CT 8857 , Request for Innocent Spouse Relief and Separation Ct Form

What is the CT 8857, Request For Innocent Spouse Relief and Separation Ct

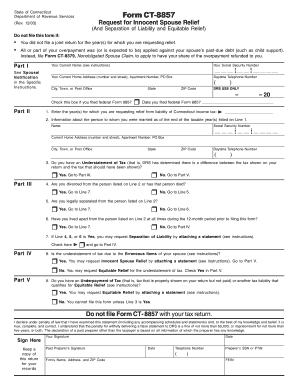

The CT 8857, Request For Innocent Spouse Relief and Separation Ct, is a tax form used by individuals who seek relief from tax liabilities incurred by their spouse or former spouse. This form is particularly relevant in situations where one spouse believes they should not be held responsible for taxes due to the other spouse's actions, such as underreporting income or claiming improper deductions. By filing this form, individuals can request the IRS to relieve them of the joint tax liability, thereby protecting their financial interests.

How to use the CT 8857, Request For Innocent Spouse Relief and Separation Ct

Using the CT 8857 involves several steps to ensure proper submission. First, individuals should gather necessary documentation, including tax returns and any correspondence with the IRS. Next, they need to fill out the form accurately, providing details about their marital status, the tax years in question, and the reasons for requesting relief. After completing the form, it can be submitted either online or via mail, depending on the IRS guidelines. It is crucial to keep copies of all submitted documents for personal records.

Steps to complete the CT 8857, Request For Innocent Spouse Relief and Separation Ct

Completing the CT 8857 requires careful attention to detail. Here are the essential steps:

- Obtain the CT 8857 form from the IRS website or through a tax professional.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about your spouse or former spouse, including their name and Social Security number.

- Indicate the tax years for which you are requesting relief.

- Explain the reasons for your request, focusing on how the tax liability arose from your spouse's actions.

- Sign and date the form before submission.

Eligibility Criteria

To qualify for relief under the CT 8857, certain eligibility criteria must be met. Individuals must demonstrate that they were married to the person who incurred the tax liability, that they did not know and had no reason to know about the tax issues, and that it would be unfair to hold them responsible for the tax debt. Additionally, the request must be made within two years of the IRS's first collection activity against the individual.

Required Documents

When submitting the CT 8857, individuals should include various supporting documents to strengthen their case. Required documents may include:

- Copies of joint tax returns for the years in question.

- Any correspondence received from the IRS regarding the tax liability.

- Financial records that demonstrate the individual's lack of knowledge about the tax issues.

- Proof of separation or divorce from the spouse responsible for the tax liability.

Form Submission Methods

The CT 8857 can be submitted in multiple ways. Individuals have the option to file the form online through the IRS e-file system or send it via mail to the appropriate IRS address. If filing by mail, it is advisable to use a secure method, such as certified mail, to ensure that the submission is tracked and confirmed. Each submission method has specific processing times, so individuals should plan accordingly.

Quick guide on how to complete ct 8857 request for innocent spouse relief and separation ct

Complete [SKS] seamlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the right form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any holdups. Manage [SKS] on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional ink signature.

- Verify the details and press the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure exceptional communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to CT 8857 , Request For Innocent Spouse Relief and Separation Ct

Create this form in 5 minutes!

How to create an eSignature for the ct 8857 request for innocent spouse relief and separation ct

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is CT 8857, Request For Innocent Spouse Relief and Separation Ct. and how can airSlate SignNow help?

CT 8857, Request For Innocent Spouse Relief and Separation Ct. is a form that allows individuals to request relief from joint tax liability due to innocent spouse status. airSlate SignNow provides an intuitive platform that simplifies the document signing process, making it easy to complete and eSign this form securely and efficiently.

-

What features does airSlate SignNow offer for processing CT 8857, Request For Innocent Spouse Relief and Separation Ct.?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and audit trails, ensuring that your CT 8857, Request For Innocent Spouse Relief and Separation Ct. is processed efficiently. The platform also supports collaboration, allowing multiple parties to eSign and submit the document seamlessly.

-

Is there a cost associated with using airSlate SignNow for CT 8857, Request For Innocent Spouse Relief and Separation Ct.?

Yes, airSlate SignNow offers several pricing tiers designed to suit different business needs, including options for individuals handling CT 8857, Request For Innocent Spouse Relief and Separation Ct. The pricing is competitive and transparent, with no hidden fees, making it a cost-effective solution.

-

How does airSlate SignNow ensure the security of my CT 8857, Request For Innocent Spouse Relief and Separation Ct. documents?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols to keep your CT 8857, Request For Innocent Spouse Relief and Separation Ct. documents secure. Additionally, user permissions and secure document sharing options further enhance the protection of sensitive information.

-

Can I integrate airSlate SignNow with other applications for managing CT 8857, Request For Innocent Spouse Relief and Separation Ct.?

Yes, airSlate SignNow offers integrations with various applications to streamline your workflow when managing CT 8857, Request For Innocent Spouse Relief and Separation Ct. You can easily connect it with platforms like Google Drive, Dropbox, and CRM systems to enhance efficiency.

-

What are the benefits of using airSlate SignNow for CT 8857, Request For Innocent Spouse Relief and Separation Ct. over traditional methods?

Using airSlate SignNow for CT 8857, Request For Innocent Spouse Relief and Separation Ct. offers numerous benefits over traditional methods, including faster processing times, reduced paperwork, and the convenience of electronic signatures. These advantages help individuals save time and minimize errors in their submissions.

-

Is it easy to use airSlate SignNow for someone unfamiliar with eSignature tools when filling out CT 8857, Request For Innocent Spouse Relief and Separation Ct.?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals unfamiliar with eSignature tools. The platform provides guided prompts and support resources, ensuring that anyone can navigate the process of filling out and signing CT 8857, Request For Innocent Spouse Relief and Separation Ct. easily.

Get more for CT 8857 , Request For Innocent Spouse Relief and Separation Ct

Find out other CT 8857 , Request For Innocent Spouse Relief and Separation Ct

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement