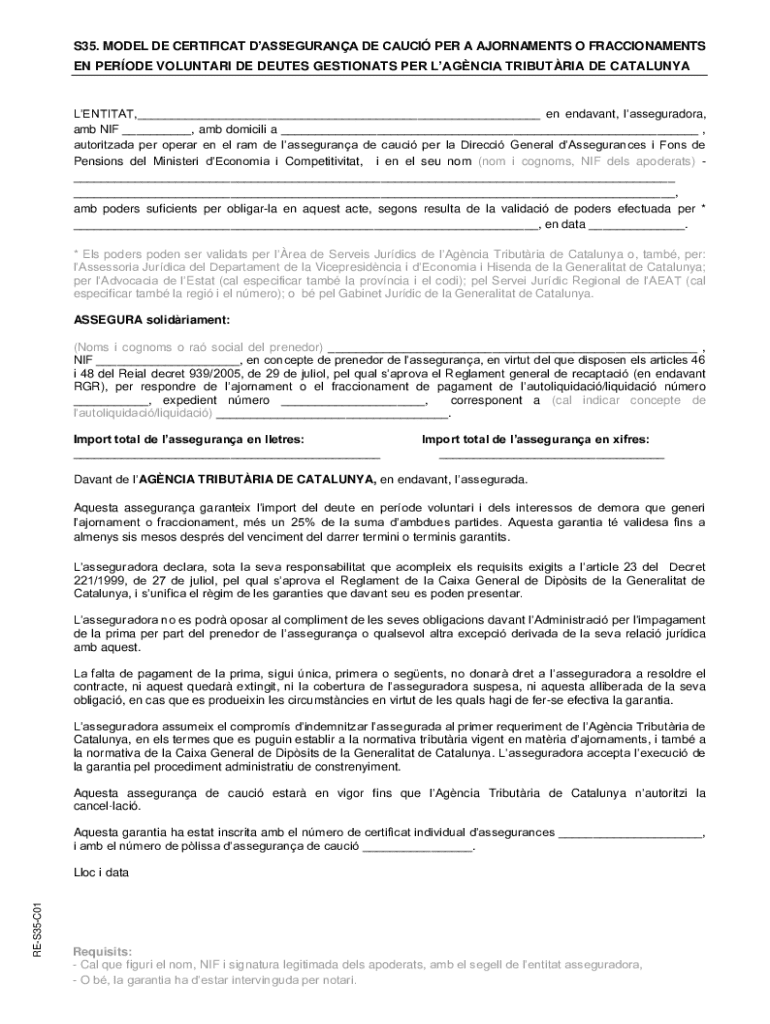

S35 Form

What is the S35

The S35 is a specific form used in various administrative processes, often related to tax or compliance matters. It serves as a standardized document that individuals or businesses must complete to provide necessary information to governmental agencies. Understanding the purpose and requirements of the S35 is essential for ensuring compliance with relevant regulations.

How to use the S35

To effectively use the S35, individuals or businesses should first familiarize themselves with the form's structure and the information required. This involves gathering necessary documents and data before starting the completion process. Once the form is filled out, it should be reviewed for accuracy and completeness to avoid delays or issues during submission.

Steps to complete the S35

Completing the S35 involves several key steps:

- Gather all required information and documents, including identification and financial records.

- Carefully fill out each section of the form, ensuring all fields are completed as needed.

- Review the form for any errors or omissions before finalizing it.

- Submit the form according to the specified guidelines, whether online, by mail, or in person.

Legal use of the S35

The S35 must be used in accordance with applicable laws and regulations. This includes ensuring that the information provided is truthful and accurate. Misuse or falsification of the form can lead to legal penalties or complications, making it crucial for users to understand the legal implications of their submissions.

Filing Deadlines / Important Dates

Filing deadlines for the S35 can vary based on the specific context in which it is used. It is important to be aware of these deadlines to avoid late submissions, which may incur penalties. Users should check the relevant guidelines or consult with a tax professional to ensure compliance with all important dates.

Required Documents

When completing the S35, certain documents are typically required. These may include:

- Identification documents, such as a driver's license or Social Security card.

- Financial statements or records that support the information provided.

- Any additional documentation as specified by the agency requiring the form.

Who Issues the Form

The S35 is typically issued by a governmental agency or regulatory body. This could include federal or state tax authorities, depending on the context of its use. Understanding who issues the form is important for users to ensure they are following the correct procedures and guidelines associated with the specific version of the S35 they are using.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s35 770897232

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the S35 plan offered by airSlate SignNow?

The S35 plan is a comprehensive solution designed for businesses looking to streamline their document signing process. It includes features such as unlimited eSignatures, customizable templates, and advanced security options. With the S35 plan, users can efficiently manage their documents while ensuring compliance and security.

-

How much does the S35 plan cost?

The S35 plan is competitively priced to provide businesses with a cost-effective solution for their eSigning needs. Pricing details can vary based on the number of users and specific features required. For the most accurate pricing information, it's best to visit the airSlate SignNow website or contact our sales team.

-

What features are included in the S35 plan?

The S35 plan includes a variety of features such as unlimited eSignatures, document templates, and real-time tracking. Additionally, users benefit from advanced security measures, including encryption and audit trails. These features are designed to enhance productivity and ensure a seamless signing experience.

-

How can the S35 plan benefit my business?

The S35 plan can signNowly benefit your business by reducing the time and resources spent on document management. With its user-friendly interface and automation capabilities, you can streamline workflows and improve efficiency. Moreover, the S35 plan helps ensure compliance with legal standards, making it a reliable choice for businesses.

-

Can I integrate the S35 plan with other software?

Yes, the S35 plan offers seamless integrations with various software applications, including CRM systems, cloud storage services, and productivity tools. This flexibility allows businesses to incorporate eSigning into their existing workflows easily. Check the airSlate SignNow website for a complete list of supported integrations.

-

Is the S35 plan suitable for small businesses?

Absolutely! The S35 plan is designed to cater to businesses of all sizes, including small businesses. Its cost-effective pricing and user-friendly features make it an ideal choice for small teams looking to enhance their document signing processes without breaking the bank.

-

What kind of support is available for S35 plan users?

Users of the S35 plan have access to comprehensive customer support, including live chat, email assistance, and a detailed knowledge base. Our support team is dedicated to helping you resolve any issues and maximize the benefits of the S35 plan. We strive to ensure that your experience with airSlate SignNow is smooth and efficient.

Get more for S35

- C42g form

- Construction and demolition debris tracking document form

- Iowa marriage license application polk county form

- Wisconsin cle form 1

- Cook county municipal summons this form replaces ccmd 81

- Car club application form

- Residential business tax application form

- Scca sample narrative and documentation form

Find out other S35

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online