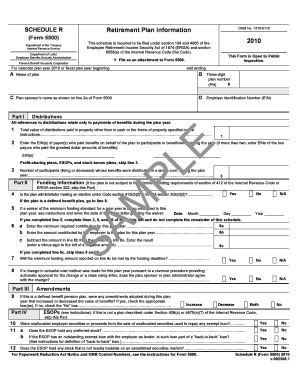

Retirement Plan Information

What is the Retirement Plan Information

The Retirement Plan Information form is a crucial document that provides details about an individual's retirement savings plan. This information typically includes the types of retirement accounts held, contribution amounts, and the plan's overall structure. Understanding this form is essential for individuals planning for their financial future, as it helps them assess their retirement readiness and make informed decisions regarding their savings strategies.

How to use the Retirement Plan Information

Using the Retirement Plan Information involves reviewing the details provided in the form to understand your retirement savings options. Individuals should start by gathering all relevant financial documents, including account statements and contribution records. By analyzing this information, one can determine if they are on track to meet their retirement goals. Additionally, this form can be used to compare different retirement plans and evaluate their benefits and drawbacks.

Steps to complete the Retirement Plan Information

Completing the Retirement Plan Information requires several straightforward steps:

- Gather necessary documents, such as account statements and previous tax returns.

- Identify all retirement accounts, including 401(k)s, IRAs, and pensions.

- Fill out the form with accurate details regarding contributions and account balances.

- Review the completed form for accuracy before submission.

Ensuring all information is correct is vital, as errors can lead to complications in managing retirement funds.

Key elements of the Retirement Plan Information

The key elements of the Retirement Plan Information typically include:

- Account types (e.g., 401(k), IRA)

- Current balances of each retirement account

- Annual contribution limits and actual contributions made

- Employer matching contributions, if applicable

- Investment options available within each plan

Understanding these elements helps individuals make informed decisions about their retirement savings.

Legal use of the Retirement Plan Information

The legal use of the Retirement Plan Information is essential for compliance with federal regulations. Individuals must ensure that the information provided is accurate and reflects their actual retirement savings situation. Misrepresentation or failure to report accurate information can lead to penalties or issues with the Internal Revenue Service (IRS). It is advisable to keep this information updated to align with any changes in financial circumstances or regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the Retirement Plan Information, including contribution limits, tax implications, and withdrawal rules. Familiarizing oneself with these guidelines is crucial for maximizing retirement savings and ensuring compliance with tax laws. The IRS updates these guidelines periodically, so it is important to stay informed about any changes that may affect retirement planning.

Quick guide on how to complete retirement plan information

Complete [SKS] effortlessly on any device

Web-based document administration has gained traction among corporations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign [SKS] to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Retirement Plan Information

Create this form in 5 minutes!

How to create an eSignature for the retirement plan information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it help with Retirement Plan Information?

airSlate SignNow is an electronic signature platform that helps businesses manage their document processes. It streamlines the acquisition and management of Retirement Plan Information, allowing for quick and secure signing of necessary documents. With its user-friendly interface, companies can easily gather and verify Retirement Plan Information, ensuring compliance and efficiency.

-

How does airSlate SignNow ensure the security of my Retirement Plan Information?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption methods to protect your Retirement Plan Information during transmission and storage. Additionally, it complies with industry standards and regulations, ensuring that your sensitive data remains safe and accessible only to authorized users.

-

What pricing options are available for airSlate SignNow related to Retirement Plan Information?

airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that facilitate the management of Retirement Plan Information, with options ranging from basic to advanced functionalities. Potential customers can find a cost-effective solution that aligns with their document management requirements involving Retirement Plan Information.

-

Can airSlate SignNow integrate with other tools to manage Retirement Plan Information?

Yes, airSlate SignNow offers various integrations with popular tools and platforms. This allows businesses to streamline their processes and easily manage Retirement Plan Information across different systems. By connecting airSlate SignNow with your existing software, you can enhance productivity and workflow efficiency.

-

What are the benefits of using airSlate SignNow for accessing Retirement Plan Information?

Using airSlate SignNow provides numerous benefits when handling Retirement Plan Information. The platform simplifies the process of collecting signatures and managing documents, reducing the time and effort required. Additionally, it enhances accuracy and compliance, ensuring that all necessary Retirement Plan Information is properly documented.

-

How can airSlate SignNow help my business stay compliant with Retirement Plan Information regulations?

airSlate SignNow helps ensure compliance with Retirement Plan Information regulations through its secure document management features. The platform provides tools for automated reminders and tracking of document statuses, which aids in maintaining compliance with regulatory requirements. By using airSlate SignNow, your business can confidently handle Retirement Plan Information while minimizing compliance risks.

-

Is it easy to use airSlate SignNow for managing Retirement Plan Information?

Absolutely! airSlate SignNow is designed with a user-friendly interface, making it easy for anyone to manage Retirement Plan Information. Whether you are a tech-savvy individual or not, you can navigate the platform easily to send documents, collect signatures, and store important Retirement Plan Information efficiently.

Get more for Retirement Plan Information

Find out other Retirement Plan Information

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document