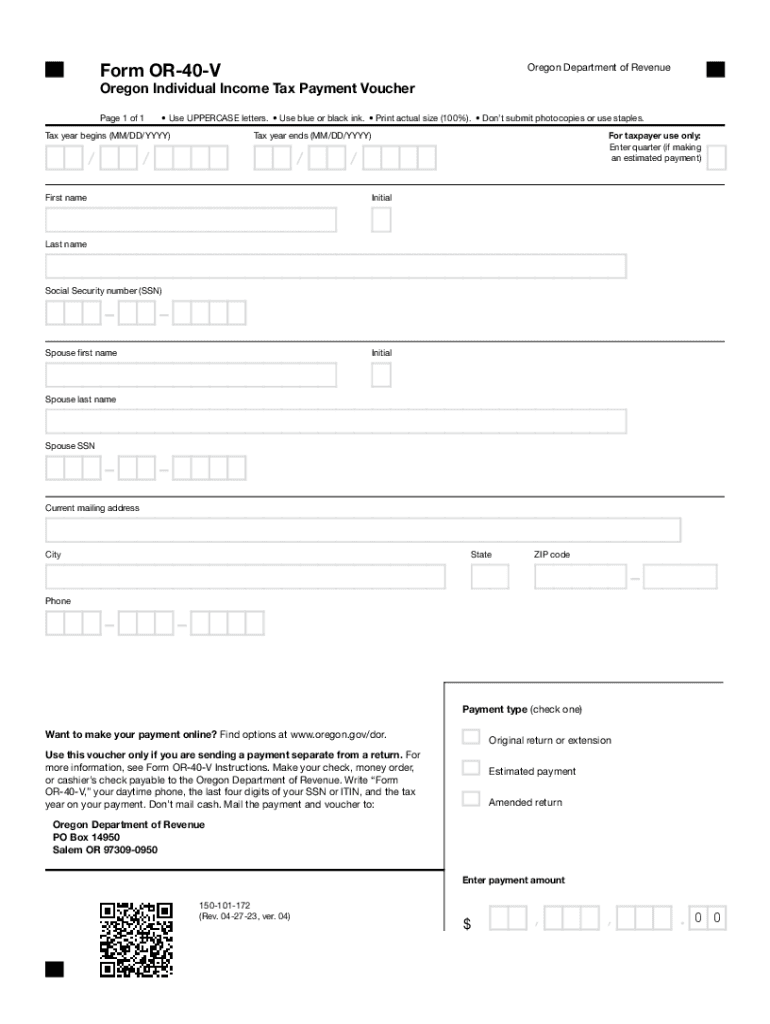

The Oregon Income Tax Form OR 40 Instructions can be obtained through the Oregon Department of Revenue's official website. Taxpayers can download the form and its accompanying instructions in PDF format for easy access. Additionally, physical copies of the form may be available at local government offices, libraries, or tax preparation services. It is important to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Required Documents for the Oregon Income Tax Form OR 40

To complete the Oregon Income Tax Form OR 40, taxpayers must gather several required documents. Key documents include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Any relevant tax credits that may apply

Having these documents ready will streamline the filing process and help ensure that all income and deductions are accurately reported.

Filing Deadlines for the Oregon Income Tax Form OR 40

Taxpayers must be aware of the filing deadlines associated with the Oregon Income Tax Form OR 40. Typically, the deadline for filing is April 15 of each year, aligning with the federal tax deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension, allowing them to file later, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods for the Oregon Income Tax Form OR 40

There are several methods for submitting the Oregon Income Tax Form OR 40. Taxpayers can choose to file electronically using approved tax software, which often simplifies the process and allows for quicker refunds. Alternatively, the form can be printed and mailed to the Oregon Department of Revenue. For those who prefer in-person submission, some local offices may accept the form directly. It is important to follow the submission guidelines outlined in the instructions to ensure proper processing.

Quick guide on how to complete oregon income tax form or 40 instructions

Effortlessly Complete Oregon Income Tax Form OR 40 Instructions on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Handle Oregon Income Tax Form OR 40 Instructions on any device using airSlate SignNow mobile apps for Android or iOS and enhance your document workflow today.

How to modify and eSign Oregon Income Tax Form OR 40 Instructions with ease

- Obtain Oregon Income Tax Form OR 40 Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to share your document, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes requiring new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Oregon Income Tax Form OR 40 Instructions and guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon income tax form or 40 instructions

Create this form in 5 minutes!

How to create an eSignature for the oregon income tax form or 40 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the airSlate SignNow platform related to Oregon Income Tax Form OR 40 Instructions?

airSlate SignNow offers a user-friendly platform that simplifies the eSigning process, especially for documents like the Oregon Income Tax Form OR 40 Instructions. It provides templates, customizable workflows, and integrated collaboration features that help users manage their tax documentation efficiently.

-

How much does it cost to use airSlate SignNow for filing Oregon Income Tax Form OR 40 Instructions?

airSlate SignNow offers various pricing plans tailored to meet different business needs, making it cost-effective for individuals and organizations preparing the Oregon Income Tax Form OR 40 Instructions. You can choose from monthly or annual subscriptions to find the right option for your budget.

-

Can airSlate SignNow help ensure compliance with Oregon Income Tax Form OR 40 Instructions?

Yes, airSlate SignNow assists users in ensuring compliance by providing secure eSigning features and maintaining a clear audit trail for all documents, including the Oregon Income Tax Form OR 40 Instructions. This helps users to keep their records organized and legally binding.

-

Is it easy to integrate airSlate SignNow with existing software for handling Oregon Income Tax Form OR 40 Instructions?

Absolutely! airSlate SignNow seamlessly integrates with popular applications and platforms, allowing users to easily incorporate it into their existing systems for managing the Oregon Income Tax Form OR 40 Instructions. This enhances workflow efficiency and saves valuable time.

-

What are the benefits of using airSlate SignNow for Oregon Income Tax Form OR 40 Instructions?

Using airSlate SignNow for the Oregon Income Tax Form OR 40 Instructions streamlines the signing process, reduces paper usage, and minimizes errors due to its user-friendly interface. This not only saves time but also offers a way to track the status of documents in real-time.

-

Does airSlate SignNow provide support for users filling out Oregon Income Tax Form OR 40 Instructions?

Yes, airSlate SignNow offers customer support to help users with any queries related to filling out the Oregon Income Tax Form OR 40 Instructions. Users can access detailed guides, FAQs, and live chat assistance to navigate any challenges they may face.

-

Can I access and manage my Oregon Income Tax Form OR 40 Instructions on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is mobile-friendly, allowing users to access and manage the Oregon Income Tax Form OR 40 Instructions from their smartphones and tablets. This flexibility enables users to sign documents on-the-go, making the process even more convenient.

Get more for Oregon Income Tax Form OR 40 Instructions

Find out other Oregon Income Tax Form OR 40 Instructions

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation