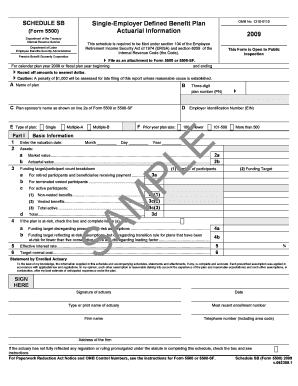

Single Employer Defined Benefit Plan Form

Understanding the Single Employer Defined Benefit Plan

A Single Employer Defined Benefit Plan is a type of retirement plan where an employer promises a specified monthly benefit to employees upon retirement. This benefit is typically calculated based on factors such as salary history and duration of employment. Unlike defined contribution plans, where the employee's retirement benefits depend on investment performance, defined benefit plans provide a predictable income stream in retirement.

Employers are responsible for funding the plan and managing the investments, ensuring that there are sufficient assets to meet future obligations. This structure provides employees with a sense of security, knowing they will receive a defined amount upon retirement.

How to Utilize the Single Employer Defined Benefit Plan

To effectively use a Single Employer Defined Benefit Plan, employers should first establish the plan according to IRS regulations. This involves defining the benefit formula, eligibility criteria, and funding requirements. Employers must communicate the plan details to employees, ensuring they understand how benefits are calculated and when they can expect to receive them.

Employees should regularly review their benefits statements and stay informed about any changes to the plan. Understanding the plan's provisions can help employees make informed decisions about their retirement savings strategy.

Steps to Complete the Single Employer Defined Benefit Plan

Completing a Single Employer Defined Benefit Plan involves several key steps:

- Plan Design: Define the benefit formula and eligibility criteria.

- Documentation: Prepare necessary plan documents, including summary plan descriptions.

- Funding: Ensure that the plan is adequately funded according to IRS guidelines.

- Compliance: Regularly review the plan for compliance with federal regulations.

- Communication: Inform employees about their benefits and any changes to the plan.

Key Elements of the Single Employer Defined Benefit Plan

Several key elements define the structure and function of a Single Employer Defined Benefit Plan:

- Benefit Formula: This determines how retirement benefits are calculated, typically based on salary and years of service.

- Vesting Schedule: This outlines how long employees must work to earn the right to their benefits.

- Funding Requirements: Employers must contribute to the plan to ensure it can meet future obligations.

- Compliance Standards: The plan must adhere to IRS regulations and reporting requirements.

Eligibility Criteria for the Single Employer Defined Benefit Plan

Eligibility for a Single Employer Defined Benefit Plan typically depends on factors such as age, length of service, and employment status. Employers may set specific criteria that employees must meet to participate in the plan. Common eligibility requirements include:

- Minimum age of participation, often 21 years old.

- A specified period of service, such as one year.

- Full-time employment status.

IRS Guidelines for the Single Employer Defined Benefit Plan

The Internal Revenue Service (IRS) provides guidelines that govern the establishment and maintenance of Single Employer Defined Benefit Plans. These guidelines include rules on plan funding, reporting, and compliance. Employers must ensure that their plans meet these requirements to maintain tax-qualified status. Regular audits and compliance checks are essential to avoid penalties and ensure that the plan remains in good standing.

Quick guide on how to complete single employer defined benefit plan

Complete Single Employer Defined Benefit Plan effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Work on Single Employer Defined Benefit Plan from any device using the airSlate SignNow apps for Android or iOS and enhance any document-based process today.

How to modify and electronically sign Single Employer Defined Benefit Plan with ease

- Find Single Employer Defined Benefit Plan and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Single Employer Defined Benefit Plan and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the single employer defined benefit plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Single Employer Defined Benefit Plan?

A Single Employer Defined Benefit Plan is a retirement plan established by an individual employer to provide fixed retirement income to employees based on a predetermined formula, often involving salary and years of service. This type of plan helps businesses attract and retain talent while ensuring financial security for employees in their retirement years.

-

How does a Single Employer Defined Benefit Plan work?

In a Single Employer Defined Benefit Plan, an employer promises a specified monthly benefit at retirement, calculated using factors like salary history and years of service. Contributions are typically made by the employer, and the plan must be funded according to specific regulations to ensure that future obligations are met.

-

What are the advantages of a Single Employer Defined Benefit Plan?

The advantages of a Single Employer Defined Benefit Plan include predictable retirement benefits for employees, which can enhance workforce stability and loyalty. Additionally, employers may enjoy tax advantages, as contributions are often tax-deductible, and the plan can improve the company's reputation as a responsible employer.

-

What features should I look for in a Single Employer Defined Benefit Plan?

When choosing a Single Employer Defined Benefit Plan, look for features such as flexibility in funding methods, compliance support, and customizable benefit formulas. Additionally, consider integration capabilities with payroll systems, ensuring the management of contributions and benefits is streamlined and efficient.

-

How can airSlate SignNow support my Single Employer Defined Benefit Plan?

airSlate SignNow empowers businesses to manage their Single Employer Defined Benefit Plan by streamlining the document signing process related to plan setup, amendments, and employee communications. Utilizing our easy-to-use interface, employers can send and eSign necessary documents quickly, ensuring compliance and enhancing operational efficiency.

-

What is the cost of implementing a Single Employer Defined Benefit Plan?

The cost of implementing a Single Employer Defined Benefit Plan can vary widely based on factors such as the plan’s complexity, the number of employees, and actuarial services required. While there may be upfront setup costs, many employers find that the long-term benefits, including employee satisfaction and tax advantages, outweigh the initial investment.

-

Are there any compliance requirements for a Single Employer Defined Benefit Plan?

Yes, a Single Employer Defined Benefit Plan must comply with various federal regulations, including the Employee Retirement Income Security Act (ERISA). Employers are required to file annual reports, maintain minimum funding standards, and provide participants with plan information to ensure transparency and accountability.

Get more for Single Employer Defined Benefit Plan

Find out other Single Employer Defined Benefit Plan

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document