BRRAG Tax Credit Certificate Selling Agreement New Jersey Form

What is the BRRAG Tax Credit Certificate Selling Agreement New Jersey

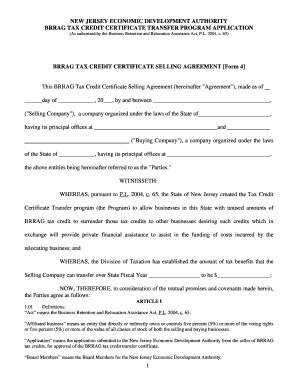

The BRRAG Tax Credit Certificate Selling Agreement in New Jersey is a legal document that allows businesses to sell their tax credits to other entities. This agreement facilitates the transfer of tax credits earned under the Business Retention and Redevelopment Act Grant (BRRAG) program. By selling these certificates, businesses can convert potential tax savings into immediate cash flow, which can be vital for operational needs or reinvestment. Understanding the specifics of this agreement is crucial for businesses looking to maximize their financial resources.

How to obtain the BRRAG Tax Credit Certificate Selling Agreement New Jersey

To obtain the BRRAG Tax Credit Certificate Selling Agreement, businesses must first ensure they are eligible for the tax credits under the BRRAG program. This typically involves applying for the tax credit through the New Jersey Division of Taxation. Once approved, businesses can access the necessary forms and templates for the selling agreement. It is advisable to consult with a legal or tax professional to ensure compliance with all state regulations and to facilitate the process of obtaining and executing the agreement.

Steps to complete the BRRAG Tax Credit Certificate Selling Agreement New Jersey

Completing the BRRAG Tax Credit Certificate Selling Agreement involves several key steps:

- Gather all relevant information, including details about the tax credits being sold and the parties involved.

- Fill out the agreement form accurately, ensuring that all required fields are completed.

- Review the agreement with legal counsel to confirm that it meets all legal requirements and protects your interests.

- Have all parties sign the agreement, either digitally or in person, depending on preferences and legal requirements.

- Submit the signed agreement to the appropriate state agency, if required, to finalize the transaction.

Key elements of the BRRAG Tax Credit Certificate Selling Agreement New Jersey

The key elements of the BRRAG Tax Credit Certificate Selling Agreement include:

- Parties involved: Clearly identify the seller and buyer of the tax credits.

- Description of credits: Provide detailed information about the tax credits being sold, including their value and eligibility.

- Terms of sale: Outline the terms under which the credits are being sold, including payment terms and conditions.

- Legal compliance: Include clauses that ensure compliance with New Jersey state laws regarding tax credits.

- Signatures: Ensure that all parties sign the document to validate the agreement.

Eligibility Criteria

Eligibility for the BRRAG Tax Credit Certificate Selling Agreement typically requires that the business has successfully earned tax credits under the BRRAG program. Additional criteria may include:

- The business must be registered and in good standing with the New Jersey Division of Taxation.

- The tax credits must be valid and not previously sold or transferred.

- Businesses must comply with all applicable state regulations and guidelines related to tax credits.

Legal use of the BRRAG Tax Credit Certificate Selling Agreement New Jersey

The legal use of the BRRAG Tax Credit Certificate Selling Agreement is governed by New Jersey state law. This agreement must be executed in accordance with all relevant legal requirements to ensure that the transfer of tax credits is valid. It is essential for businesses to consult with legal professionals to navigate any complexities involved in the agreement and to ensure that both parties are protected under the law. Proper documentation and adherence to legal protocols are crucial for the successful execution of this agreement.

Quick guide on how to complete brrag tax credit certificate selling agreement new jersey

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign [SKS] and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to BRRAG Tax Credit Certificate Selling Agreement New Jersey

Create this form in 5 minutes!

How to create an eSignature for the brrag tax credit certificate selling agreement new jersey

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the BRRAG Tax Credit Certificate Selling Agreement New Jersey?

The BRRAG Tax Credit Certificate Selling Agreement New Jersey is a legal document that allows businesses to sell their tax credits to other entities. This agreement facilitates the transfer of tax benefits, helping businesses maximize their financial resources. Understanding this agreement is crucial for businesses looking to leverage tax credits effectively.

-

How can I benefit from the BRRAG Tax Credit Certificate Selling Agreement New Jersey?

By utilizing the BRRAG Tax Credit Certificate Selling Agreement New Jersey, businesses can convert tax credits into immediate cash flow. This can signNowly enhance liquidity and provide funds for reinvestment or operational expenses. It's an excellent strategy for businesses seeking to optimize their financial position.

-

What are the costs associated with the BRRAG Tax Credit Certificate Selling Agreement New Jersey?

The costs related to the BRRAG Tax Credit Certificate Selling Agreement New Jersey can vary based on the transaction size and the parties involved. Typically, there may be fees for legal services, processing, and potential commissions. It's advisable to consult with a financial advisor to understand the full scope of costs.

-

How does the BRRAG Tax Credit Certificate Selling Agreement New Jersey work?

The BRRAG Tax Credit Certificate Selling Agreement New Jersey works by allowing businesses to sell their tax credits to other companies that can utilize them. Once the agreement is executed, the buyer can claim the tax credits on their tax returns, while the seller receives immediate financial benefits. This process is streamlined through proper documentation and compliance.

-

Are there any specific eligibility requirements for the BRRAG Tax Credit Certificate Selling Agreement New Jersey?

Yes, there are specific eligibility requirements for the BRRAG Tax Credit Certificate Selling Agreement New Jersey. Businesses must meet certain criteria set by the state to qualify for tax credits. It's essential to review these requirements carefully to ensure compliance and maximize the benefits of the agreement.

-

Can I integrate the BRRAG Tax Credit Certificate Selling Agreement New Jersey with other financial tools?

Yes, the BRRAG Tax Credit Certificate Selling Agreement New Jersey can be integrated with various financial tools and software. This integration can help streamline the management of tax credits and enhance overall financial planning. Utilizing technology can simplify the process and improve efficiency.

-

What features should I look for in a service provider for the BRRAG Tax Credit Certificate Selling Agreement New Jersey?

When selecting a service provider for the BRRAG Tax Credit Certificate Selling Agreement New Jersey, look for features such as expertise in tax credit transactions, user-friendly documentation processes, and strong customer support. A reliable provider will also offer transparent pricing and a proven track record in facilitating similar agreements.

Get more for BRRAG Tax Credit Certificate Selling Agreement New Jersey

- 3881 ach vendormiscellaneous payment enrollment omb number form

- The commonwealth of massachusetts department of fi form

- Lc 7603 lc 7603 form

- Authorization agreement for accounts payable electronic form

- Palm beach school forms

- Continuing education provider approval application form

- Cos022 cosmetology mini salon license application form

- Contact us j ampamp k set agency university of kashmir form

Find out other BRRAG Tax Credit Certificate Selling Agreement New Jersey

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT