Ohio Tax Forms 2016

Understanding Ohio Tax Forms

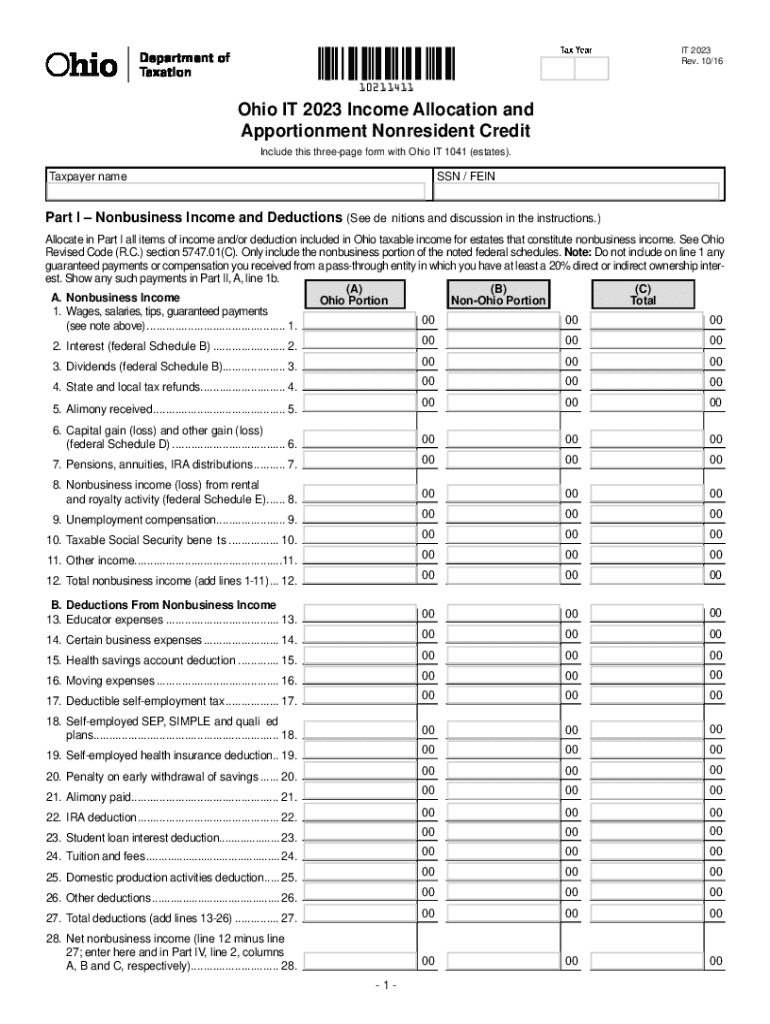

The Ohio nonresident allocation and apportionment fillable form is essential for individuals and businesses that earn income in Ohio but reside elsewhere. This form allows nonresidents to report their income sourced from Ohio and calculate the tax owed to the state. It is crucial for ensuring compliance with Ohio tax laws while accurately reflecting the income generated within the state.

Steps to Complete the Ohio Tax Forms

Completing the Ohio nonresident allocation and apportionment fillable form involves several steps:

- Gather necessary documentation, including income statements and records of Ohio-sourced income.

- Fill out personal information, including name, address, and Social Security number.

- Report total income earned in Ohio and any deductions applicable to nonresidents.

- Calculate the tax owed using the provided tax tables or formulas.

- Review the completed form for accuracy before submission.

How to Obtain the Ohio Tax Forms

The Ohio nonresident allocation and apportionment fillable form can be obtained through the Ohio Department of Taxation's website. It is available for download in a fillable PDF format, allowing users to complete the form digitally. Additionally, physical copies may be available at local tax offices or public libraries across Ohio.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the Ohio nonresident allocation and apportionment fillable form. Typically, the form must be submitted by the due date for individual income tax returns, which is usually April 15. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Always check for any updates or changes to deadlines each tax year.

Required Documents

When filling out the Ohio nonresident allocation and apportionment fillable form, certain documents are required to support the reported income and deductions. These may include:

- W-2 forms from employers for Ohio-sourced income.

- 1099 forms for other types of income earned in Ohio.

- Records of any deductions claimed, such as business expenses.

- Proof of residency in another state.

Legal Use of the Ohio Tax Forms

The Ohio nonresident allocation and apportionment fillable form must be used in accordance with Ohio tax laws. It is legally binding and should be filled out truthfully and accurately. Misrepresentation of income or failure to file can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is essential for compliance and avoiding potential issues with the Ohio Department of Taxation.

Quick guide on how to complete ohio tax forms

Effortlessly Prepare Ohio Tax Forms on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers a seamless, eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ohio Tax Forms on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Edit and Electronically Sign Ohio Tax Forms with Ease

- Locate Ohio Tax Forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Ohio Tax Forms to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ohio tax forms

Create this form in 5 minutes!

How to create an eSignature for the ohio tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ohio nonresident allocation and apportionment fillable form?

The Ohio nonresident allocation and apportionment fillable form is a detailed document used to report income earned by nonresidents of Ohio. This form allows users to accurately allocate and apportion their income for taxation purposes. By using our fillable format, you can efficiently complete and submit this essential tax document.

-

How does airSlate SignNow simplify the Ohio nonresident allocation and apportionment process?

airSlate SignNow offers a seamless platform for completing the Ohio nonresident allocation and apportionment fillable form. Our user-friendly interface facilitates easy data entry and document management, ensuring that you can handle your tax filings quickly and accurately. This streamlined process saves you time and reduces the potential for errors.

-

Is there a cost associated with using the Ohio nonresident allocation and apportionment fillable form through airSlate SignNow?

Yes, there are pricing options available for using airSlate SignNow, including plans that cater to various business needs. Our pricing is competitive, especially considering the time and resources you save by using our Ohio nonresident allocation and apportionment fillable form. Explore our pricing tiers to find the right solution for your needs.

-

What features does airSlate SignNow provide for the Ohio nonresident allocation and apportionment fillable form?

airSlate SignNow provides features such as electronic signatures, customizable templates, and secure document storage for the Ohio nonresident allocation and apportionment fillable form. These features enhance the document management process, making it easier for you to collect signatures and keep all your tax documents organized. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other applications for managing my Ohio nonresident allocation and apportionment fillable forms?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easier to manage your Ohio nonresident allocation and apportionment fillable forms alongside your other business tools. Whether you use CRM systems, accounting software, or cloud storage services, our integrations enhance your workflow.

-

What are the benefits of using airSlate SignNow for my Ohio nonresident allocation and apportionment fillable forms?

Using airSlate SignNow for your Ohio nonresident allocation and apportionment fillable forms provides several benefits, including increased efficiency, error reduction, and improved organization. Our platform simplifies the document signing and filing process, allowing you to focus more on your core business operations. Additionally, the secure environment ensures that your sensitive information remains protected.

-

How can I ensure the security of my Ohio nonresident allocation and apportionment fillable forms on airSlate SignNow?

airSlate SignNow employs advanced security measures to protect your Ohio nonresident allocation and apportionment fillable forms. This includes encryption, secure data storage, and robust access controls. We prioritize your privacy and confidentiality, ensuring that your documents are secure while in transit and at rest.

Get more for Ohio Tax Forms

- Adoption intake form bailey amp galyen

- Traffic ticket intake form bailey amp galyen

- Texas application birth certificate online form

- Social security intake form bailey amp galyen

- Paternity intake form bailey amp galyen

- Divorce intake sheet form

- Name change intake form bailey amp galyen

- Imperial health authorization form 487092215

Find out other Ohio Tax Forms

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History