Form ST 810 May , New York State and Local Sales and Use Tax Ny

What is the Form ST 810 May, New York State And Local Sales And Use Tax Ny

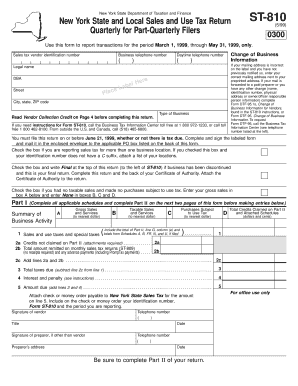

The Form ST 810 is a crucial document used in New York State for claiming an exemption from sales and use tax. It is specifically designed for businesses and individuals who qualify for exemptions under specific circumstances, such as purchases made for resale or certain tax-exempt organizations. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations.

How to use the Form ST 810 May, New York State And Local Sales And Use Tax Ny

Using the Form ST 810 involves a straightforward process. First, ensure that you meet the eligibility criteria for exemption. Next, accurately complete the form by providing necessary details such as the purchaser's name, address, and the reason for the exemption. Once filled out, the form should be presented to the seller at the time of purchase, allowing for tax-free transactions under the applicable laws.

Steps to complete the Form ST 810 May, New York State And Local Sales And Use Tax Ny

Completing the Form ST 810 requires careful attention to detail. Here are the steps to follow:

- Obtain the form from the New York State Department of Taxation and Finance website or authorized sources.

- Fill in the purchaser's name, address, and identification number, if applicable.

- Indicate the reason for claiming the exemption by selecting the appropriate box.

- Provide the seller's information, including their name and address.

- Sign and date the form to certify the accuracy of the information provided.

Key elements of the Form ST 810 May, New York State And Local Sales And Use Tax Ny

The Form ST 810 includes several key elements that are essential for its validity. These elements consist of the purchaser's details, the seller's information, and the specific exemption reason. Additionally, the form must include a signature from the purchaser, affirming that the information is correct and that the exemption is applicable under New York tax laws.

Filing Deadlines / Important Dates

While the Form ST 810 itself does not have a specific filing deadline, it is important to present it at the time of purchase to avoid sales tax charges. Businesses should maintain accurate records of all transactions involving the form to ensure compliance during tax audits. Keeping track of any changes in tax regulations or exemption criteria is also advisable to remain informed.

Legal use of the Form ST 810 May, New York State And Local Sales And Use Tax Ny

The legal use of the Form ST 810 is strictly defined under New York State tax laws. It can only be used for transactions that qualify for exemption, such as sales for resale or purchases made by exempt organizations. Misuse of the form, such as claiming exemptions for ineligible purchases, can result in penalties and interest charges. It is essential to understand the legal implications of using this form to ensure compliance.

Quick guide on how to complete form st 810 may new york state and local sales and use tax ny

Effortlessly prepare [SKS] on any device

Online document administration has become increasingly favored by companies and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to edit and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark essential sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

No more concerns about missing or lost files, tedious form searches, or mistakes that require printing out new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign [SKS] while ensuring effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form ST 810 May , New York State And Local Sales And Use Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form st 810 may new york state and local sales and use tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form ST 810 May, New York State And Local Sales And Use Tax NY?

Form ST 810 May, New York State And Local Sales And Use Tax NY is a tax exemption certificate used by eligible purchasers when making tax-exempt purchases in New York. This form allows businesses to avoid paying sales tax on qualifying items, thereby streamlining the purchase process. Understanding how to properly use this form can lead to signNow savings for businesses.

-

How does airSlate SignNow help with Form ST 810 May, New York State And Local Sales And Use Tax NY?

airSlate SignNow simplifies the process of sending and eSigning Form ST 810 May, New York State And Local Sales And Use Tax NY. With our user-friendly interface, you can easily complete and send this crucial document to ensure compliance and expedite transactions. This service offers a seamless experience for users handling tax-related documents.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans to cater to various business needs. Whether you're a small business or a large organization, we provide cost-effective solutions that support the use of documents like Form ST 810 May, New York State And Local Sales And Use Tax NY. Our pricing is designed to give you great value while helping you manage your tax documents efficiently.

-

What features does airSlate SignNow offer for managing Form ST 810 May, New York State And Local Sales And Use Tax NY?

Our platform provides a suite of features that enhance document management, including templates, customizable workflows, and secure eSigning capabilities. You can easily create, share, and sign Form ST 810 May, New York State And Local Sales And Use Tax NY with confidence. Additionally, our integration options allow for seamless workflow automation and tracking.

-

Is airSlate SignNow compliant with tax regulations for Form ST 810 May, New York State And Local Sales And Use Tax NY?

Yes, airSlate SignNow is committed to compliance and security, ensuring that all transactions involving Form ST 810 May, New York State And Local Sales And Use Tax NY meet relevant regulations. Our platform uses top-notch encryption and security measures to protect sensitive information. This compliance helps businesses avoid potential tax-related issues.

-

Can I integrate airSlate SignNow with other accounting tools for tax management?

Absolutely! airSlate SignNow is designed to integrate with various accounting and tax software tools, ensuring that your use of Form ST 810 May, New York State And Local Sales And Use Tax NY fits smoothly into your existing workflow. This interoperability enhances efficiency and allows for better management of tax documentation across platforms.

-

What benefits can businesses expect from using airSlate SignNow for Form ST 810 May, New York State And Local Sales And Use Tax NY?

By using airSlate SignNow for Form ST 810 May, New York State And Local Sales And Use Tax NY, businesses can expect improved efficiency in document handling, faster transaction times, and reduced paperwork. Our electronic signature solution streamlines the approval process, allowing for quicker compliance with tax regulations. Additionally, this tool helps ensure accuracy and minimizes errors.

Get more for Form ST 810 May , New York State And Local Sales And Use Tax Ny

- Cs 704 12 19 form

- E311 declaration card form

- Pptc 153 e adult general passport application for canadians 16 years of age or over applying in canada or the usa form

- Pptc 054 e adult simplified renewal passport application for eligible canadians applying in canada or the usa form

- Cit 0407 e how to calculate physical presence form

- Form application british columbia

- Registration form online

- Dealer online authority to register form

Find out other Form ST 810 May , New York State And Local Sales And Use Tax Ny

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document