Get Form or TM V, TriMet Self Employment Tax Payment 2014

What is the Get Form OR TM V, TriMet Self Employment Tax Payment

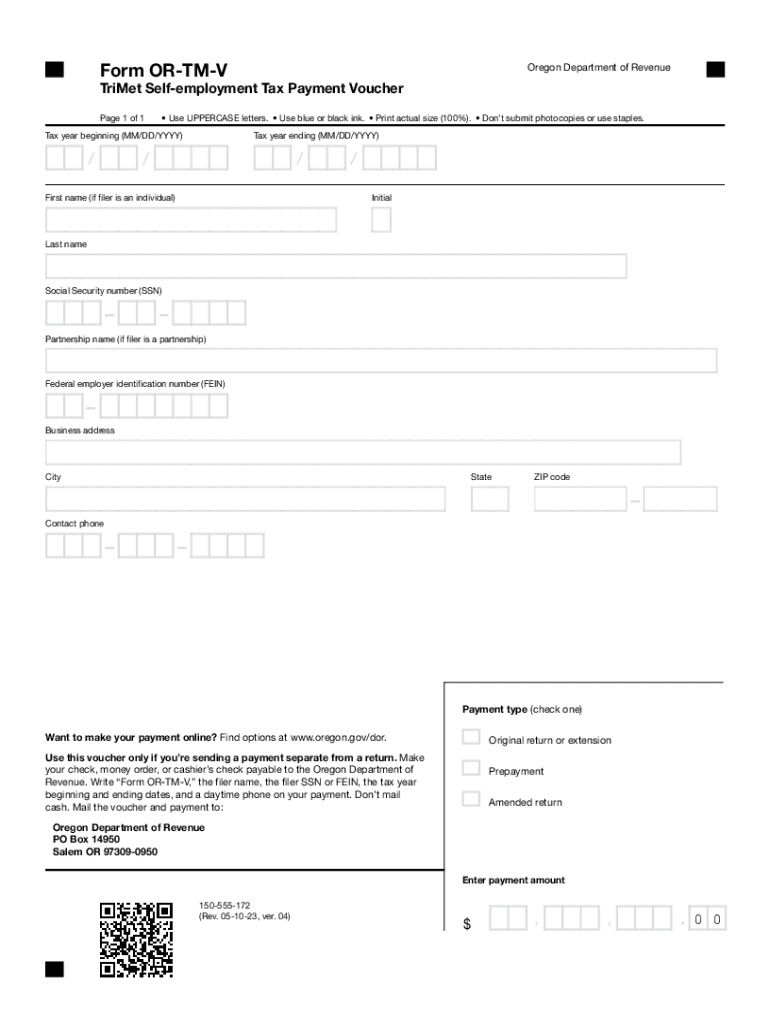

The Get Form OR TM V, TriMet Self Employment Tax Payment is a specific tax form used by self-employed individuals in the TriMet service area of Oregon. This form is designed to facilitate the payment of self-employment taxes, which are required for individuals who earn income through self-employment. It ensures that the appropriate taxes are collected to fund various public services, including transportation. Understanding this form is essential for compliance with local tax regulations.

How to use the Get Form OR TM V, TriMet Self Employment Tax Payment

Using the Get Form OR TM V, TriMet Self Employment Tax Payment involves several key steps. First, individuals must accurately fill out the form with their personal information, including name, address, and Social Security number. Next, they should report their self-employment income and calculate the taxes owed based on the current rates. It is important to review the form for accuracy before submission, as errors can lead to penalties or delays in processing.

Steps to complete the Get Form OR TM V, TriMet Self Employment Tax Payment

Completing the Get Form OR TM V, TriMet Self Employment Tax Payment requires careful attention to detail. Here are the steps involved:

- Gather necessary financial documents, including records of income and expenses.

- Obtain the form from the appropriate local tax authority or download it from an official source.

- Fill out the form, ensuring all information is accurate and complete.

- Calculate the total self-employment taxes owed based on your reported income.

- Review the form for any errors or omissions.

- Submit the completed form by the designated deadline.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Get Form OR TM V, TriMet Self Employment Tax Payment. Typically, the form must be submitted by April fifteenth of the following year for income earned during the previous calendar year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Keeping track of these dates helps avoid late fees and penalties.

Required Documents

To successfully complete the Get Form OR TM V, TriMet Self Employment Tax Payment, several documents are necessary. These include:

- Proof of income, such as 1099 forms or profit and loss statements.

- Records of business expenses to accurately calculate net income.

- Identification documents, including a Social Security number or Employer Identification Number (EIN).

Having these documents ready will streamline the process and ensure compliance with tax regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Get Form OR TM V, TriMet Self Employment Tax Payment can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for self-employed individuals to understand their obligations and ensure timely submission of the form to avoid these consequences.

Quick guide on how to complete get form or tm v trimet self employment tax payment 708858221

Easily Prepare Get Form OR TM V, TriMet Self Employment Tax Payment on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage Get Form OR TM V, TriMet Self Employment Tax Payment on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Get Form OR TM V, TriMet Self Employment Tax Payment with Ease

- Find Get Form OR TM V, TriMet Self Employment Tax Payment and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and bears the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks, from any device you choose. Modify and electronically sign Get Form OR TM V, TriMet Self Employment Tax Payment and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get form or tm v trimet self employment tax payment 708858221

Create this form in 5 minutes!

How to create an eSignature for the get form or tm v trimet self employment tax payment 708858221

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Get Form OR TM V, TriMet Self Employment Tax Payment using airSlate SignNow?

To Get Form OR TM V, TriMet Self Employment Tax Payment with airSlate SignNow, simply upload the form to our platform. You can then fill it out, sign it digitally, and send it directly to the TriMet authority. Our user-friendly interface makes the entire process seamless and efficient.

-

Are there any costs associated with using airSlate SignNow to Get Form OR TM V, TriMet Self Employment Tax Payment?

Yes, there is a subscription fee associated with using airSlate SignNow. However, our pricing is designed to be cost-effective, especially when considering the convenience of digitally signing and managing documents like the TriMet Self Employment Tax Payment. Explore our pricing plans to find the best fit for your needs.

-

What features does airSlate SignNow offer for easy processing of the TriMet Self Employment Tax Payment?

airSlate SignNow offers features such as template creation, electronic signature capabilities, and document tracking, all designed to simplify the process of getting forms like the TriMet Self Employment Tax Payment completed. These features enhance your experience, ensuring that you can efficiently manage your documents.

-

Can I integrate airSlate SignNow with other tools for managing tax payments?

Absolutely! airSlate SignNow easily integrates with various productivity and financial tools, making it simple to manage your processes when getting Form OR TM V, TriMet Self Employment Tax Payment. Check our integration options to connect your favorite applications seamlessly.

-

How secure is the information when I Get Form OR TM V, TriMet Self Employment Tax Payment on airSlate SignNow?

Security is a priority at airSlate SignNow. When you Get Form OR TM V, TriMet Self Employment Tax Payment, your data is encrypted and stored securely. We comply with industry standards to ensure that your information remains confidential and protected.

-

Can I access my signed TriMet Self Employment Tax Payment documents from anywhere?

Yes, with airSlate SignNow, your signed TriMet Self Employment Tax Payment documents are accessible from any device with internet connectivity. This flexibility allows you to manage your important tax documents on the go or from your home office, enhancing your accessibility and convenience.

-

Is it easy to update or correct a TriMet Self Employment Tax Payment form through airSlate SignNow?

Yes, airSlate SignNow simplifies the process of updating or correcting your TriMet Self Employment Tax Payment forms. If you need to make changes, you can quickly edit your document, re-sign, and resend it without hassle. This user-centric approach saves you time and effort.

Get more for Get Form OR TM V, TriMet Self Employment Tax Payment

- Worksheet graphing quadratics from standard form answer key

- Experienced teacher annual learning plan limestone district form

- Spalding university transcript request form

- Early entrance program signature form howard community college howardcc

- Patrick catholic high school parent conference documentation form student date teacher class participants in conference areas

- Transcript request formpdf sarah pyle academy sarahpyleacademy

- Employee termination report form

- Of termination report form

Find out other Get Form OR TM V, TriMet Self Employment Tax Payment

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice