Oregon Form 40 V 2020

What is the Oregon Form 40 V

The Oregon Form 40 V is a tax form used by individuals to claim a refund for overpaid taxes in the state of Oregon. This form is specifically designed for taxpayers who have made estimated tax payments or have had taxes withheld from their income that exceed their actual tax liability. The Form 40 V allows for a streamlined process to request a refund from the Oregon Department of Revenue.

How to use the Oregon Form 40 V

To effectively use the Oregon Form 40 V, taxpayers should first gather all necessary documentation, including W-2 forms and records of any estimated tax payments made. The form requires detailed information about the taxpayer's income, deductions, and credits. After completing the form, it should be submitted to the Oregon Department of Revenue, either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Oregon Form 40 V

Completing the Oregon Form 40 V involves several key steps:

- Gather all relevant tax documents, including W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income, deductions, and any credits you are eligible for.

- Calculate your total tax liability and any overpayments.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Oregon Form 40 V

The Oregon Form 40 V is legally binding when completed and submitted according to the state's tax regulations. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Oregon Department of Revenue. This includes providing accurate information and submitting the form by the designated deadlines. Failure to comply may result in penalties or delays in processing refunds.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines when filing the Oregon Form 40 V. Typically, the deadline for submitting the form aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to check for any updates or changes to these dates each tax year.

Required Documents

To complete the Oregon Form 40 V, taxpayers must have certain documents on hand. These include:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Records of estimated tax payments made during the tax year.

- Any relevant documentation for deductions or credits being claimed.

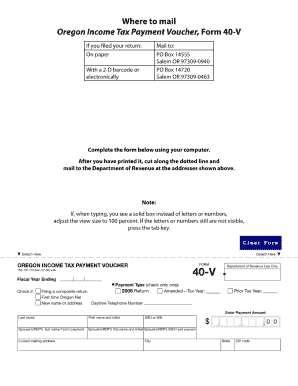

Form Submission Methods (Online / Mail / In-Person)

The Oregon Form 40 V can be submitted through various methods. Taxpayers have the option to file online using the Oregon Department of Revenue's e-filing system, which is often the fastest method. Alternatively, the form can be printed and mailed to the appropriate address provided by the Department of Revenue. In-person submissions may also be possible at designated tax offices, but it is advisable to check for availability and hours of operation.

Quick guide on how to complete oregon form 40 v 2016

Effortlessly Prepare Oregon Form 40 V on Any Device

Digital document management has become widely embraced by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Oregon Form 40 V on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Oregon Form 40 V with ease

- Obtain Oregon Form 40 V and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click the Done button to save your adjustments.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or forgotten files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign Oregon Form 40 V to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon form 40 v 2016

Create this form in 5 minutes!

How to create an eSignature for the oregon form 40 v 2016

The best way to create an electronic signature for a PDF online

The best way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the Oregon 40V form and how can it be used?

The Oregon 40V form is a specific document utilized for various business and administrative processes in Oregon. With airSlate SignNow, you can easily send, receive, and eSign the Oregon 40V form online, streamlining your document management.

-

How much does it cost to use the Oregon 40V form with airSlate SignNow?

Pricing for using the Oregon 40V form with airSlate SignNow is based on the plans we offer, which are designed to fit different business needs. We provide competitive pricing structures that include features like unlimited eSigning and document storage at a fraction of traditional methods.

-

What are the key features of the Oregon 40V form within airSlate SignNow?

Key features of the Oregon 40V form in airSlate SignNow include customizable templates, secure eSigning, and real-time tracking of document status. Users can enhance their workflow with automation options to send reminders and notifications related to the Oregon 40V form.

-

Can I integrate the Oregon 40V form with other software?

Yes, airSlate SignNow allows seamless integration with a variety of popular software applications, making it easy to utilize the Oregon 40V form alongside your existing tools. This integration ensures that you can manage your documents and workflows efficiently.

-

What are the benefits of using airSlate SignNow for the Oregon 40V form?

Using airSlate SignNow for the Oregon 40V form offers benefits such as reduced turnaround time for document processing and enhanced accessibility from any device. Additionally, the platform ensures compliance with legal standards, making your eSigned documents securely valid.

-

Is the Oregon 40V form legally valid when eSigned with airSlate SignNow?

Absolutely! The Oregon 40V form eSigned using airSlate SignNow is legally binding and compliant with governing laws. Our platform utilizes advanced security measures to protect your documents, ensuring their validity.

-

How does airSlate SignNow ensure the security of the Oregon 40V form?

airSlate SignNow prioritizes security by implementing encryption protocols for the Oregon 40V form. We provide features such as audit trails and secure storage to safeguard your documents and provide peace of mind to all users.

Get more for Oregon Form 40 V

Find out other Oregon Form 40 V

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free