IRA Roth Application TCI ROTHIRA120 4 0512 DOC Form

What is the IRA Roth Application TCI ROTHIRA120 4 0512 doc

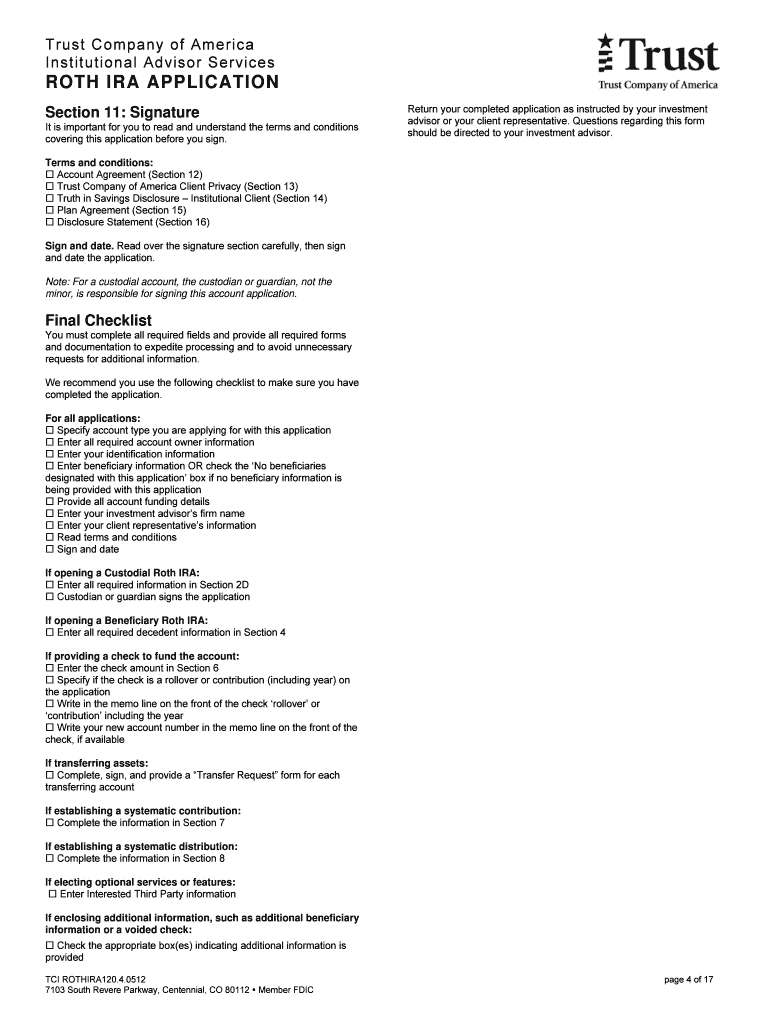

The IRA Roth Application TCI ROTHIRA120 4 0512 doc is a specific form used for establishing a Roth Individual Retirement Account (IRA). This application allows individuals to contribute after-tax income into their retirement savings, enabling tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met. The form is essential for those looking to take advantage of the tax benefits associated with Roth IRAs, which differ from traditional IRAs in terms of tax treatment and withdrawal rules.

Key elements of the IRA Roth Application TCI ROTHIRA120 4 0512 doc

Several key elements are included in the IRA Roth Application TCI ROTHIRA120 4 0512 doc. These elements typically consist of:

- Personal Information: This section requires the applicant's name, address, Social Security number, and date of birth.

- Contribution Details: Applicants must specify the amount they wish to contribute, as well as the year for which the contribution applies.

- Investment Choices: This section allows individuals to select how their contributions will be invested, including options such as mutual funds or stocks.

- Beneficiary Designation: Applicants can designate beneficiaries for their account, which is crucial for estate planning.

- Signature: The form must be signed by the applicant to validate the application and confirm the information provided.

Steps to complete the IRA Roth Application TCI ROTHIRA120 4 0512 doc

Completing the IRA Roth Application TCI ROTHIRA120 4 0512 doc involves several straightforward steps:

- Gather Personal Information: Collect all necessary personal details, including your Social Security number and contact information.

