Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return 2022-2026

Understanding the 2011 763 Form: Virginia Nonresident Income Tax Return

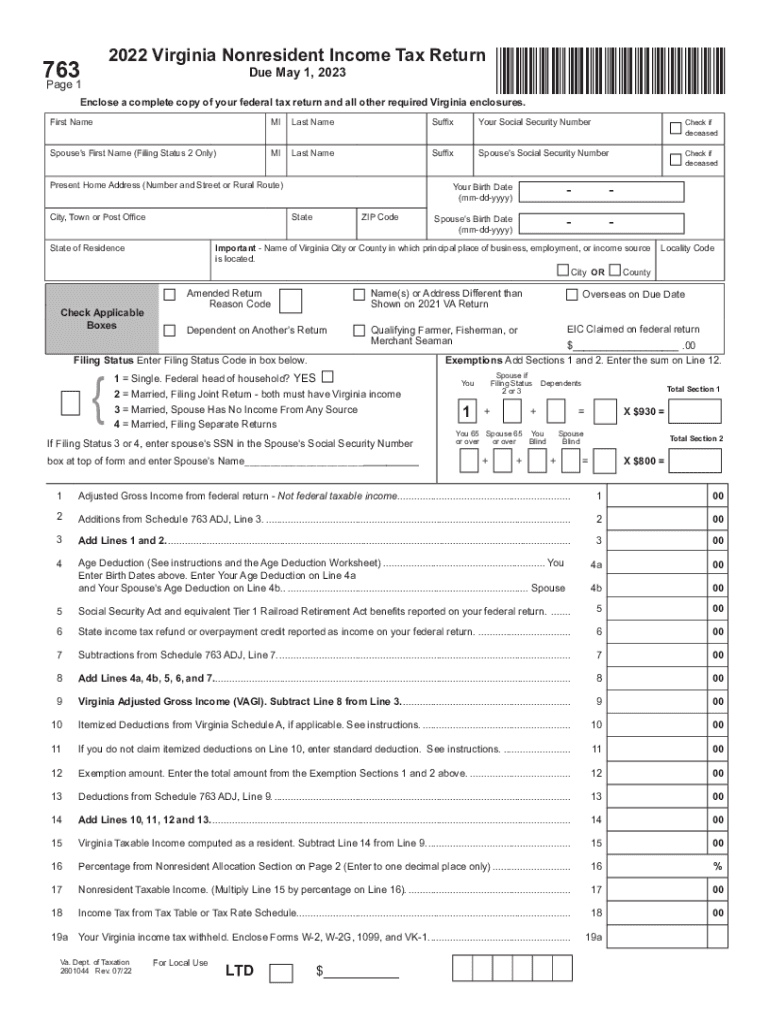

The 2011 763 form, also known as the Virginia Nonresident Income Tax Return, is designed for individuals who earn income in Virginia but are not residents of the state. This form allows nonresidents to report their Virginia-source income and calculate their tax liability accordingly. It is essential for ensuring compliance with Virginia tax laws while accurately reflecting the income earned within the state.

Steps to Complete the 2011 763 Form

Completing the 2011 763 form involves several key steps:

- Gather all necessary documents, including W-2s and 1099s that report Virginia-source income.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income earned in Virginia on the appropriate lines of the form.

- Calculate your tax liability using the provided tax tables or rates.

- Complete any applicable schedules or additional forms, if required.

- Sign and date the form before submission.

Key Elements of the 2011 763 Form

The 2011 763 form includes several important sections that taxpayers should pay attention to:

- Income Reporting: This section requires detailed reporting of all income earned in Virginia.

- Deductions: Taxpayers may be eligible for certain deductions that can reduce their taxable income.

- Tax Calculation: This part helps determine the total tax owed based on the reported income and applicable rates.

- Signature Section: A valid signature is necessary to certify that the information provided is accurate.

Filing Deadlines for the 2011 763 Form

It is crucial to be aware of the filing deadlines associated with the 2011 763 form to avoid penalties:

- The form is typically due on May 1st of the year following the tax year.

- If the due date falls on a weekend or holiday, the deadline is extended to the next business day.

Legal Use of the 2011 763 Form

The 2011 763 form is legally recognized for filing taxes in Virginia. To ensure its validity, it must be completed accurately and submitted by the deadline. Electronic filing options are available, which can streamline the process and provide immediate confirmation of receipt.

Obtaining the 2011 763 Form

Taxpayers can obtain the 2011 763 form through various channels:

- Visit the Virginia Department of Taxation website to download the form directly.

- Request a physical copy by contacting the department or visiting local tax offices.

- Access the form through tax preparation software that supports Virginia tax filings.

Quick guide on how to complete draft 2022 form 763 virginia nonresident income tax return 2022 virginia nonresident income tax return

Handle Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to acquire the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return with minimal effort

- Locate Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct draft 2022 form 763 virginia nonresident income tax return 2022 virginia nonresident income tax return

Create this form in 5 minutes!

People also ask

-

What is form 763 nr alloc pct and how can airSlate SignNow help?

Form 763 nr alloc pct is a specific document used for nonresident allocation of personal income tax. With airSlate SignNow, you can easily create, send, and eSign this form, streamlining the tax filing process and ensuring compliance with state regulations.

-

How much does it cost to use airSlate SignNow for handling form 763 nr alloc pct?

airSlate SignNow offers competitive pricing plans tailored to various business needs. Depending on the features you choose, you can manage form 763 nr alloc pct at an affordable rate, ensuring your document signing process remains budget-friendly.

-

What features does airSlate SignNow offer for managing form 763 nr alloc pct?

airSlate SignNow provides features like customizable templates, real-time collaboration, and automated reminders specifically designed to assist with documents like form 763 nr alloc pct. These tools simplify document workflows and enhance productivity.

-

Can I integrate airSlate SignNow with other applications for form 763 nr alloc pct?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM software, cloud storage solutions, and productivity tools. This integration support allows for a smoother workflow when dealing with form 763 nr alloc pct and other essential documents.

-

Is it easy to eSign form 763 nr alloc pct using airSlate SignNow?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to eSign form 763 nr alloc pct. The platform offers a straightforward signing process, whether you are on a desktop or a mobile device.

-

What are the benefits of using airSlate SignNow for form 763 nr alloc pct?

Using airSlate SignNow for form 763 nr alloc pct provides numerous benefits, including faster turnaround times, enhanced security for your documents, and improved tracking capabilities. It allows businesses to focus more on core activities rather than administrative tasks.

-

How can I get started with airSlate SignNow for form 763 nr alloc pct?

Getting started with airSlate SignNow for form 763 nr alloc pct is simple. You can sign up for a free trial to explore the features and capabilities, allowing you to see firsthand how the software can facilitate your document management.

Get more for Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return

Find out other Draft Form 763, Virginia Nonresident Income Tax Return Virginia Nonresident Income Tax Return

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple