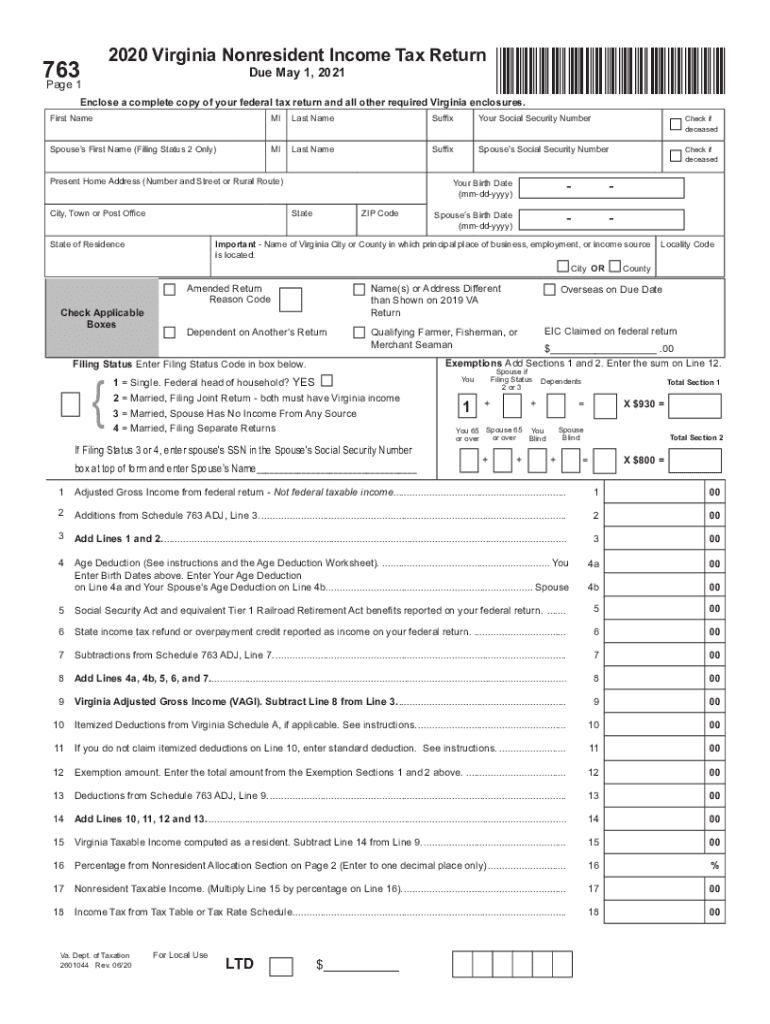

Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return 2020

What is the Virginia State Income Tax Form 763?

The Virginia State Income Tax Form 763 is specifically designed for nonresidents who earn income in Virginia. This form allows individuals who do not reside in Virginia but have income sourced from the state to report their earnings and calculate their tax liability. It is essential for ensuring compliance with Virginia tax laws for those who may work or earn income within the state while maintaining residency elsewhere.

How to Obtain the Virginia State Income Tax Form 763

The Virginia State Income Tax Form 763 can be obtained from the Virginia Department of Taxation website. It is available for download in PDF format, allowing taxpayers to print and fill out the form manually. Additionally, many tax preparation software programs include the form, providing an option for electronic completion and submission.

Steps to Complete the Virginia State Income Tax Form 763

Completing the Virginia State Income Tax Form 763 involves several key steps:

- Gather all necessary documents, including W-2s and 1099s that report Virginia-sourced income.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income earned in Virginia.

- Calculate deductions and credits applicable to your situation.

- Determine your tax liability based on the income reported.

- Sign and date the form before submission.

Legal Use of the Virginia State Income Tax Form 763

The Virginia State Income Tax Form 763 is legally binding when completed accurately and submitted in accordance with state tax regulations. It must be signed by the taxpayer to validate the information provided. Electronic signatures are acceptable if using a compliant eSignature solution, ensuring that the form meets legal standards for submission.

Key Elements of the Virginia State Income Tax Form 763

Key elements of the Virginia State Income Tax Form 763 include:

- Personal Information: This section requires the taxpayer's name, address, and Social Security number.

- Income Reporting: Taxpayers must report all income earned in Virginia.

- Deductions and Credits: Applicable deductions and credits can reduce overall tax liability.

- Signature: A valid signature is required for the form to be considered complete.

Filing Deadlines for the Virginia State Income Tax Form 763

The filing deadline for submitting the Virginia State Income Tax Form 763 typically aligns with the federal tax deadline, which is usually April 15. However, it is essential to verify specific dates each tax year, as they may vary due to weekends or holidays. Taxpayers should ensure timely submission to avoid penalties.

Quick guide on how to complete 2020 form 763 virginia nonresident income tax return 2020 virginia nonresident income tax return

Complete Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without any delays. Manage Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to alter and eSign Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return with ease

- Locate Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return and click Get Form to initiate.

- Utilize the tools available to complete your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 763 virginia nonresident income tax return 2020 virginia nonresident income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 763 virginia nonresident income tax return 2020 virginia nonresident income tax return

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Virginia state income tax form 763?

The Virginia state income tax form 763 is a tax return form designated for nonresidents and part-year residents who have income from Virginia sources. It allows taxpayers to report their income and calculate their tax liability accordingly. By utilizing form 763, individuals ensure compliance with Virginia tax laws.

-

How can I access the virginia state income tax form 763?

You can easily access the Virginia state income tax form 763 via the Virginia Department of Taxation's official website. The form is available for download in PDF format, which you can then fill out and submit either electronically or by mail. Online platforms like airSlate SignNow also allow you to manage and eSign documents seamlessly.

-

What are the benefits of using airSlate SignNow for the virginia state income tax form 763?

Using airSlate SignNow for the Virginia state income tax form 763 means you can eSign and send your forms quickly and securely. It signNowly reduces paperwork and printing costs, making the entire process more efficient. Plus, our platform ensures that your documents are legally binding and easily accessible.

-

Is there a cost associated with filing the virginia state income tax form 763 through airSlate SignNow?

While filling out and filing the Virginia state income tax form 763 through airSlate SignNow involves a subscription cost, the savings in time and resources can outweigh this expense. Our service offers competitive pricing tailored to businesses of all sizes, ensuring you get the best value for your needs.

-

Can I integrate airSlate SignNow with other tools when completing the virginia state income tax form 763?

Yes, airSlate SignNow offers integrations with various other software platforms that can help streamline your workflow. This allows you to connect your financial software or document management systems directly with our platform while working on the Virginia state income tax form 763, enhancing your productivity.

-

What features does airSlate SignNow offer for managing the virginia state income tax form 763?

airSlate SignNow provides features like electronic signatures, document tracking, and custom templates to make managing the Virginia state income tax form 763 easy and efficient. You can automate reminders and notifications to ensure timely filing, leaving you free to focus on other important tasks.

-

How do I ensure my virginia state income tax form 763 is filled out correctly?

To ensure your Virginia state income tax form 763 is filled out correctly, double-check your income sources and applicable deductions as per Virginia tax guidelines. Utilizing airSlate SignNow can also help streamline this process; our user-friendly interface simplifies filling out the form and helps reduce errors with real-time validation.

Get more for Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return

Find out other Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now