BFormb TM V TriMet Self Employment Tax the Tax Team LLC 2014

What is the BFormb TM V TriMet Self Employment Tax The Tax Team LLC

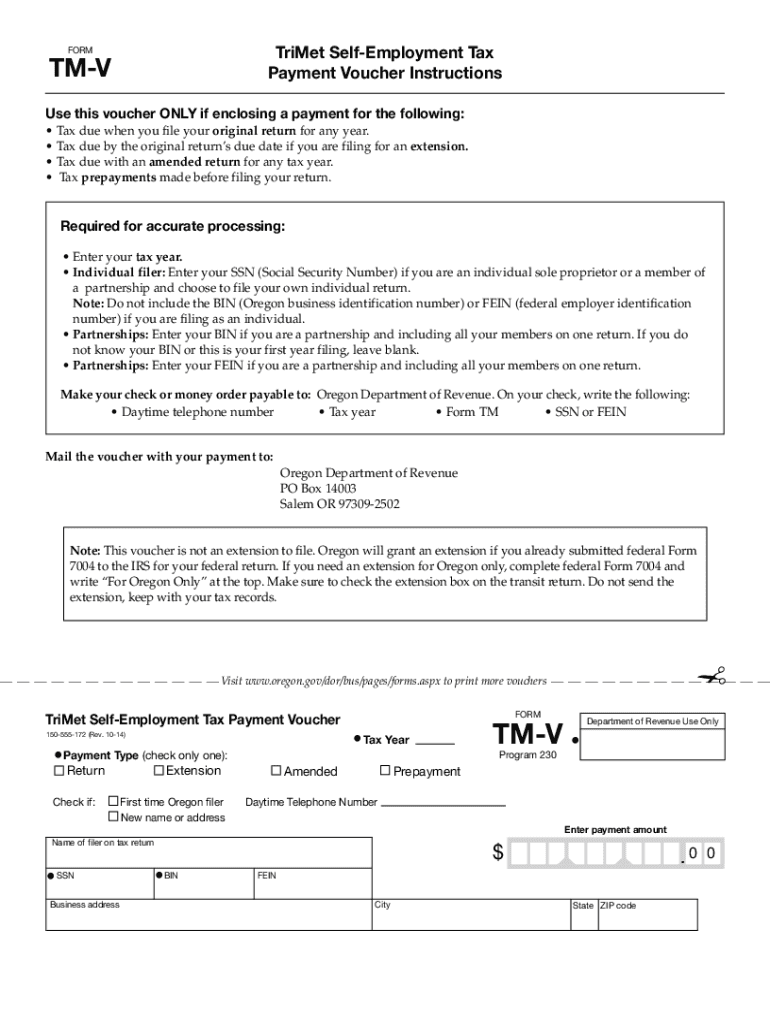

The BFormb TM V TriMet Self Employment Tax The Tax Team LLC is a specific tax form designed for individuals who are self-employed and need to report their income and expenses accurately. This form helps ensure compliance with federal tax regulations while providing a clear overview of self-employment earnings. It is essential for calculating the self-employment tax, which includes contributions to Social Security and Medicare. Understanding this form is crucial for self-employed individuals to avoid penalties and ensure they are meeting their tax obligations.

How to use the BFormb TM V TriMet Self Employment Tax The Tax Team LLC

Using the BFormb TM V TriMet Self Employment Tax The Tax Team LLC involves several straightforward steps. First, gather all necessary financial documents, including income statements and expense receipts. Next, accurately fill out the form by entering your total income and deductible expenses. It is important to ensure that all entries are correct to avoid discrepancies. After completing the form, review it for accuracy and then submit it according to the specified guidelines, either electronically or by mail.

Steps to complete the BFormb TM V TriMet Self Employment Tax The Tax Team LLC

Completing the BFormb TM V TriMet Self Employment Tax The Tax Team LLC requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income and expense records.

- Fill out your personal information at the top of the form.

- Enter your total income from self-employment activities.

- List all allowable business expenses to determine your net income.

- Calculate the self-employment tax based on your net income.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline.

Legal use of the BFormb TM V TriMet Self Employment Tax The Tax Team LLC

The legal use of the BFormb TM V TriMet Self Employment Tax The Tax Team LLC is governed by federal tax laws. To be considered valid, the form must be filled out accurately and submitted on time. It is essential to maintain records that support the information provided on the form, as these may be required for audits or inquiries from the IRS. Compliance with the legal requirements ensures that the self-employment tax is calculated correctly and that the taxpayer fulfills their obligations under U.S. tax law.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the BFormb TM V TriMet Self Employment Tax The Tax Team LLC. These guidelines outline the necessary information to include, the deadlines for submission, and the acceptable methods for filing. It is important for self-employed individuals to familiarize themselves with these guidelines to ensure compliance and avoid potential penalties. Regularly checking the IRS website for updates can help taxpayers stay informed about any changes in tax laws that may affect their filing.

Filing Deadlines / Important Dates

Filing deadlines for the BFormb TM V TriMet Self Employment Tax The Tax Team LLC are crucial for avoiding penalties. Typically, the deadline for submitting this form aligns with the annual tax return due date, which is usually April fifteenth for most taxpayers. However, self-employed individuals should be aware of any extensions or changes that may apply, especially in light of specific circumstances such as natural disasters or legislative changes. Keeping track of these important dates ensures timely compliance with tax obligations.

Quick guide on how to complete bformb tm v trimet self employment tax the tax team llc

Complete BFormb TM V TriMet Self Employment Tax The Tax Team LLC seamlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly, without unnecessary delays. Handle BFormb TM V TriMet Self Employment Tax The Tax Team LLC on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign BFormb TM V TriMet Self Employment Tax The Tax Team LLC with ease

- Locate BFormb TM V TriMet Self Employment Tax The Tax Team LLC and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Identify signNow sections of your documents or redact sensitive information with the tools available through airSlate SignNow designed for that purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal authority as a traditional ink signature.

- Review all details thoroughly and then click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign BFormb TM V TriMet Self Employment Tax The Tax Team LLC to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct bformb tm v trimet self employment tax the tax team llc

Create this form in 5 minutes!

People also ask

-

What is BFormb TM V TriMet Self Employment Tax?

BFormb TM V TriMet Self Employment Tax is a specialized tax service provided by The Tax Team LLC designed for self-employed individuals. It helps users navigate their self-employment tax obligations efficiently, ensuring compliance with tax regulations while maximizing potential deductions.

-

How does BFormb TM V TriMet Self Employment Tax help with filing taxes?

BFormb TM V TriMet Self Employment Tax simplifies the tax filing process for freelancers and self-employed individuals. The service offers guidance on estimating tax liabilities, understanding write-offs, and accurately completing necessary tax forms, making filing less stressful.

-

What are the pricing options for BFormb TM V TriMet Self Employment Tax?

BFormb TM V TriMet Self Employment Tax offers competitive pricing to accommodate various budgets. The Tax Team LLC provides flexible payment plans, ensuring that users receive the support they need without overspending on their tax preparation services.

-

What features are included in BFormb TM V TriMet Self Employment Tax?

Key features of BFormb TM V TriMet Self Employment Tax include personalized tax planning, detailed guidance on self-employment deductions, and real-time support from tax professionals at The Tax Team LLC. Users also benefit from user-friendly tools that streamline the entire tax process.

-

Can I integrate BFormb TM V TriMet Self Employment Tax with other financial software?

Yes, BFormb TM V TriMet Self Employment Tax seamlessly integrates with various financial management and accounting software. This integration helps users maintain accurate records and simplifies the overall tax preparation process, making it easier to track income and expenses.

-

What benefits can I expect from using BFormb TM V TriMet Self Employment Tax?

Using BFormb TM V TriMet Self Employment Tax enables self-employed individuals to maximize their deductions and minimize their tax liabilities. Additionally, The Tax Team LLC provides expert support, ensuring users feel confident in their filings and compliance with tax regulations.

-

How user-friendly is the BFormb TM V TriMet Self Employment Tax platform?

The BFormb TM V TriMet Self Employment Tax platform is designed with user experience in mind. It features an intuitive interface that simplifies navigation, allowing users to easily access resources and tools necessary for effective tax management.

Get more for BFormb TM V TriMet Self Employment Tax The Tax Team LLC

Find out other BFormb TM V TriMet Self Employment Tax The Tax Team LLC

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template