- Determine Contribution Amount: Decide how much you want to contribute to your Roth IRA for the current tax year.

- Choose Investments: Review the available investment options and select those that align with your retirement goals.

- Designate Beneficiaries: Fill out the beneficiary section to ensure your assets are distributed according to your wishes.

- Review and Sign: Carefully review the completed application for accuracy, then sign and date the form.

Legal use of the IRA Roth Application TCI ROTHIRA120 4 0512 doc

The IRA Roth Application TCI ROTHIRA120 4 0512 doc must be used in accordance with Internal Revenue Service (IRS) regulations. This includes adhering to contribution limits, eligibility requirements, and withdrawal rules. It is important to ensure that the application is filled out correctly and submitted to the appropriate financial institution to avoid any legal issues or penalties. Additionally, understanding the implications of the form on your tax situation is crucial for compliance with federal tax laws.

Eligibility Criteria

To use the IRA Roth Application TCI ROTHIRA120 4 0512 doc, individuals must meet specific eligibility criteria established by the IRS. These criteria include:

- Having earned income within the tax year, which can include wages, salaries, or self-employment income.

- Meeting income limits that determine the ability to contribute directly to a Roth IRA, which may vary annually.

- Being under the age of seventy and a half, as individuals older than this may have different contribution rules.

Form Submission Methods

The IRA Roth Application TCI ROTHIRA120 4 0512 doc can typically be submitted through various methods, depending on the financial institution's requirements:

- Online Submission: Many institutions allow for digital submission through their secure online portals.

- Mail: The completed form can often be printed and mailed to the designated address of the financial institution.

- In-Person: Applicants may also have the option to submit the form in person at a local branch office.

Quick guide on how to complete ira roth application tci rothira120 4 0512 doc

Effortlessly prepare [SKS] on any gadget

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and safely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ira roth application tci rothira120 4 0512 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRA Roth Application TCI ROTHIRA120 4 0512 doc?

The IRA Roth Application TCI ROTHIRA120 4 0512 doc is a specific document designed for individuals looking to open a Roth IRA account. This application simplifies the process of establishing a Roth IRA, ensuring compliance with IRS regulations while maximizing your investment potential.

-

How much does the IRA Roth Application TCI ROTHIRA120 4 0512 doc cost?

The IRA Roth Application TCI ROTHIRA120 4 0512 doc is available at a competitive price, making it an affordable option for those looking to invest in their future. Pricing may vary based on additional services or features you choose to include with your application.

-

What features does the IRA Roth Application TCI ROTHIRA120 4 0512 doc offer?

The IRA Roth Application TCI ROTHIRA120 4 0512 doc includes features such as easy eSigning, document tracking, and secure storage. These features ensure that your application process is streamlined and efficient, allowing you to focus on your investment goals.

-

What are the benefits of using the IRA Roth Application TCI ROTHIRA120 4 0512 doc?

Using the IRA Roth Application TCI ROTHIRA120 4 0512 doc provides numerous benefits, including time savings and enhanced security. With airSlate SignNow, you can complete your application quickly and securely, ensuring that your personal information is protected throughout the process.

-

Can I integrate the IRA Roth Application TCI ROTHIRA120 4 0512 doc with other tools?

Yes, the IRA Roth Application TCI ROTHIRA120 4 0512 doc can be easily integrated with various business tools and platforms. This flexibility allows you to streamline your workflow and manage your documents more effectively within your existing systems.

-

Is the IRA Roth Application TCI ROTHIRA120 4 0512 doc user-friendly?

Absolutely! The IRA Roth Application TCI ROTHIRA120 4 0512 doc is designed with user experience in mind. Its intuitive interface makes it easy for anyone to navigate the application process, regardless of their technical expertise.

-

How secure is the IRA Roth Application TCI ROTHIRA120 4 0512 doc?

The IRA Roth Application TCI ROTHIRA120 4 0512 doc is built with top-notch security features to protect your sensitive information. airSlate SignNow employs advanced encryption and secure storage solutions to ensure that your data remains confidential and safe.

Get more for IRA Roth Application TCI ROTHIRA120 4 0512 doc

Find out other IRA Roth Application TCI ROTHIRA120 4 0512 doc

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement