24 Enter the Amount of Income Tax Computed on Your Return for the Other State Tax Ny Form

Understanding the 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

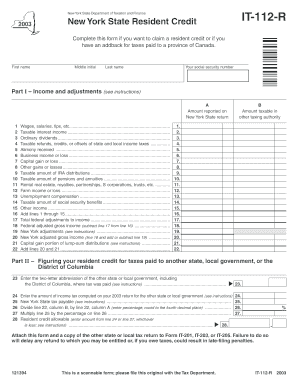

The form titled "24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny" is essential for taxpayers who have income sourced from another state while filing their New York state tax return. This section requires individuals to report the income tax they have already paid to another state, which can help prevent double taxation. By accurately entering this amount, taxpayers can ensure they receive the appropriate credit on their New York tax return, thereby reducing their overall tax liability.

Steps to Complete the 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

Completing this section involves several key steps:

- Gather documentation from the other state, including any tax returns or payment receipts.

- Determine the total amount of income tax paid to the other state for the relevant tax year.

- Locate the appropriate line on your New York tax return where this information is required.

- Enter the total amount of income tax computed on your return for the other state accurately.

- Review your entries to ensure accuracy before submission.

Key Elements of the 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

Several critical elements are involved in this form section:

- Amount of Tax Paid: This is the total income tax you have paid to the other state.

- Documentation: You may need to provide proof of tax payments, such as copies of tax returns or payment confirmations.

- Filing Status: Your filing status may affect how this amount is calculated and reported.

- State-Specific Rules: Each state may have different rules regarding tax credits for taxes paid to other states, so it is essential to be aware of these regulations.

Examples of Using the 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

Here are a couple of scenarios illustrating how to use this form section:

- If you reside in New York but work in New Jersey, you would enter the amount of New Jersey state income tax paid on your New York return to claim a credit.

- For a taxpayer who has rental income from a property located in another state, the income tax paid to that state should also be reported in this section to avoid double taxation.

IRS Guidelines for Reporting Other State Taxes

The IRS provides guidelines on how to report taxes paid to other states. Taxpayers should refer to IRS Publication 514, which outlines the rules for claiming a credit for taxes paid to other jurisdictions. It is important to follow these guidelines to ensure compliance and to maximize any potential tax credits.

Legal Use of the 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

This form section is legally binding and must be filled out accurately to comply with New York state tax laws. Failing to report the correct amount may lead to penalties, interest, or an audit. Taxpayers are encouraged to keep accurate records of all tax payments made to other states to support their claims and ensure they are in compliance with legal requirements.

Quick guide on how to complete 24 enter the amount of income tax computed on your return for the other state tax ny

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the 24 enter the amount of income tax computed on your return for the other state tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny?

The phrase '24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny' refers to a critical step in your tax preparation process. Accurately entering this amount ensures compliance with tax regulations and proper tax reporting for your income. By using airSlate SignNow, you can easily manage and eSign your tax documents to avoid any errors in this important detail.

-

How can airSlate SignNow help with documenting the 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny?

airSlate SignNow offers a seamless platform designed for eSigning and managing crucial tax documents. Users can easily input, document, and share their tax information related to '24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny.' This ensures accuracy and compliance while saving time during tax season.

-

What are the pricing plans for airSlate SignNow, and do they cater to tax documentation needs?

airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. Each plan includes features that support the eSigning and documentation of tax-related information, including '24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny.' You can choose a plan that fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, allowing users to streamline their documentation process. When addressing '24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny,' these integrations enhance efficiency and ensure that all necessary tax documents are easily accessible and eSigned in one place.

-

What features does airSlate SignNow offer that simplify the process of filing out my tax return?

airSlate SignNow provides features like document templates, cloud storage, and a user-friendly interface to streamline your tax return process. When filling out information such as '24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny,' these features help ensure every detail is accurately captured and managed efficiently.

-

How secure is the data when using airSlate SignNow for my tax documents?

Security is a top priority for airSlate SignNow. All documents, including those needing '24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny,' are encrypted to protect your sensitive information. Additionally, the platform complies with industry regulations to ensure that your data remains private and secure throughout the eSigning process.

-

Can I use airSlate SignNow for both personal and business tax returns?

Absolutely! airSlate SignNow is designed to cater to both personal and business needs. Whether you are managing '24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny' for individual tax purposes or business returns, the platform offers features that simplify and enhance the eSignature process for all types of tax documents.

Get more for 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

- Southern county mutual texas insurance company form

- Application relieve estate form

- Application for seal record ofdismissal or not guilty web pdf form

- Mdtagsnow compdfvr 210applicationfordisabilitymotor vehicle administration 6601 ritchie highway n e vr form

- Lessor authorization lessor authorization azdot form

- Maryland odometer form

- Mdot careers mississippi department of transportation form

- Vr 026 08 12 form

Find out other 24 Enter The Amount Of Income Tax Computed On Your Return For The Other State Tax Ny

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later