Montana Individual Income Tax Payment Voucher Form it 2021-2026

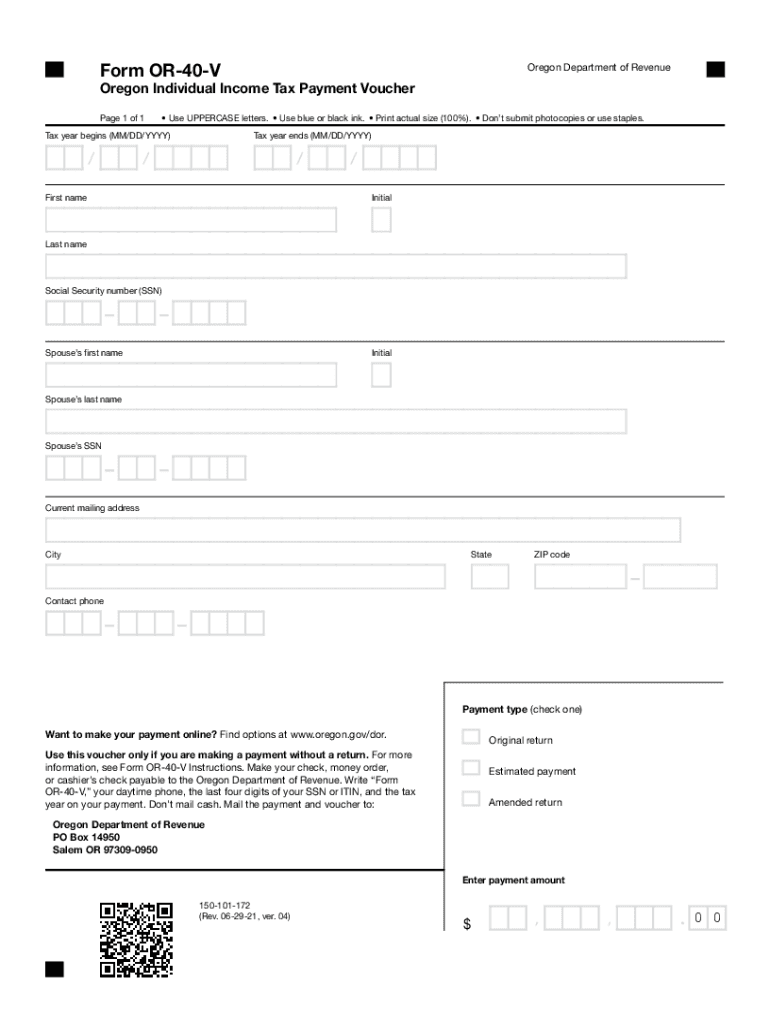

What is the Oregon 40 V Form?

The Oregon 40 V form, also known as the Oregon tax voucher, is a document used by individuals to make payments towards their state income taxes. It is particularly relevant for taxpayers who wish to remit their tax payments directly to the Oregon Department of Revenue. This form is essential for ensuring that payments are properly recorded and credited to the taxpayer's account. By utilizing the Oregon 40 V, individuals can maintain compliance with state tax obligations and avoid potential penalties associated with late payments.

Steps to Complete the Oregon 40 V Form

Completing the Oregon 40 V form involves several straightforward steps to ensure accuracy and compliance. Follow these guidelines:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are making the payment.

- Specify the amount you are paying, ensuring it matches your tax liability.

- Provide any additional details requested on the form, such as your filing status.

- Review the completed form for accuracy before submission.

Once completed, the form can be submitted either online or via mail, depending on your preference.

Legal Use of the Oregon 40 V Form

The Oregon 40 V form is legally recognized as a valid method for submitting tax payments to the state. It complies with the regulations set forth by the Oregon Department of Revenue, ensuring that taxpayers can fulfill their obligations without facing legal repercussions. Proper use of this form helps maintain accurate records and provides a clear trail of payments made, which can be essential in the event of an audit or inquiry.

Form Submission Methods

Taxpayers have multiple options for submitting the Oregon 40 V form. These methods include:

- Online Submission: Taxpayers can complete and submit the form electronically through the Oregon Department of Revenue's website.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Oregon Department of Revenue.

- In-Person Submission: Individuals may also choose to deliver the form in person at designated state offices.

Choosing the right submission method can depend on personal convenience and the urgency of the payment.

Filing Deadlines / Important Dates

It is crucial for taxpayers to be aware of the filing deadlines associated with the Oregon 40 V form. Typically, payments are due on the same date as the annual income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should consult the Oregon Department of Revenue for specific dates related to their filing year to avoid late fees and penalties.

Penalties for Non-Compliance

Failure to submit the Oregon 40 V form and remit payment by the deadline can result in penalties. These may include:

- Late Payment Penalty: A percentage of the unpaid tax amount may be added as a penalty.

- Interest Charges: Interest may accrue on any unpaid balance from the due date until the payment is made.

- Potential Legal Action: Continued non-compliance may lead to further legal consequences.

It is advisable for taxpayers to stay informed about their obligations to avoid these penalties.

Quick guide on how to complete montana individual income tax payment voucher form it

Prepare Montana Individual Income Tax Payment Voucher Form IT seamlessly on any device

Digital document management has become favored among companies and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Montana Individual Income Tax Payment Voucher Form IT on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and eSign Montana Individual Income Tax Payment Voucher Form IT effortlessly

- Locate Montana Individual Income Tax Payment Voucher Form IT and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Bid farewell to lost or mislaid documents, tedious form searching, or errors that require the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Montana Individual Income Tax Payment Voucher Form IT to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct montana individual income tax payment voucher form it

Create this form in 5 minutes!

People also ask

-

What is the form or 40 v and how does it work?

The form or 40 v is a specific document used for various processes in business transactions. With airSlate SignNow, you can easily create, send, and eSign the form or 40 v ensuring streamlined workflows and compliance. Our platform provides templates to simplify the creation process, making it user-friendly for everyone.

-

How much does it cost to use airSlate SignNow for the form or 40 v?

airSlate SignNow offers flexible pricing plans tailored to suit businesses of all sizes. Pricing for using the platform to manage the form or 40 v starts at a competitive rate, ensuring that you only pay for the features you need. Check our website for detailed pricing plans and choose the one that fits your needs.

-

What features are available for managing the form or 40 v?

Our platform provides a range of features for managing the form or 40 v, including customizable templates, automated workflows, and real-time tracking of document status. You can also integrate with various apps to enhance functionality. These features streamline the eSignature process, making it more efficient.

-

Can I integrate other applications with airSlate SignNow for the form or 40 v?

Yes, airSlate SignNow supports a variety of integrations with popular applications, enabling you to manage the form or 40 v seamlessly. Integrations with tools like Google Drive, Salesforce, and more can help you maintain a unified workflow. This simplifies data transfer and ensures you have everything in one place.

-

What are the benefits of using airSlate SignNow for the form or 40 v?

Using airSlate SignNow for the form or 40 v provides numerous benefits, including enhanced security with encrypted signatures, ease of access from any device, and reduced turnaround times for document approvals. It empowers businesses with a cost-effective solution that boosts productivity and improves customer satisfaction.

-

Is training provided for using airSlate SignNow for the form or 40 v?

Yes, airSlate SignNow offers comprehensive training resources including tutorials, webinars, and dedicated customer support. This training ensures that you and your team can effectively utilize the features of the platform for managing the form or 40 v. Our help center is also a valuable resource for ongoing learning.

-

How secure is airSlate SignNow when handling the form or 40 v?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods to protect documents, including the form or 40 v, during transmission and storage. Furthermore, we comply with industry standards to ensure that your sensitive information is always safe and secure.

Get more for Montana Individual Income Tax Payment Voucher Form IT

- Fencing contract for contractor montana form

- Hvac contract for contractor montana form

- Landscape contract for contractor montana form

- Commercial contract for contractor montana form

- Excavator contract for contractor montana form

- Renovation contract for contractor montana form

- Concrete mason contract for contractor montana form

- Demolition contract for contractor montana form

Find out other Montana Individual Income Tax Payment Voucher Form IT

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile