3581, Michigan Historic Preservation Tax Credit 3581, Michigan Historic Preservation Tax Credit Form

Understanding the 3581, Michigan Historic Preservation Tax Credit

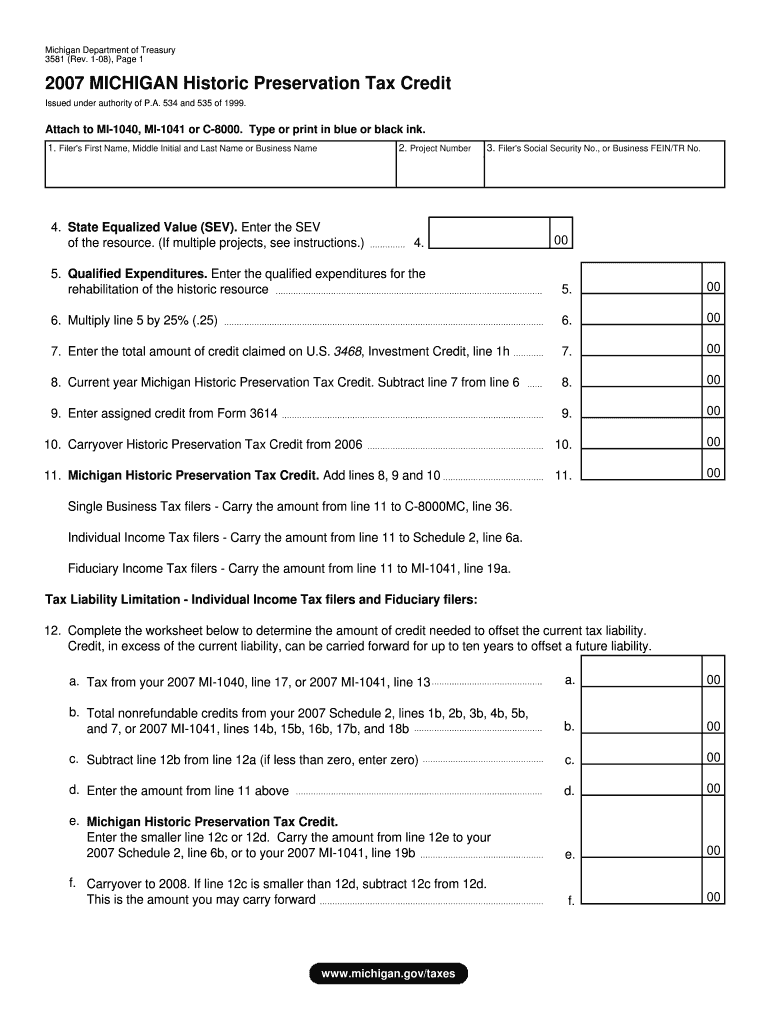

The 3581, Michigan Historic Preservation Tax Credit is a financial incentive designed to encourage the preservation and rehabilitation of historic properties in Michigan. This credit is available to property owners who undertake qualified rehabilitation projects on eligible historic sites. The program aims to promote the conservation of Michigan's rich architectural heritage while stimulating local economies through increased property values and tourism.

Eligible properties typically include those listed on the National Register of Historic Places or those designated as local landmarks. The tax credit can significantly reduce the cost of rehabilitation, making it an attractive option for property owners committed to preserving historic structures.

Eligibility Criteria for the 3581, Michigan Historic Preservation Tax Credit

To qualify for the 3581, Michigan Historic Preservation Tax Credit, property owners must meet specific eligibility requirements. The property must be a certified historic structure, which can be determined through its listing on the National Register of Historic Places or local historic district designation. Additionally, the rehabilitation work must meet the Secretary of the Interior's Standards for Rehabilitation.

Property owners must also demonstrate that the rehabilitation costs exceed a minimum threshold, which is usually set at a percentage of the property's assessed value. This ensures that the tax credit is reserved for substantial rehabilitation projects that contribute to the preservation of the historic character of the property.

Steps to Complete the 3581, Michigan Historic Preservation Tax Credit Application

Completing the application for the 3581, Michigan Historic Preservation Tax Credit involves several key steps. First, property owners should confirm eligibility by verifying the historic status of their property. Next, they should prepare detailed documentation of the proposed rehabilitation work, including plans, photographs, and cost estimates.

Once the documentation is ready, property owners must submit the application to the Michigan State Historic Preservation Office for review. This review process ensures that the proposed work aligns with preservation standards. After receiving approval, property owners can proceed with the rehabilitation and subsequently claim the tax credit on their state tax return.

Required Documents for the 3581, Michigan Historic Preservation Tax Credit

When applying for the 3581, Michigan Historic Preservation Tax Credit, specific documents are required to support the application. These typically include:

- Proof of property ownership

- Documentation of the property's historic status

- Detailed plans and specifications for the rehabilitation work

- Itemized cost estimates and invoices for completed work

- Photographs of the property before, during, and after rehabilitation

Gathering these documents in advance can streamline the application process and help ensure compliance with state requirements.

Legal Use of the 3581, Michigan Historic Preservation Tax Credit

The legal framework surrounding the 3581, Michigan Historic Preservation Tax Credit is established by state law, which outlines the eligibility criteria, application process, and compliance requirements. Property owners must adhere to the regulations set forth by the Michigan State Historic Preservation Office and the Internal Revenue Service.

It is crucial for applicants to understand that failure to comply with the established guidelines can result in penalties, including the loss of the tax credit. Therefore, maintaining accurate records and following the approved rehabilitation plans is essential for legal compliance.

Application Process and Approval Time for the 3581, Michigan Historic Preservation Tax Credit

The application process for the 3581, Michigan Historic Preservation Tax Credit involves several stages, beginning with the submission of the required documentation to the Michigan State Historic Preservation Office. After submission, the office reviews the application to ensure it meets all eligibility criteria and preservation standards.

The approval time can vary based on the complexity of the project and the volume of applications being processed. Typically, applicants can expect a response within a few months. It is advisable to plan accordingly and allow sufficient time for the review process, especially if the rehabilitation work is time-sensitive.

Quick guide on how to complete 3581 michigan historic preservation tax credit 3581 michigan historic preservation tax credit

Complete [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Don't worry about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign [SKS] while ensuring seamless communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 3581, Michigan Historic Preservation Tax Credit 3581, Michigan Historic Preservation Tax Credit

Create this form in 5 minutes!

How to create an eSignature for the 3581 michigan historic preservation tax credit 3581 michigan historic preservation tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3581, Michigan Historic Preservation Tax Credit?

The 3581, Michigan Historic Preservation Tax Credit is a financial incentive designed to encourage the preservation of historic properties in Michigan. This tax credit allows property owners to receive a percentage of their rehabilitation costs back as a tax credit, making it a valuable resource for those looking to restore historic buildings.

-

How can I apply for the 3581, Michigan Historic Preservation Tax Credit?

To apply for the 3581, Michigan Historic Preservation Tax Credit, you must complete the application process through the Michigan State Housing Development Authority (MSHDA). This involves submitting detailed plans for your project and demonstrating how it meets the criteria for historic preservation.

-

What are the benefits of the 3581, Michigan Historic Preservation Tax Credit?

The benefits of the 3581, Michigan Historic Preservation Tax Credit include signNow financial savings on rehabilitation costs and the preservation of Michigan's rich architectural heritage. By utilizing this tax credit, property owners can enhance the value of their properties while contributing to community revitalization.

-

Are there any costs associated with applying for the 3581, Michigan Historic Preservation Tax Credit?

While there are no direct application fees for the 3581, Michigan Historic Preservation Tax Credit, applicants should consider costs related to project planning, documentation, and potential consultation with preservation experts. These costs can vary based on the complexity of the project.

-

What types of properties qualify for the 3581, Michigan Historic Preservation Tax Credit?

To qualify for the 3581, Michigan Historic Preservation Tax Credit, properties must be listed on the National Register of Historic Places or contribute to a historic district. Additionally, the rehabilitation work must meet specific standards set by the National Park Service.

-

How does the 3581, Michigan Historic Preservation Tax Credit impact property value?

Utilizing the 3581, Michigan Historic Preservation Tax Credit can signNowly increase property value by enhancing the building's appeal and functionality. Properties that are well-preserved often attract higher market interest and can lead to increased rental or sale prices.

-

Can I combine the 3581, Michigan Historic Preservation Tax Credit with other incentives?

Yes, property owners can often combine the 3581, Michigan Historic Preservation Tax Credit with other local, state, or federal incentives aimed at historic preservation. This can maximize financial benefits and make rehabilitation projects more feasible.

Get more for 3581, Michigan Historic Preservation Tax Credit 3581, Michigan Historic Preservation Tax Credit

- Tax federal return form

- D d form 22 93 application for former spouse payments from

- Form applicant

- Poverty guidelines form

- Essay student form

- Download anthem blue cross blue shield insurance claim form

- The city of san luis obispo human relations commission hrc grants in aid program provides financial slocity form

- Contact form complaint

Find out other 3581, Michigan Historic Preservation Tax Credit 3581, Michigan Historic Preservation Tax Credit

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking