Louisiana Tax Power of Attorney Form R 7006 PDF 2023

What is the Louisiana Tax Power Of Attorney Form R 7006?

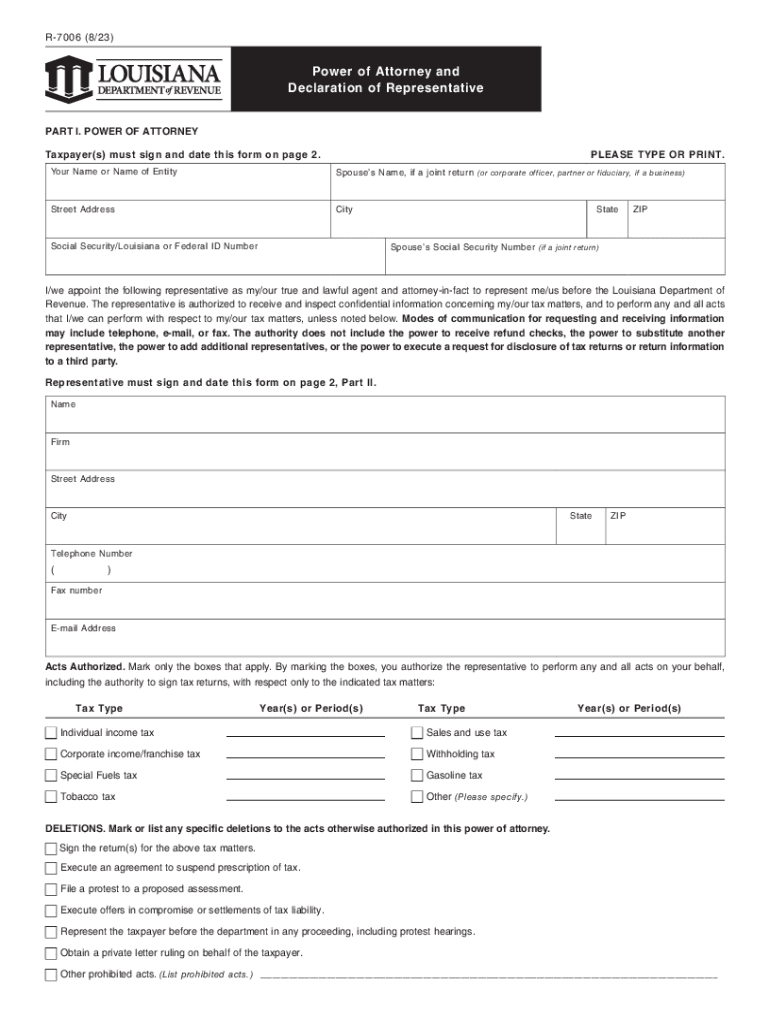

The Louisiana Tax Power of Attorney Form R 7006 is a legal document that allows an individual to designate another person to act on their behalf in matters related to state tax affairs. This form is specifically tailored for Louisiana and is used to grant authority to a representative to handle tax-related issues with the Louisiana Department of Revenue. It is essential for taxpayers who may need assistance in managing their tax obligations, ensuring that their representative can communicate effectively with the tax authorities.

How to use the Louisiana Tax Power Of Attorney Form R 7006

To use the Louisiana Tax Power of Attorney Form R 7006, the taxpayer must complete the form by providing their personal information, including name, address, and taxpayer identification number. The form also requires the designation of the representative, who will be authorized to act on the taxpayer's behalf. Once completed, the form should be signed and dated by the taxpayer. It is advisable to keep a copy of the signed form for personal records, as it serves as proof of the authority granted to the representative.

Steps to complete the Louisiana Tax Power Of Attorney Form R 7006

Completing the Louisiana Tax Power of Attorney Form R 7006 involves several straightforward steps:

- Obtain the form from the Louisiana Department of Revenue or a trusted source.

- Fill in the taxpayer's information, including full name, address, and Social Security number or taxpayer ID.

- Provide the representative's details, including name, address, and contact information.

- Specify the scope of authority granted to the representative, which can include all tax matters or specific issues.

- Sign and date the form to validate it.

Key elements of the Louisiana Tax Power Of Attorney Form R 7006

The key elements of the Louisiana Tax Power of Attorney Form R 7006 include:

- Taxpayer Information: Essential details about the taxpayer, including identification numbers.

- Representative Information: Contact details for the person authorized to act on behalf of the taxpayer.

- Scope of Authority: Clear specifications of the powers granted to the representative.

- Signature: The taxpayer's signature is required to confirm the authority granted.

Legal use of the Louisiana Tax Power Of Attorney Form R 7006

The Louisiana Tax Power of Attorney Form R 7006 is legally recognized and allows the designated representative to perform various tax-related functions on behalf of the taxpayer. This includes filing tax returns, responding to inquiries from the Louisiana Department of Revenue, and representing the taxpayer in audits. It is important for both the taxpayer and the representative to understand the legal implications of this authority and to ensure that the form is used in compliance with state regulations.

Eligibility Criteria

To use the Louisiana Tax Power of Attorney Form R 7006, the taxpayer must be a resident of Louisiana or have tax obligations in the state. The representative must be an individual or entity capable of providing the necessary assistance in tax matters. There are no specific qualifications required for the representative, but it is advisable to choose someone knowledgeable about Louisiana tax laws and procedures.

Quick guide on how to complete louisiana tax power of attorney form r 7006 pdf

Complete Louisiana Tax Power Of Attorney Form R 7006 PDF seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly without delays. Manage Louisiana Tax Power Of Attorney Form R 7006 PDF on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and electronically sign Louisiana Tax Power Of Attorney Form R 7006 PDF with ease

- Obtain Louisiana Tax Power Of Attorney Form R 7006 PDF and click Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Mark pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Louisiana Tax Power Of Attorney Form R 7006 PDF and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct louisiana tax power of attorney form r 7006 pdf

Create this form in 5 minutes!

How to create an eSignature for the louisiana tax power of attorney form r 7006 pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the louisiana revenue poa?

The louisiana revenue power of attorney (POA) allows individuals to designate someone to manage their tax affairs with the Louisiana Department of Revenue. This legal document ensures that your chosen representative can act on your behalf, making it crucial for efficient financial management. Understanding the specifics of the louisiana revenue POA can help you avoid potential pitfalls during tax season.

-

How can airSlate SignNow help with the louisiana revenue poa?

airSlate SignNow simplifies the process of creating and signing your louisiana revenue POA electronically. Our platform enables quick document preparation, secure eSigning, and easy storage, making legal procedures more efficient. With airSlate SignNow, you can ensure your louisiana revenue POA is handled swiftly and safely.

-

What are the costs associated with creating a louisiana revenue poa?

Creating a louisiana revenue POA using airSlate SignNow is cost-effective with our competitive pricing plans tailored for individuals and businesses. You can streamline the drafting and signing process without worrying about high legal fees. Our platform offers several affordable options to help you manage your louisiana revenue POA effortlessly.

-

Are there any specific features for the louisiana revenue poa on airSlate SignNow?

Yes, airSlate SignNow offers features specifically designed for the louisiana revenue POA, such as customizable templates, electronic signatures, and real-time tracking of document status. These tools ensure that your POA is not only compliant but also processed as quickly as possible. Our intuitive interface makes it easy to navigate the requirements of the louisiana revenue POA.

-

What are the advantages of using airSlate SignNow for my louisiana revenue poa?

Using airSlate SignNow for your louisiana revenue POA provides numerous advantages, including increased efficiency and enhanced security. You can complete your documents online, reducing the risk of errors associated with manual entry. Additionally, the electronic signature feature streamlines the approval process, allowing you to focus on other important tasks.

-

How do I ensure the louisiana revenue poa is legally binding?

To ensure that your louisiana revenue POA is legally binding, it is important to follow the state-specific guidelines for signatures and notarizations. airSlate SignNow provides compliance features that meet Louisiana's legal requirements, giving you peace of mind. By creating your POA through our platform, you can easily meet these legal standards.

-

Can I integrate airSlate SignNow with other software for my louisiana revenue poa?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to streamline your workflows related to the louisiana revenue POA. You can connect with CRMs, document management tools, and more to ensure seamless collaboration. These integrations help you manage your financial documentation more effectively.

Get more for Louisiana Tax Power Of Attorney Form R 7006 PDF

- Payments for you form

- New business application for financial advisors form

- Bostonxinetbosworkjobs30804piece551982922frmnpdistrib form

- Nn0739e request for change evidence of insurability not required nn0739e form

- Pregnancy consent form

- Po box 18804 chattanooga tn 37422 form

- Additional payment remittance for use with massmutual form

- Topical ointment ampamp sunscreen authorization ymca of form

Find out other Louisiana Tax Power Of Attorney Form R 7006 PDF

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract