Payment VouchersArizona Department of Revenue AZDOR 2021-2026

Understanding the 2023 trimet tax form

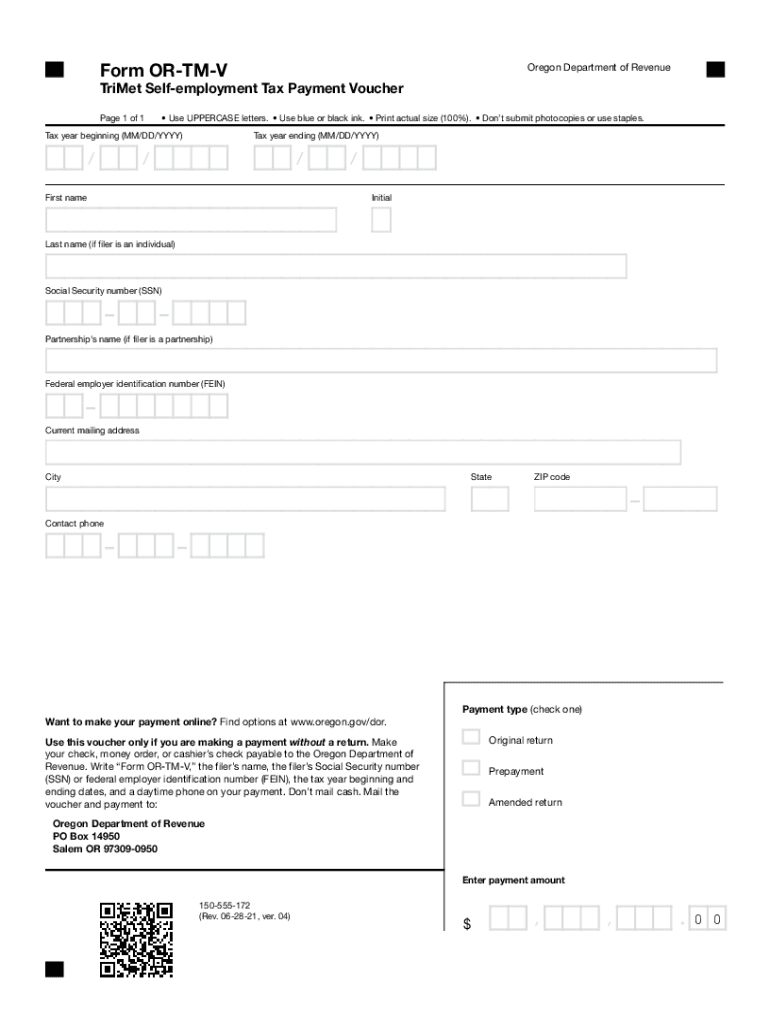

The 2023 trimet tax form is essential for individuals and businesses in Oregon who need to report and pay their taxes related to the Tri-County Metropolitan Transportation District. This form is designed to ensure compliance with local tax regulations and helps fund public transportation services. Understanding its purpose and requirements is crucial for accurate filing and timely payments.

Steps to complete the 2023 trimet tax form

Completing the 2023 trimet tax form involves several key steps:

- Gather necessary information, including your personal details, income, and any deductions applicable.

- Access the form online or download the fillable PDF version for convenience.

- Carefully fill out each section, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before submitting.

- Submit the form electronically or print it for mailing, depending on your preference.

Required documents for filing

To successfully file the 2023 trimet tax form, you will need to provide specific documentation, including:

- Proof of income, such as W-2 forms or 1099 statements.

- Any relevant deductions or credits that apply to your situation.

- Identification information, including your Social Security number.

Filing deadlines for the 2023 trimet tax form

It is important to be aware of the filing deadlines for the 2023 trimet tax form to avoid penalties. Generally, the deadline for submitting this form aligns with the federal tax deadline, which is typically April 15. However, it is advisable to verify any specific local deadlines that may apply.

Legal use of the 2023 trimet tax form

The 2023 trimet tax form is legally binding when completed and submitted in accordance with local regulations. It is essential to ensure that all information provided is truthful and accurate, as discrepancies may lead to legal consequences. Utilizing a reliable platform for eSigning and submitting the form can enhance its legitimacy.

Digital vs. paper version of the 2023 trimet tax form

Choosing between the digital and paper versions of the 2023 trimet tax form can impact your filing experience. The digital version allows for easier completion, quicker submission, and often provides immediate confirmation of receipt. Conversely, the paper version may be preferred by those who are more comfortable with traditional methods or lack internet access.

Quick guide on how to complete payment vouchersarizona department of revenue azdor

Finalize Payment VouchersArizona Department Of Revenue AZDOR effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing for easy access to the correct format and secure online storage. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Payment VouchersArizona Department Of Revenue AZDOR on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to adjust and electronically sign Payment VouchersArizona Department Of Revenue AZDOR with ease

- Locate Payment VouchersArizona Department Of Revenue AZDOR and click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize essential portions of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details thoroughly and click the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from your chosen device. Modify and electronically sign Payment VouchersArizona Department Of Revenue AZDOR to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payment vouchersarizona department of revenue azdor

Create this form in 5 minutes!

People also ask

-

What is Oregon TM tax and how does it relate to digital signatures?

Oregon TM tax refers to the state's tax on tangible personal property, including items related to digital signature processes. Businesses must understand how this tax impacts the cost of implementing electronic signature solutions like airSlate SignNow. By ensuring compliance with Oregon TM tax, you can avoid potential penalties and optimize your eSignature processes.

-

How much does airSlate SignNow cost for businesses in Oregon?

airSlate SignNow offers competitive pricing plans that cater to businesses in Oregon. The cost will vary based on the selected features and number of users, but our solutions remain cost-effective, especially when considering the savings associated with compliance such as Oregon TM tax.

-

What features does airSlate SignNow provide for managing Oregon TM tax requirements?

airSlate SignNow includes features that help businesses streamline their documentation processes while ensuring compliance with Oregon TM tax regulations. With customizable templates and integrated workflows, you can efficiently manage tax-related documents and maintain compliance.

-

Can airSlate SignNow integrate with accounting software to help manage Oregon TM tax?

Yes, airSlate SignNow integrates with various accounting software systems, allowing businesses to manage Oregon TM tax more effectively. This integration helps streamline the process of preparing and filing tax documents directly from your eSignature platform.

-

What benefits does airSlate SignNow offer to Oregon businesses regarding document signing and compliant tax practices?

airSlate SignNow enhances document signing for Oregon businesses by providing a user-friendly, secure platform that adheres to compliance standards, including those set by Oregon TM tax. This means you can sign, send, and store documents without worrying about compliance issues.

-

Is airSlate SignNow a secure solution for handling sensitive documents related to Oregon TM tax?

Absolutely! airSlate SignNow prioritizes the security of sensitive documents, including those related to Oregon TM tax. Our platform uses advanced encryption and compliance with industry standards to ensure that all your documents are safe and secure.

-

How can airSlate SignNow help businesses stay updated on Oregon TM tax changes?

airSlate SignNow offers a range of resources, including newsletters and updates, to help businesses stay informed about changes related to Oregon TM tax. By utilizing our platform, you can easily access the latest compliance guidelines that may affect your operation.

Get more for Payment VouchersArizona Department Of Revenue AZDOR

- Framing contract for contractor montana form

- Security contract for contractor montana form

- Insulation contract for contractor montana form

- Paving contract for contractor montana form

- Site work contract for contractor montana form

- Siding contract for contractor montana form

- Refrigeration contract for contractor montana form

- Drainage contract for contractor montana form

Find out other Payment VouchersArizona Department Of Revenue AZDOR

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast