Govform1099oid 2014

What is the Govform1099oid

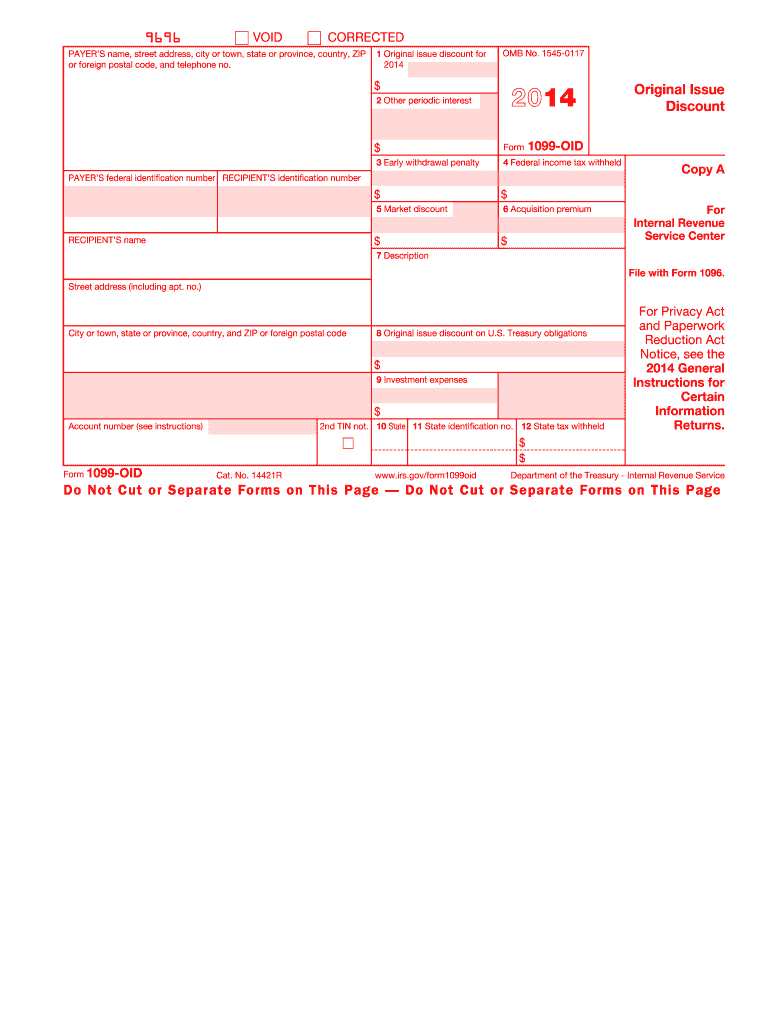

The Govform1099oid is a tax form used in the United States for reporting original issue discount (OID) income. This form is essential for both issuers and investors, as it provides a clear record of the income earned from certain debt instruments. The IRS requires this form to ensure that taxpayers accurately report their earnings from OID, which can arise from bonds, notes, or other financial instruments that are issued at a discount to their face value.

How to use the Govform1099oid

Using the Govform1099oid involves several key steps. First, the issuer must complete the form by detailing the amount of OID income earned by the taxpayer during the tax year. This includes providing the taxpayer's identification information, the amount of OID, and any other relevant financial data. Once completed, the issuer sends a copy of the form to the IRS and provides a copy to the taxpayer for their records. Taxpayers then use this information when filing their income tax returns to ensure compliance with IRS regulations.

Steps to complete the Govform1099oid

Completing the Govform1099oid requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Determine the total amount of OID income that needs to be reported.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the designated deadline and provide a copy to the taxpayer.

Legal use of the Govform1099oid

The legal use of the Govform1099oid is governed by IRS regulations, which dictate how and when the form must be filed. It is crucial for both issuers and recipients to understand their obligations under the law. Failure to file this form correctly can result in penalties for the issuer and may lead to discrepancies in the taxpayer's reported income, which could trigger audits or additional scrutiny from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Govform1099oid are critical for compliance. Typically, issuers must provide the form to recipients by January thirty-first of the year following the tax year in which the OID income was earned. Additionally, the form must be filed with the IRS by the end of February if filed on paper, or by the end of March if filed electronically. Keeping track of these dates helps avoid penalties and ensures that all parties remain compliant with tax regulations.

Who Issues the Form

The Govform1099oid is typically issued by financial institutions, corporations, or other entities that provide debt instruments generating OID income. These issuers are responsible for accurately reporting the OID income to both the IRS and the recipients. It is important for issuers to maintain accurate records of all transactions that may result in OID to ensure proper reporting and compliance with tax laws.

Quick guide on how to complete govform1099oid

Complete Govform1099oid effortlessly on any device

Managing documents online has become increasingly popular with both organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed files, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Govform1099oid on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Govform1099oid with ease

- Find Govform1099oid and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Govform1099oid and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct govform1099oid

Create this form in 5 minutes!

How to create an eSignature for the govform1099oid

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is Govform1099oid and how can it benefit my business?

Govform1099oid is a form used to report payments made to independent contractors. Using airSlate SignNow, managing these documents becomes straightforward, allowing businesses to easily send and eSign 1099 forms digitally, thus streamlining the tax reporting process.

-

How does airSlate SignNow integrate with Govform1099oid?

airSlate SignNow offers seamless integration capabilities for Govform1099oid, ensuring that users can easily fill out, send, and eSign the form electronically. This integration helps maintain compliance and reduces administrative burdens associated with paper-based processes.

-

What are the pricing options for using airSlate SignNow with Govform1099oid?

AirSlate SignNow offers flexible pricing plans suitable for different business needs, including options for those specifically dealing with Govform1099oid. Each plan is designed to provide a cost-effective solution for document management while ensuring users can eSign and store forms securely.

-

Is it secure to use airSlate SignNow for Govform1099oid documents?

Yes, airSlate SignNow employs advanced encryption and security measures to protect all documents, including Govform1099oid. This ensures that sensitive financial information remains confidential and is accessible only to authorized users during the eSigning process.

-

Can I customize Govform1099oid templates on airSlate SignNow?

Absolutely! AirSlate SignNow allows users to customize Govform1099oid templates to suit their specific needs. This flexibility helps you tailor the forms with your branding and ensure that all required information is captured accurately.

-

What features does airSlate SignNow provide for Govform1099oid management?

AirSlate SignNow offers features like automated workflows, reminders, and status tracking specifically for Govform1099oid management. These tools simplify the process of document eSigning and help ensure that all necessary steps are followed efficiently.

-

How can airSlate SignNow help with compliance regarding Govform1099oid?

By utilizing airSlate SignNow for your Govform1099oid, businesses can ensure compliance with IRS regulations. The platform provides easy access to signed documents and maintains a secure audit trail, helping businesses meet necessary reporting requirements.

Get more for Govform1099oid

Find out other Govform1099oid

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself