Real Estate Excise Tax Affidavit Return Form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign in 2022-2026

Understanding the Real Estate Excise Tax Affidavit

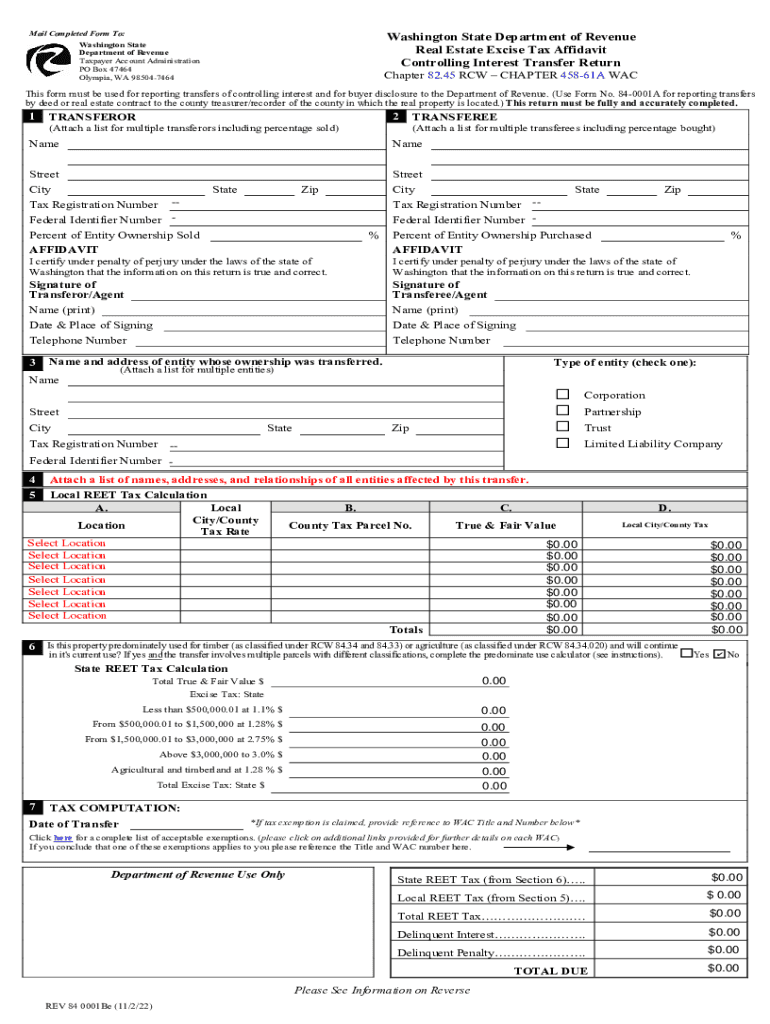

The Real Estate Excise Tax Affidavit, commonly referred to as the 84 0001A form in Washington, is a crucial document used when transferring property ownership. This affidavit serves to report the sale of real estate and calculate the excise tax owed to the state. It is essential for both buyers and sellers to understand the implications of this form, as it ensures compliance with state tax laws and helps avoid potential penalties.

Steps to Complete the Real Estate Excise Tax Affidavit

Completing the Real Estate Excise Tax Affidavit involves several key steps:

- Gather necessary information, including property details, sale price, and buyer/seller information.

- Access the 84 0001A form through the Washington Department of Revenue website or other authorized sources.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed affidavit for any errors or omissions.

- Submit the form either online, by mail, or in person, depending on your preference and local regulations.

Legal Use of the Real Estate Excise Tax Affidavit

The Real Estate Excise Tax Affidavit must be used in accordance with Washington state laws. It is a legally binding document that must be filed to report real estate transactions. Failure to file this affidavit can result in penalties, including fines and interest on unpaid taxes. Understanding the legal requirements surrounding this form is essential for ensuring compliance and protecting your rights in real estate transactions.

Required Documents for Filing the Affidavit

When filing the Real Estate Excise Tax Affidavit, certain documents are typically required:

- Proof of property ownership, such as a deed or title.

- Sales agreement or contract detailing the terms of the sale.

- Identification information for both the buyer and seller.

- Any additional documentation specific to the transaction, such as exemptions or deductions applicable to the sale.

Form Submission Methods

The Real Estate Excise Tax Affidavit can be submitted through various methods:

- Online: Many jurisdictions allow electronic submission through their official websites.

- By Mail: Completed forms can be mailed to the appropriate local tax office.

- In-Person: Submissions can often be made directly at local government offices.

Penalties for Non-Compliance

Failure to file the Real Estate Excise Tax Affidavit can lead to significant penalties. These may include:

- Fines for late submission.

- Interest on unpaid taxes.

- Potential legal action for failure to comply with state tax laws.

Quick guide on how to complete real estate excise tax affidavit return form 84 0001b wamy dor sign inmy dor sign inmy dor sign in

Complete Real Estate Excise Tax Affidavit Return form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign In seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the right form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage Real Estate Excise Tax Affidavit Return form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign In on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

How to update and eSign Real Estate Excise Tax Affidavit Return form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign In effortlessly

- Find Real Estate Excise Tax Affidavit Return form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign In and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form-finding, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Edit and eSign Real Estate Excise Tax Affidavit Return form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign In and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct real estate excise tax affidavit return form 84 0001b wamy dor sign inmy dor sign inmy dor sign in

Create this form in 5 minutes!

People also ask

-

What is a Washington real estate excise tax affidavit?

A Washington real estate excise tax affidavit is a legal document that outlines the details of a real estate transaction, including the sale price and the involved parties. This affidavit is required to ensure compliance with state tax regulations when property is sold or transferred in Washington.

-

How do I prepare a Washington real estate excise tax affidavit using airSlate SignNow?

Preparing a Washington real estate excise tax affidavit using airSlate SignNow is straightforward. Simply use our user-friendly interface to fill in the necessary details, and then electronically sign the document for submission. Our platform guides you through the process to ensure all required information is included.

-

What are the costs associated with filing a Washington real estate excise tax affidavit?

Filing a Washington real estate excise tax affidavit typically involves fees based on the property's sale price as defined by state regulations. While airSlate SignNow itself is a cost-effective solution for document signing, it's essential to factor in any applicable taxes and fees stipulated by local authorities during the filing process.

-

Are there any benefits to using airSlate SignNow for my Washington real estate excise tax affidavit?

Using airSlate SignNow for your Washington real estate excise tax affidavit provides several benefits, including enhanced security, rapid turnaround times, and streamlined document management. Our platform allows for easy collaboration with all parties involved, ensuring a smooth transaction process.

-

Can I integrate airSlate SignNow with other tools for Washington real estate excise tax affidavit management?

Yes, airSlate SignNow offers integrations with various third-party applications that enhance your experience in managing Washington real estate excise tax affidavits. You can connect it with popular tools like CRMs, storage services, and accounting software to centralize your work and save time.

-

What features does airSlate SignNow provide for creating a Washington real estate excise tax affidavit?

airSlate SignNow includes features like customizable templates, real-time collaboration, and legally binding electronic signatures, all of which simplify the creation of a Washington real estate excise tax affidavit. These features ensure you can efficiently complete and file your documents without any hassle.

-

How does airSlate SignNow ensure the security of my Washington real estate excise tax affidavit?

Security is a top priority at airSlate SignNow. We employ advanced encryption methods and comply with industry standards to protect your Washington real estate excise tax affidavit and other sensitive documents. You can rest assured that your information remains confidential and secure.

Get more for Real Estate Excise Tax Affidavit Return form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign In

- Petitioner application form

- Certificate of document preparation oregon form

- Petitioners respondent form

- Oregon request hearing form

- Oregon child support 497323965 form

- Petitioners affidavit in support of motion for order of default oregon 497323966 form

- Affidavit of service regarding various motions orders etc regarding cope oregon form

- Affidavit of service regarding petition and summons oregon form

Find out other Real Estate Excise Tax Affidavit Return form 84 0001B WaMy DOR Sign InMy DOR Sign InMy DOR Sign In

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form