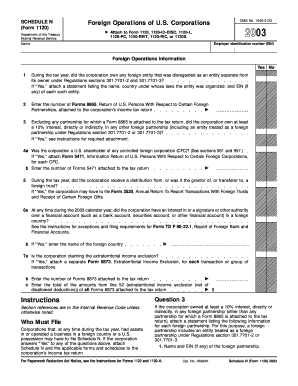

Form 1120 Schedule N Foreign Operations of U S Corporations

What is the Form 1120 Schedule N Foreign Operations Of U S Corporations

The Form 1120 Schedule N is a crucial document for U.S. corporations engaged in foreign operations. It is used to report the income, deductions, and other tax-related information of U.S. corporations that have foreign subsidiaries or branches. This form helps the Internal Revenue Service (IRS) understand the extent of a corporation's foreign activities and ensures compliance with U.S. tax laws. By detailing foreign operations, corporations can accurately calculate their tax obligations and avoid potential penalties for non-compliance.

How to use the Form 1120 Schedule N Foreign Operations Of U S Corporations

Using Form 1120 Schedule N involves several key steps. Corporations must first gather all relevant financial data regarding their foreign operations, including income earned, expenses incurred, and any applicable tax credits. Once the necessary information is collected, it should be entered into the appropriate sections of the form. Accurate reporting is essential, as any discrepancies could lead to audits or penalties. After completing the form, corporations should review it for accuracy before submission to ensure compliance with IRS regulations.

Steps to complete the Form 1120 Schedule N Foreign Operations Of U S Corporations

Completing Form 1120 Schedule N requires a systematic approach:

- Gather financial statements from foreign operations, including profit and loss statements and balance sheets.

- Identify all foreign subsidiaries and branches, along with their financial contributions.

- Fill out the form sections, detailing income, deductions, and credits related to foreign operations.

- Review the completed form for accuracy and completeness.

- Submit the form with the corporation's annual tax return.

Key elements of the Form 1120 Schedule N Foreign Operations Of U S Corporations

Form 1120 Schedule N includes several key elements that are critical for accurate reporting. These elements consist of:

- Foreign Income: Report all income generated from foreign sources.

- Deductions: Include any deductions applicable to foreign operations.

- Tax Credits: Detail any foreign tax credits that may reduce U.S. tax liability.

- Ownership Structure: Provide information on the ownership percentage of foreign subsidiaries.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing Form 1120 Schedule N. Typically, the form is due on the same date as the corporation's annual tax return, which is usually the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is essential to file on time to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file Form 1120 Schedule N accurately and on time can result in significant penalties. The IRS may impose fines for late submissions, inaccuracies, or failure to disclose required information. These penalties can accumulate quickly, potentially leading to financial strain for the corporation. It is crucial for businesses to understand their obligations and ensure timely and accurate filing to avoid these consequences.

Quick guide on how to complete form 1120 schedule n foreign operations of u s corporations

Effortlessly complete [SKS] on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] across any platform using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just several clicks from your device of choice. Modify and electronically sign [SKS] to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 Schedule N Foreign Operations Of U S Corporations

Create this form in 5 minutes!

How to create an eSignature for the form 1120 schedule n foreign operations of u s corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1120 Schedule N Foreign Operations Of U S Corporations?

Form 1120 Schedule N Foreign Operations Of U S Corporations is a tax form used by U.S. corporations to report their foreign operations. It provides vital information for tax purposes, detailing income and expenses generated outside of the U.S. This form is essential for ensuring compliance with IRS regulations regarding international business activities.

-

How does airSlate SignNow assist with completing Form 1120 Schedule N?

airSlate SignNow simplifies the process of filling out Form 1120 Schedule N Foreign Operations Of U S Corporations by allowing users to easily send and eSign documents. With its user-friendly interface, you can quickly gather the necessary signatures, ensuring your tax documents are complete and accurate. This can save you signNow time during tax season.

-

What are the costs associated with using airSlate SignNow for Form 1120 Schedule N?

airSlate SignNow offers a cost-effective solution for managing your documents, including those related to Form 1120 Schedule N Foreign Operations Of U S Corporations. Pricing plans vary based on features and user needs, ensuring businesses of all sizes can afford the service. A trial period is also available to evaluate the software before committing.

-

What features does airSlate SignNow provide for handling tax documents?

airSlate SignNow provides features tailored for managing tax documents, such as secure eSigning, templates, and automatic reminders for deadlines like the submission of Form 1120 Schedule N Foreign Operations Of U S Corporations. These features help streamline your workflow, making tax season less stressful and more efficient.

-

Can airSlate SignNow integrate with accounting software for Form 1120 Schedule N?

Yes, airSlate SignNow can integrate with various accounting and finance software, simplifying the preparation of Form 1120 Schedule N Foreign Operations Of U S Corporations. This integration allows users to pull necessary data directly into their tax forms, reducing manual entry errors and enhancing accuracy.

-

What are the benefits of using airSlate SignNow for filing Form 1120 Schedule N?

Using airSlate SignNow for filing Form 1120 Schedule N Foreign Operations Of U S Corporations provides numerous benefits, including enhanced security, compliance, and ease of access. Users can electronically sign and store their documents securely, ensuring they are readily available for filing while meeting IRS deadlines.

-

Is airSlate SignNow suitable for small businesses needing Form 1120 Schedule N?

Absolutely! airSlate SignNow is specifically designed to be user-friendly and cost-effective, making it an ideal solution for small businesses that need to complete Form 1120 Schedule N Foreign Operations Of U S Corporations. The software enhances productivity and ensures that even small teams can manage their documentation efficiently without a steep learning curve.

Get more for Form 1120 Schedule N Foreign Operations Of U S Corporations

- Dhs 5841 form

- Corel draw 11 tutorials pdf in hindi form

- Erie county prc form

- Sickkids referral form

- Request to waive or substitute course requirements byui form

- Ohio cacfp policy is that infant under one year of age meal counts be recorded by individual childs name form

- Food and safety license form

- Pay stub request form 41165890

Find out other Form 1120 Schedule N Foreign Operations Of U S Corporations

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement