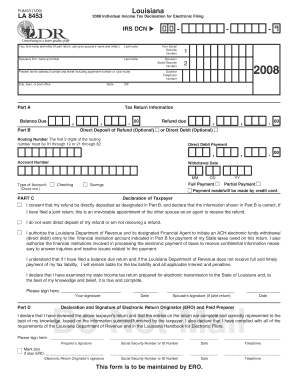

Individual Income Tax Declaration for Electronic Filing Revenue Louisiana Form

What is the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana

The Individual Income Tax Declaration for Electronic Filing in Louisiana is a crucial document that allows taxpayers to file their state income tax returns electronically. This form is specifically designed to facilitate the submission of personal income tax information to the Louisiana Department of Revenue. By utilizing this electronic filing option, taxpayers can ensure a more efficient and streamlined process, reducing the risk of errors associated with paper forms.

How to use the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana

To use the Individual Income Tax Declaration for Electronic Filing, taxpayers must first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. After compiling this information, individuals can access the form through approved e-filing software or platforms that support Louisiana tax submissions. Following the prompts within the software, users will input their financial data, review for accuracy, and submit the declaration electronically to the Louisiana Department of Revenue.

Steps to complete the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana

Completing the Individual Income Tax Declaration involves several key steps:

- Gather all relevant tax documents, including income statements and deduction records.

- Choose an e-filing software that is compatible with Louisiana tax forms.

- Input your personal information, including Social Security number and filing status.

- Enter your income details accurately, ensuring all figures match your documents.

- Review the completed form for any errors or omissions.

- Submit the declaration electronically to the Louisiana Department of Revenue.

Required Documents

When filing the Individual Income Tax Declaration electronically, taxpayers must have several documents on hand:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income

- Documentation for deductions and credits, such as mortgage interest statements

- Previous year’s tax return for reference

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Individual Income Tax Declaration is essential to avoid penalties. In Louisiana, the deadline for filing individual income tax returns typically aligns with the federal deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be aware of any extensions that may apply and confirm specific dates each tax year.

Penalties for Non-Compliance

Failure to file the Individual Income Tax Declaration on time or inaccuracies in the submitted information can result in penalties. Louisiana imposes fines for late filings, which can accumulate over time. Additionally, taxpayers may face interest charges on any unpaid taxes. It is crucial to file on time and ensure all information is correct to avoid these financial repercussions.

Quick guide on how to complete individual income tax declaration for electronic filing revenue louisiana

Complete [SKS] seamlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to access the right form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Use the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with specialized tools provided by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Individual Income Tax Declaration For Electronic Filing Revenue Louisiana

Create this form in 5 minutes!

How to create an eSignature for the individual income tax declaration for electronic filing revenue louisiana

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana?

The Individual Income Tax Declaration For Electronic Filing Revenue Louisiana is a form that allows residents of Louisiana to file their income taxes electronically. This process simplifies tax filing and ensures that your submissions are accurate and timely. Utilizing airSlate SignNow can streamline this process, making it easier for you to manage your tax documents.

-

How does airSlate SignNow assist with the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana?

airSlate SignNow provides a user-friendly platform that allows you to easily prepare and eSign your Individual Income Tax Declaration For Electronic Filing Revenue Louisiana. With its intuitive interface, you can quickly fill out the necessary forms and submit them electronically, ensuring compliance with state regulations. This saves you time and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax declarations?

airSlate SignNow offers flexible pricing plans that cater to different needs, including options for individuals and businesses. You can choose a plan that best fits your requirements for managing the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana. Each plan includes features that enhance your document management experience.

-

Are there any features specifically designed for tax filing in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax filing, such as templates for the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana. These templates help you quickly fill out your tax forms while ensuring that all necessary information is included. Additionally, the platform allows for secure eSigning and document storage.

-

What benefits does airSlate SignNow offer for electronic tax filing?

Using airSlate SignNow for your Individual Income Tax Declaration For Electronic Filing Revenue Louisiana offers numerous benefits, including increased efficiency and reduced paperwork. The platform allows for quick eSigning and submission, which can lead to faster processing times for your tax returns. Moreover, it enhances security by keeping your documents safe and accessible.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow can be integrated with various accounting and tax management software, making it easier to handle your Individual Income Tax Declaration For Electronic Filing Revenue Louisiana. This integration allows for seamless data transfer and ensures that all your financial information is up-to-date and accurate.

-

Is airSlate SignNow compliant with Louisiana tax regulations?

Yes, airSlate SignNow is designed to comply with Louisiana tax regulations, including those related to the Individual Income Tax Declaration For Electronic Filing Revenue Louisiana. The platform is regularly updated to reflect any changes in tax laws, ensuring that your filings are compliant and accurate. This gives you peace of mind when submitting your tax documents.

Get more for Individual Income Tax Declaration For Electronic Filing Revenue Louisiana

- Specialty pharmacy longs drugs form

- Doctors care employer health services form

- Medical history form carolina dental alliance

- Isanti county probation form

- Focused housing centered plan form

- Head start physical exam form

- Registro de vacunacin del alumno pupil immunization record minnesota dept of health spanish version of the record for form

- C22 home study assessment for corporate child foster care form

Find out other Individual Income Tax Declaration For Electronic Filing Revenue Louisiana

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online