Form it 221Disability Income ExclusionIT221 Department of

What is the Form IT-221 Disability Income Exclusion

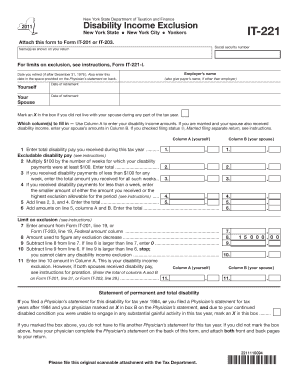

The Form IT-221, also known as the Disability Income Exclusion, is a tax form used by residents of New York State to claim an exclusion for certain types of disability income. This form is specifically designed for individuals who receive disability payments and wish to exclude a portion of that income from their taxable income. By filing this form, taxpayers can potentially reduce their overall tax liability, making it an important document for eligible individuals.

How to Obtain the Form IT-221

The Form IT-221 can be obtained through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print it for completion. Additionally, the form may be available at local tax offices or through tax preparation services. Ensuring that you have the most current version of the form is crucial, as tax regulations may change annually.

Steps to Complete the Form IT-221

Completing the Form IT-221 involves several key steps:

- Provide personal information, including your name, address, and Social Security number.

- Indicate the type of disability income you are receiving.

- Calculate the amount of income you wish to exclude based on the guidelines provided.

- Sign and date the form to certify that the information is accurate.

It is essential to follow the instructions carefully to ensure that your claim is processed without delays.

Eligibility Criteria for Form IT-221

To be eligible to use Form IT-221, individuals must meet specific criteria set by the New York State Department of Taxation and Finance. Generally, the applicant must be a resident of New York State and receive disability income from qualified sources. Additionally, there may be limits on the amount of income that can be excluded, so reviewing the eligibility requirements is vital before submission.

Legal Use of Form IT-221

The legal use of Form IT-221 is governed by New York State tax laws. Taxpayers must ensure that they are using the form in compliance with these laws to avoid penalties. Misuse of the form, such as claiming ineligible income, can result in fines or additional taxes owed. It is advisable to consult a tax professional if there are any uncertainties regarding eligibility or proper usage.

Filing Deadlines for Form IT-221

Filing deadlines for Form IT-221 typically align with the general tax filing deadlines in New York State. Taxpayers should be aware that the form must be submitted along with their annual tax return. Keeping track of these deadlines is crucial to ensure that you do not miss the opportunity to claim the disability income exclusion.

Quick guide on how to complete form it 221disability income exclusionit221 department of

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS and enhance your document-related tasks today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools specifically available through airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IT 221Disability Income ExclusionIT221 Department Of

Create this form in 5 minutes!

How to create an eSignature for the form it 221disability income exclusionit221 department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 221Disability Income ExclusionIT221 Department Of?

Form IT 221Disability Income ExclusionIT221 Department Of is a tax form used in the United States to report disability income exclusions for state tax purposes. This form helps individuals claim specific exclusions based on their disability income, ensuring they optimize their tax situation.

-

How does airSlate SignNow assist with Form IT 221Disability Income ExclusionIT221 Department Of?

airSlate SignNow enables users to electronically fill, sign, and submit Form IT 221Disability Income ExclusionIT221 Department Of quickly and securely. Our platform ensures that all documents are legally compliant and can be easily tracked throughout the signing process.

-

What features does airSlate SignNow offer for Form IT 221Disability Income ExclusionIT221 Department Of?

airSlate SignNow offers features such as customizable templates, secure eSignature options, and automated workflows which can be invaluable when managing Form IT 221Disability Income ExclusionIT221 Department Of. These features simplify the process and enhance document management signNowly.

-

Is airSlate SignNow cost-effective for submitting Form IT 221Disability Income ExclusionIT221 Department Of?

Yes, airSlate SignNow offers a range of pricing plans designed to suit different business needs, making it a cost-effective solution for submitting Form IT 221Disability Income ExclusionIT221 Department Of. Users can benefit from various features without incurring high costs.

-

Can I integrate airSlate SignNow with other applications for Form IT 221Disability Income ExclusionIT221 Department Of?

Absolutely! airSlate SignNow supports integrations with various business applications, allowing for seamless handling of Form IT 221Disability Income ExclusionIT221 Department Of. This capability ensures that data flows smoothly between your tools, enhancing efficiency.

-

What benefits does eSigning provide for Form IT 221Disability Income ExclusionIT221 Department Of?

eSigning with airSlate SignNow for Form IT 221Disability Income ExclusionIT221 Department Of provides quick turnaround times and improved security. The digital signature process is efficient, reduces paper waste, and facilitates faster processing with electronic records.

-

Is airSlate SignNow user-friendly for completing Form IT 221Disability Income ExclusionIT221 Department Of?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to complete Form IT 221Disability Income ExclusionIT221 Department Of. The intuitive interface ensures that users can navigate the platform without extensive training.

Get more for Form IT 221Disability Income ExclusionIT221 Department Of

- Food stamp application for seniorsalabamalegalhelp org form

- Psychopharmacology a master class hms cme cme med harvard form

- Literature circle role summarizer sebring k12 oh form

- Health insurance agreement form california state polytechnic csupomona

- Suppliers listing form vihiga county

- Weekly language review q1 6 answer key form

- Hud as a short form

- Sr 13 alabama form

Find out other Form IT 221Disability Income ExclusionIT221 Department Of

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT