Anexo Iii Form

What is the Anexo Iii

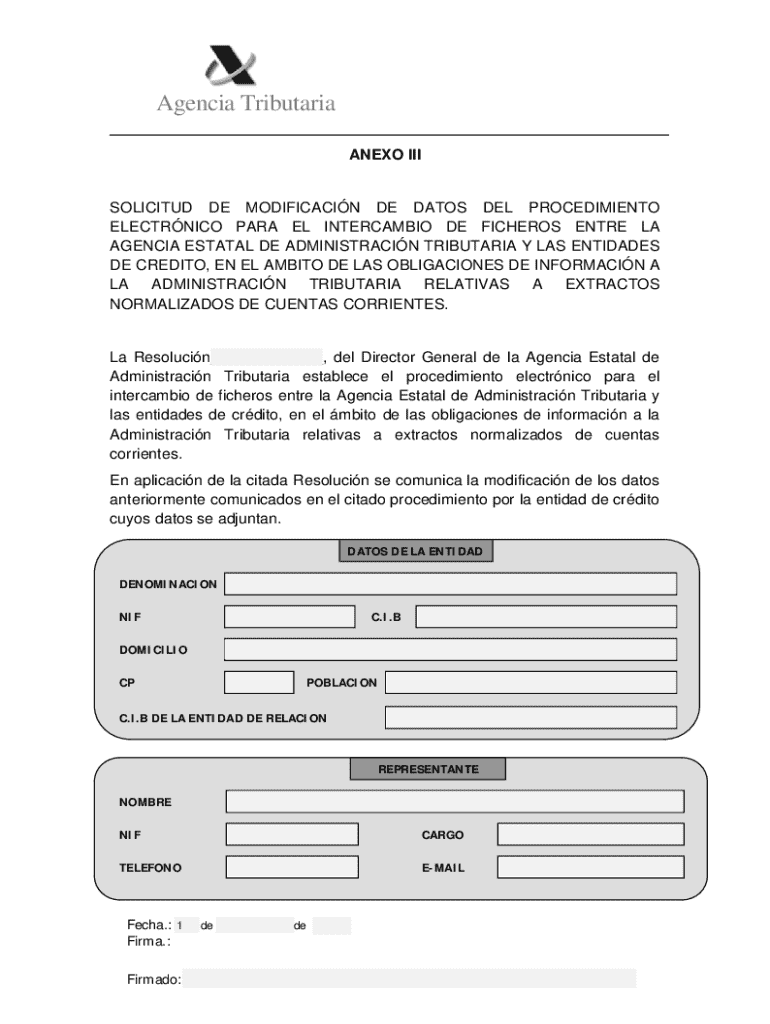

The Anexo Iii is a specific form used in various administrative processes, often related to tax reporting and compliance. It is essential for individuals and businesses to accurately complete this form to ensure adherence to legal requirements. The form typically collects information about income, deductions, and other financial data necessary for tax assessment and reporting.

How to use the Anexo Iii

Using the Anexo Iii involves understanding the specific sections of the form and accurately filling them out. Users should gather all necessary financial documents and information beforehand. Each section of the form corresponds to different financial aspects, such as income sources and applicable deductions. It is important to follow the instructions provided with the form carefully to avoid errors that could lead to compliance issues.

Steps to complete the Anexo Iii

Completing the Anexo Iii requires a systematic approach. Here are the general steps to follow:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Review the instructions for the Anexo Iii to understand each section.

- Fill out personal information accurately, including name, address, and taxpayer identification number.

- Provide detailed information about income sources and any deductions you plan to claim.

- Double-check all entries for accuracy before submission.

Legal use of the Anexo Iii

The Anexo Iii serves a legal purpose in ensuring compliance with tax laws and regulations. It is crucial for taxpayers to understand that submitting this form accurately can prevent legal complications, such as audits or penalties. Misrepresentation or inaccuracies can lead to serious consequences, including fines or legal action.

Filing Deadlines / Important Dates

Filing deadlines for the Anexo Iii vary depending on the specific tax year and the taxpayer's filing status. Generally, the form must be submitted by the established federal tax deadline, which is typically April 15 for most individuals. It is advisable to keep track of any changes in deadlines announced by the IRS to ensure timely submission.

Required Documents

To complete the Anexo Iii, certain documents are required. These typically include:

- Income statements such as W-2s or 1099s.

- Receipts for any deductible expenses.

- Previous year’s tax return for reference.

- Any additional documentation that supports the information provided on the form.

Form Submission Methods

The Anexo Iii can be submitted through various methods. Taxpayers have the option to file online through approved e-filing services, mail a paper copy to the appropriate IRS address, or, in some cases, submit in person at designated IRS offices. Each method has its own processing times and requirements, so it is important to choose the one that best suits individual needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the anexo iii

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Anexo III and how does it relate to airSlate SignNow?

Anexo III is a crucial document format that businesses often need for compliance and record-keeping. airSlate SignNow simplifies the process of creating, sending, and eSigning Anexo III documents, ensuring that your business remains compliant while saving time and resources.

-

How much does it cost to use airSlate SignNow for Anexo III documents?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those specifically for managing Anexo III documents. You can choose from monthly or annual subscriptions, with options that provide great value for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Anexo III documents?

airSlate SignNow provides a range of features tailored for Anexo III documents, including customizable templates, secure eSigning, and automated workflows. These features help streamline the document management process, making it easier for businesses to handle Anexo III efficiently.

-

Can I integrate airSlate SignNow with other tools for Anexo III management?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing your ability to manage Anexo III documents. Whether you use CRM systems, cloud storage, or project management tools, you can easily connect them with airSlate SignNow for a more efficient workflow.

-

What are the benefits of using airSlate SignNow for Anexo III?

Using airSlate SignNow for Anexo III provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your Anexo III documents are handled quickly and securely, allowing your business to focus on what matters most.

-

Is airSlate SignNow user-friendly for handling Anexo III documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage Anexo III documents. The intuitive interface allows users to create, send, and eSign documents without any technical expertise.

-

How does airSlate SignNow ensure the security of Anexo III documents?

airSlate SignNow prioritizes the security of your Anexo III documents by implementing advanced encryption and compliance with industry standards. This ensures that your sensitive information remains protected throughout the document lifecycle.

Get more for Anexo Iii

Find out other Anexo Iii

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template