Virginia Nonresident Income Tax Form 2018

What is the Virginia Nonresident Income Tax Form

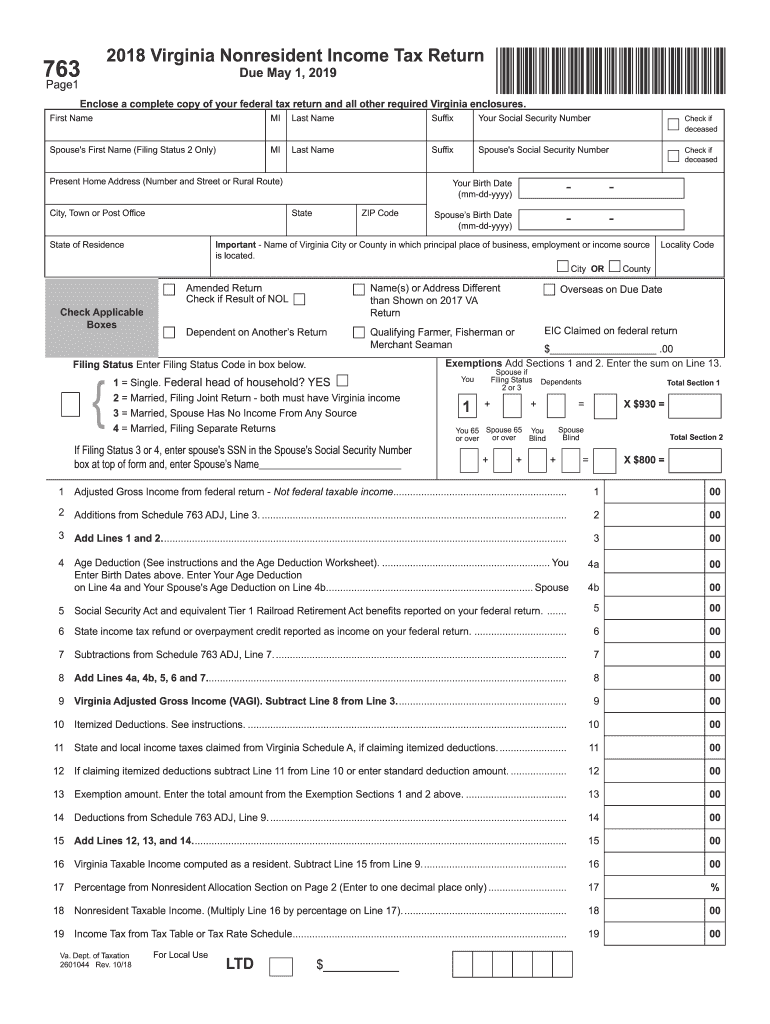

The 2018 Virginia Nonresident Income Tax Form is designed for individuals who earn income in Virginia but reside in another state. This form allows nonresidents to report and pay taxes on income sourced from Virginia. It is essential for ensuring compliance with state tax laws and for accurately calculating the amount owed to the Virginia Department of Taxation.

How to use the Virginia Nonresident Income Tax Form

To effectively use the Virginia Nonresident Income Tax Form, begin by gathering all necessary financial documents, including W-2s, 1099s, and any other income statements. Carefully follow the instructions provided on the form to report your income accurately. Be sure to include any deductions or credits that apply to your situation. After completing the form, review it for accuracy before submitting it to the appropriate tax authority.

Steps to complete the Virginia Nonresident Income Tax Form

Completing the Virginia Nonresident Income Tax Form involves several key steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out personal information, including your name, address, and Social Security number.

- Report your Virginia-sourced income in the designated section.

- Apply any eligible deductions or credits.

- Calculate your total tax liability based on the provided instructions.

- Sign and date the form before submission.

Required Documents

When preparing to file the 2018 Virginia Nonresident Income Tax Form, you will need several documents to ensure accurate reporting. These include:

- W-2 forms from employers for income earned in Virginia.

- 1099 forms for any freelance or contract work completed in the state.

- Records of any deductions or credits you plan to claim.

- Your federal tax return for reference.

Form Submission Methods

The 2018 Virginia Nonresident Income Tax Form can be submitted through various methods. Taxpayers have the option to file online, which is often the most convenient and efficient method. Alternatively, you can mail the completed form to the Virginia Department of Taxation or submit it in person at designated locations. Ensure that you check the specific submission guidelines for each method to avoid delays.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Virginia Nonresident Income Tax Form. Typically, the deadline for submitting your tax return is May first of the year following the tax year. However, if you require additional time, you may be eligible to file for an extension. Be mindful of any changes to deadlines, especially during tax seasons.

Quick guide on how to complete va 763 form 2018 2019

Your assistance manual on how to prepare your Virginia Nonresident Income Tax Form

If you’re wondering how to create and submit your Virginia Nonresident Income Tax Form, here are some concise guidelines on how to simplify tax submission.

To begin, you simply need to set up your airSlate SignNow account to change the way you handle documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to modify, create, and finalize your tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures, and revisit to adjust information as necessary. Enhance your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Adhere to the instructions below to complete your Virginia Nonresident Income Tax Form in just a few minutes:

- Establish your account and start managing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Obtain form to access your Virginia Nonresident Income Tax Form in our editor.

- Enter the necessary fillable fields with your information (text, numerals, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can result in increased errors and delayed refunds. Of course, before electronically filing your taxes, verify the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct va 763 form 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the va 763 form 2018 2019

How to generate an electronic signature for your Va 763 Form 2018 2019 online

How to make an eSignature for your Va 763 Form 2018 2019 in Chrome

How to generate an electronic signature for signing the Va 763 Form 2018 2019 in Gmail

How to make an eSignature for the Va 763 Form 2018 2019 right from your mobile device

How to create an electronic signature for the Va 763 Form 2018 2019 on iOS devices

How to create an electronic signature for the Va 763 Form 2018 2019 on Android devices

People also ask

-

What is the 2018 Virginia nonresident income tax form?

The 2018 Virginia nonresident income tax form is a document used by individuals who earned income in Virginia but do not reside there. This form allows nonresidents to report their Virginia income and pay any applicable taxes. Using the correct form ensures compliance with state tax regulations.

-

How do I access the 2018 Virginia nonresident income tax form?

You can access the 2018 Virginia nonresident income tax form online through the Virginia Department of Taxation's website. They provide downloadable versions of all necessary tax forms. Additionally, platforms like airSlate SignNow allow you to securely sign and send these forms electronically.

-

What are the pricing options for using airSlate SignNow with the 2018 Virginia nonresident income tax form?

airSlate SignNow offers various pricing plans that cater to different business needs, including a pay-as-you-go option and subscription plans. Prices are competitive, making it a cost-effective solution for managing documents like the 2018 Virginia nonresident income tax form. You can choose a plan that fits your frequency of use.

-

Can I eSign the 2018 Virginia nonresident income tax form with airSlate SignNow?

Yes, airSlate SignNow provides a seamless eSigning feature that allows you to electronically sign the 2018 Virginia nonresident income tax form. This feature is both simple and compliant with legal standards for electronic signatures. It ensures quick submission without the need for physical paperwork.

-

What features does airSlate SignNow offer for managing the 2018 Virginia nonresident income tax form?

With airSlate SignNow, you can easily create, edit, and send forms like the 2018 Virginia nonresident income tax form. Additional features include document templates, document sharing, and collaboration tools that streamline the tax filing process. This efficiency helps you avoid delays and errors when submitting your tax forms.

-

Are there any benefits of using airSlate SignNow for the 2018 Virginia nonresident income tax form?

Using airSlate SignNow for the 2018 Virginia nonresident income tax form offers several benefits, including time savings, enhanced security, and improved document management. The platform allows you to track the status of your forms and get reminders to stay compliant with deadlines. This results in a stress-free tax filing experience.

-

How does airSlate SignNow integrate with other software for tax filing?

airSlate SignNow easily integrates with various accounting software and tax filing platforms, making it convenient to manage your 2018 Virginia nonresident income tax form. These integrations ensure that you can pull data directly into your tax forms, reducing data entry errors. Streamlining your workflow is essential for an efficient tax filing process.

Get more for Virginia Nonresident Income Tax Form

- Tn 9 trade name discontinuance new hampshire secretary of state sos nh form

- Singapore visa form

- Information and authorization form ultimate medical academy

- Ceft form

- Remittance advice form overview for account 123456 dpd

- Tinnitus handicap inventory thi hearcare inc amp associates form

- Divorce paperwork form

- Utilities investment company inc form

Find out other Virginia Nonresident Income Tax Form

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter