Real Estate Excise Tax Affidavit Return Form 84 0001B Form Used to Report Real Estate Transfers of Controlling Interest in 2015

What is the Real Estate Excise Tax Affidavit Return form 84 0001B?

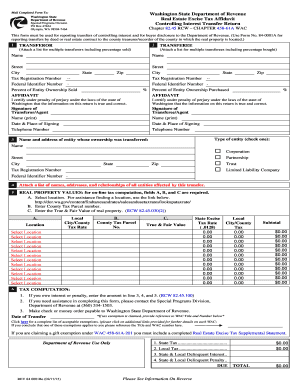

The Real Estate Excise Tax Affidavit Return form 84 0001B is a crucial document used to report real estate transfers of controlling interest in real property. This form is essential for ensuring compliance with state tax laws regarding real estate transactions. It captures necessary information about the parties involved, the property being transferred, and the financial aspects of the transaction. By accurately completing this form, taxpayers can properly report their real estate transactions and fulfill their tax obligations.

Steps to complete the Real Estate Excise Tax Affidavit Return form 84 0001B

Completing the Real Estate Excise Tax Affidavit Return form 84 0001B involves several key steps:

- Gather all necessary information about the property, including its legal description, address, and the names of the parties involved in the transaction.

- Fill out the form with accurate details, ensuring that all required fields are completed. This includes information about the buyer, seller, and the nature of the transfer.

- Calculate the excise tax based on the sale price or the value of the transferred interest, as required by state law.

- Review the completed form for accuracy and completeness before submission.

- Sign and date the form, ensuring that all parties involved have provided their signatures where necessary.

How to obtain the Real Estate Excise Tax Affidavit Return form 84 0001B

The Real Estate Excise Tax Affidavit Return form 84 0001B can be obtained through various channels. It is typically available on the official state department of revenue website or the local tax assessor's office. Additionally, many real estate professionals and legal advisors can provide this form as part of their services. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax law.

Legal use of the Real Estate Excise Tax Affidavit Return form 84 0001B

The legal use of the Real Estate Excise Tax Affidavit Return form 84 0001B is essential for documenting real estate transactions. This form serves as a legal declaration that the transfer of property has occurred and that the appropriate taxes have been calculated and reported. Failure to properly use this form can result in penalties, including fines or additional taxes owed. It is important to adhere to all legal requirements associated with this form to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Real Estate Excise Tax Affidavit Return form 84 0001B can vary by state and should be closely monitored to ensure compliance. Typically, the form must be filed within a specific period following the transfer of property, often within thirty days. It is important to check with local tax authorities to confirm the exact deadlines applicable to your situation. Missing these deadlines can lead to penalties and interest on unpaid taxes.

Form Submission Methods

The Real Estate Excise Tax Affidavit Return form 84 0001B can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the state’s tax department website, where electronic filing is permitted.

- Mailing a hard copy of the completed form to the appropriate tax authority.

- In-person submission at local tax offices or other designated locations.

Choosing the appropriate submission method can streamline the filing process and ensure timely compliance with tax obligations.

Quick guide on how to complete real estate excise tax affidavit return form 84 0001b form used to report real estate transfers of controlling interest in real

Your assistance manual on how to prepare your Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In

If you’re looking to learn how to generate and submit your Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In, here are some brief instructions on making tax filing easier.

First, you just need to set up your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an extremely user-friendly and robust document solution that enables you to alter, draft, and finalize your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and return to adjust information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In in a matter of minutes:

- Create your account and start working on PDFs shortly.

- Utilize our directory to find any IRS tax form; explore various versions and schedules.

- Click Obtain form to bring up your Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In in our editor.

- Fill in the required fields with your details (text, numbers, check marks).

- Utilize the Signature Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and fix any errors.

- Save alterations, print your copy, forward it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically using airSlate SignNow. Please be aware that filing on paper might increase return mistakes and delay refunds. Moreover, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct real estate excise tax affidavit return form 84 0001b form used to report real estate transfers of controlling interest in real

Create this form in 5 minutes!

How to create an eSignature for the real estate excise tax affidavit return form 84 0001b form used to report real estate transfers of controlling interest in real

How to make an electronic signature for the Real Estate Excise Tax Affidavit Return Form 84 0001b Form Used To Report Real Estate Transfers Of Controlling Interest In Real in the online mode

How to generate an eSignature for the Real Estate Excise Tax Affidavit Return Form 84 0001b Form Used To Report Real Estate Transfers Of Controlling Interest In Real in Chrome

How to create an eSignature for putting it on the Real Estate Excise Tax Affidavit Return Form 84 0001b Form Used To Report Real Estate Transfers Of Controlling Interest In Real in Gmail

How to generate an electronic signature for the Real Estate Excise Tax Affidavit Return Form 84 0001b Form Used To Report Real Estate Transfers Of Controlling Interest In Real from your smart phone

How to make an electronic signature for the Real Estate Excise Tax Affidavit Return Form 84 0001b Form Used To Report Real Estate Transfers Of Controlling Interest In Real on iOS devices

How to create an eSignature for the Real Estate Excise Tax Affidavit Return Form 84 0001b Form Used To Report Real Estate Transfers Of Controlling Interest In Real on Android OS

People also ask

-

What is the Real Estate Excise Tax Affidavit Return form 84 0001B used for?

The Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In is a crucial document for reporting signNow real estate transactions. It helps ensure compliance with local tax regulations and allows authorities to track real estate transfers efficiently.

-

How can I access the Real Estate Excise Tax Affidavit Return form 84 0001B?

You can easily access the Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In online through official government websites or available platforms like airSlate SignNow that facilitate document management and eSigning.

-

Is there a costs associated with using the Real Estate Excise Tax Affidavit Return form 84 0001B through airSlate SignNow?

While accessing the Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In may be free, using airSlate SignNow may involve a subscription or service fee for enhanced features like eSigning and document tracking.

-

How does airSlate SignNow simplify filling out the Real Estate Excise Tax Affidavit Return form 84 0001B?

airSlate SignNow streamlines the process of completing the Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In with its easy-to-use interface. Users can fill out forms digitally, sign them electronically, and send them instantly for processing.

-

What are the benefits of using airSlate SignNow for the Real Estate Excise Tax Affidavit Return form 84 0001B?

Using airSlate SignNow for the Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In enhances efficiency and accuracy. The platform offers features like automatic reminders, real-time status updates, and secure cloud storage for your important documents.

-

Can I integrate airSlate SignNow with other software for managing the Real Estate Excise Tax Affidavit Return form 84 0001B?

Yes, airSlate SignNow can be integrated with various third-party applications to support your workflow. This means you can connect your existing systems with the Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In for seamless document management.

-

What security measures does airSlate SignNow implement for the Real Estate Excise Tax Affidavit Return form 84 0001B?

airSlate SignNow prioritizes security, ensuring that all documents, including the Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In, are encrypted and securely stored. The platform also complies with legal standards to protect sensitive information.

Get more for Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In

- Candy comparisons scholastic form

- Declaration about annual turnover by fbo food safety form

- Pmsby enrollment form

- Plot plansite plan certification affidavit town of form

- Quik x bol form

- Wonders california content reader form

- Service level for a cleaning company agreement template form

- Service line agreement template form

Find out other Real Estate Excise Tax Affidavit Return form 84 0001B Form Used To Report Real Estate Transfers Of Controlling Interest In

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy