Form it 203 X , Amended Nonresident and Part Year Tax Ny

Understanding Form IT 203 X, Amended Nonresident And Part Year Tax NY

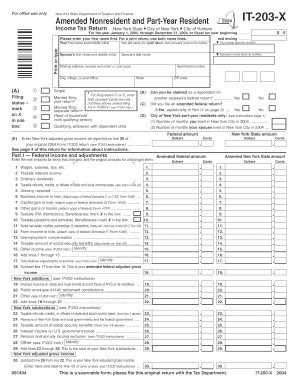

Form IT 203 X is a tax form used by nonresidents and part-year residents of New York State to amend their previously filed New York State income tax returns. This form allows taxpayers to correct errors or make changes to their tax filings, ensuring that their tax obligations are accurately reported. It is specifically designed for individuals who have income sourced from New York but do not reside in the state for the entire year.

Steps to Complete Form IT 203 X

Completing Form IT 203 X involves several key steps. First, gather all necessary documentation, including your original tax return, W-2 forms, and any other relevant financial records. Next, clearly indicate the changes you wish to make on the form, providing detailed explanations for each amendment. Ensure that you fill in all required fields accurately to avoid delays in processing. Finally, review the form for completeness and accuracy before submission.

Obtaining Form IT 203 X

Form IT 203 X can be obtained through multiple channels. You can download the form directly from the New York State Department of Taxation and Finance website. Additionally, physical copies may be available at local tax offices or by request through the mail. It is important to ensure you have the most current version of the form to comply with state regulations.

Filing Deadlines for Form IT 203 X

The filing deadline for Form IT 203 X typically aligns with the original tax return due date. For most taxpayers, this is April 15 of the following year. However, if you are amending your return, it is advisable to submit the form as soon as you identify the need for changes, ideally within three years from the original due date of the return. This ensures that you remain compliant with state tax laws.

Legal Use of Form IT 203 X

Form IT 203 X is legally recognized by the New York State Department of Taxation and Finance for amending tax returns. Using this form appropriately allows taxpayers to rectify mistakes, claim additional deductions, or report new income. It is essential to follow the guidelines provided by the state to ensure that the amendments are valid and do not result in penalties or legal issues.

Key Elements of Form IT 203 X

Key elements of Form IT 203 X include personal identification information, details of the original return, and sections for listing the specific changes being made. Taxpayers must also provide explanations for each amendment and include any supporting documentation that justifies the changes. Accurate completion of these elements is crucial for the successful processing of the amended return.

Quick guide on how to complete form it 203 x amended nonresident and part year tax ny

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and eSign [SKS] Without Effort

- Locate [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize important parts of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your revisions.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes requiring new document prints. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure smooth communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IT 203 X , Amended Nonresident And Part Year Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form it 203 x amended nonresident and part year tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 203 X, Amended Nonresident And Part Year Tax Ny?

Form IT 203 X, Amended Nonresident And Part Year Tax Ny, is a tax form used in New York for non-residents and part-year residents to amend their previously filed state tax returns. This form allows individuals to correct errors, claim additional deductions, or adjust their tax liability. By using airSlate SignNow, you can eSign and submit this form quickly and securely.

-

How can airSlate SignNow help me with Form IT 203 X?

airSlate SignNow simplifies the process of managing your Form IT 203 X, Amended Nonresident And Part Year Tax Ny. With our intuitive platform, you can easily upload, eSign, and share your amended tax forms with professionals or tax authorities. This streamlines the filing process and ensures your amendments are submitted accurately.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to meet a variety of user needs. Whether you're an individual needing to manage forms like the Form IT 203 X, Amended Nonresident And Part Year Tax Ny, or a business looking for team solutions, our pricing plans provide cost-effective options. Detailed pricing information can be found on our website.

-

Are there any specific features for tax form eSigning?

Yes, airSlate SignNow comes with features specifically designed for tax form eSigning, including secure digital signatures, document tracking, and access to templates like Form IT 203 X, Amended Nonresident And Part Year Tax Ny. These features ensure compliance and provide an audit trail for better record-keeping, making it easier for users to manage their tax documents.

-

Can I save and store my Form IT 203 X electronically?

Absolutely! With airSlate SignNow, you can save and store your Form IT 203 X, Amended Nonresident And Part Year Tax Ny, electronically in a secure cloud environment. This ensures that your documents are easily accessible whenever you need them while also minimizing the risk of loss or damage associated with paper forms.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. All documents, including Form IT 203 X, Amended Nonresident And Part Year Tax Ny, are encrypted during transmission and storage. Additionally, our platform complies with industry standards and regulations to safeguard your sensitive information, providing peace of mind while you manage your tax documents.

-

Is airSlate SignNow compatible with other software?

Yes, airSlate SignNow integrates seamlessly with various software tools, enhancing your productivity. You can easily connect it with accounting software, CRM systems, and other applications to streamline the management of documents like Form IT 203 X, Amended Nonresident And Part Year Tax Ny, improving overall efficiency.

Get more for Form IT 203 X , Amended Nonresident And Part Year Tax Ny

Find out other Form IT 203 X , Amended Nonresident And Part Year Tax Ny

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online