Ohio it Income Allocation and Apportionment Nonresident Credit 2017-2026

What is the Ohio IT Income Allocation and Apportionment Nonresident Credit

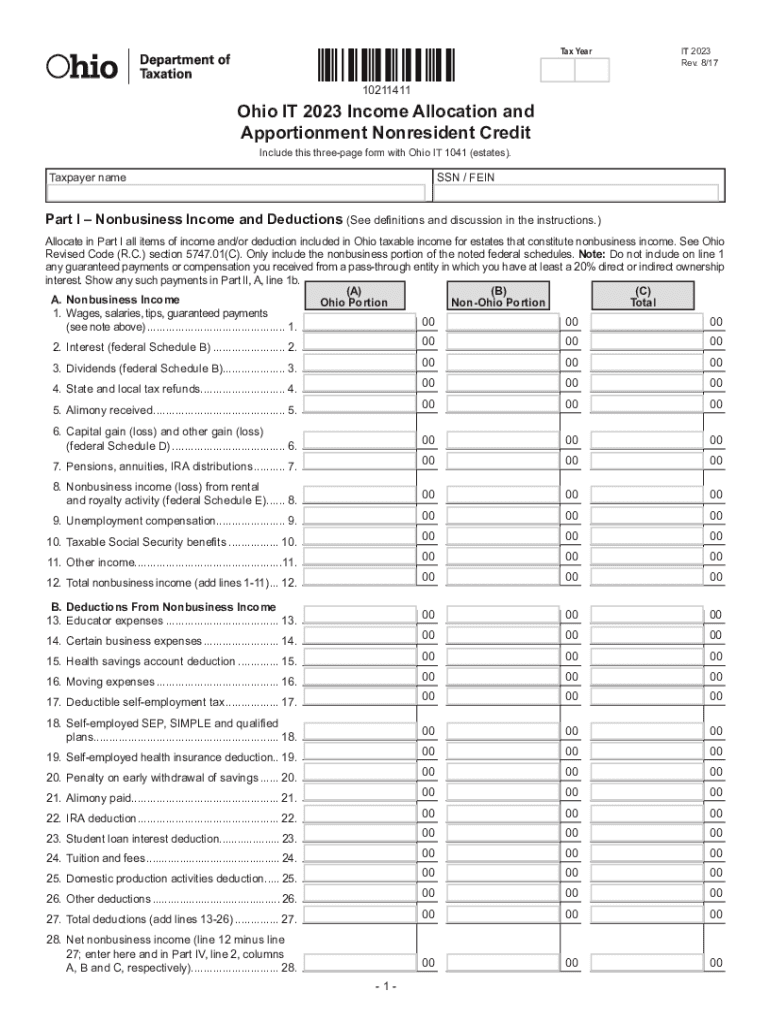

The Ohio IT Income Allocation and Apportionment Nonresident Credit is a tax provision designed for individuals who earn income in Ohio but reside in another state. This credit allows nonresidents to allocate and apportion their income appropriately, ensuring they are not taxed on income earned outside Ohio. The credit is particularly beneficial for those who work in Ohio while maintaining residency elsewhere, as it helps to prevent double taxation on the same income.

How to Use the Ohio IT Income Allocation and Apportionment Nonresident Credit

To utilize the Ohio IT Income Allocation and Apportionment Nonresident Credit, taxpayers must first determine their total income earned within Ohio. This involves calculating the portion of their income that is attributable to Ohio sources. After determining the Ohio income, taxpayers can apply the credit on their tax return, reducing their overall tax liability. It's important to ensure that all calculations are accurate to maximize the benefits of the credit.

Steps to Complete the Ohio IT Income Allocation and Apportionment Nonresident Credit

Completing the Ohio IT Income Allocation and Apportionment Nonresident Credit involves several key steps:

- Gather all relevant income documentation, including W-2s and 1099s.

- Calculate total income earned in Ohio.

- Determine the appropriate allocation and apportionment percentages based on the source of income.

- Complete the necessary forms, ensuring all figures are accurate.

- Submit the completed forms with your Ohio tax return by the designated deadline.

Eligibility Criteria for the Ohio IT Income Allocation and Apportionment Nonresident Credit

Eligibility for the Ohio IT Income Allocation and Apportionment Nonresident Credit requires that the individual be a nonresident of Ohio who has earned income from Ohio sources. Additionally, the taxpayer must file an Ohio income tax return and provide documentation to support their claims of income earned within the state. Meeting these criteria is essential to qualify for the credit and avoid potential penalties.

Required Documents for the Ohio IT Income Allocation and Apportionment Nonresident Credit

To successfully claim the Ohio IT Income Allocation and Apportionment Nonresident Credit, taxpayers need to prepare several documents:

- W-2 forms showing income earned in Ohio.

- 1099 forms for any additional income sources.

- Documentation supporting the allocation and apportionment calculations.

- A completed Ohio tax return form.

Filing Deadlines for the Ohio IT Income Allocation and Apportionment Nonresident Credit

Filing deadlines for the Ohio IT Income Allocation and Apportionment Nonresident Credit typically align with the general Ohio income tax return deadlines. Taxpayers should be aware that the standard deadline is usually April 15th of each year. However, extensions may be available, and it is crucial to check for any updates or changes to the filing schedule to ensure timely submission.

Quick guide on how to complete ohio it income allocation and apportionment nonresident credit

Effortlessly Prepare Ohio IT Income Allocation And Apportionment Nonresident Credit on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Ohio IT Income Allocation And Apportionment Nonresident Credit on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to Modify and eSign Ohio IT Income Allocation And Apportionment Nonresident Credit with Ease

- Locate Ohio IT Income Allocation And Apportionment Nonresident Credit and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as an ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Ohio IT Income Allocation And Apportionment Nonresident Credit and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio it income allocation and apportionment nonresident credit

Create this form in 5 minutes!

How to create an eSignature for the ohio it income allocation and apportionment nonresident credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio nonresident allocation and apportionment fillable document?

The Ohio nonresident allocation and apportionment fillable document is a standardized form used by nonresident taxpayers to report income earned in Ohio. This form simplifies the process of ensuring proper tax obligations are met for businesses operating in multiple states.

-

How can airSlate SignNow assist with the Ohio nonresident allocation and apportionment fillable form?

airSlate SignNow provides an intuitive platform to eSign and manage the Ohio nonresident allocation and apportionment fillable form, enabling businesses to send and receive documents efficiently. Our easy-to-use solution streamlines the document workflow, making it hassle-free.

-

Is there a cost associated with using airSlate SignNow for Ohio nonresident allocation and apportionment fillable documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features suitable for managing Ohio nonresident allocation and apportionment fillable documents effectively, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing the Ohio nonresident allocation and apportionment fillable document?

airSlate SignNow includes features such as customizable templates, electronic signatures, and document tracking for the Ohio nonresident allocation and apportionment fillable document. These features streamline the signing process and enhance document security.

-

Can I store my Ohio nonresident allocation and apportionment fillable documents in airSlate SignNow?

Absolutely! All your Ohio nonresident allocation and apportionment fillable documents can be securely stored within the airSlate SignNow platform. This ensures easy access and organization of your important tax documents at any time.

-

Does airSlate SignNow integrate with other platforms for the Ohio nonresident allocation and apportionment fillable forms?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and CRM systems. This allows you to manage your Ohio nonresident allocation and apportionment fillable documents efficiently across different platforms.

-

How can the Ohio nonresident allocation and apportionment fillable form benefit my business?

Utilizing the Ohio nonresident allocation and apportionment fillable form helps ensure compliance with state tax regulations, preventing potential penalties. Properly filing this form can streamline your tax obligations and promote smooth business operations in Ohio.

Get more for Ohio IT Income Allocation And Apportionment Nonresident Credit

- Field trip proposal template form

- Homeowner nominal form

- Exit interview checklist form

- Get cap org form

- Fbi application form

- Unemployment insurance ui rules require that you actively search for work making at least your minimum number of required form

- Bexar county personal data information sheet

- Texas hazlewood application form

Find out other Ohio IT Income Allocation And Apportionment Nonresident Credit

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization