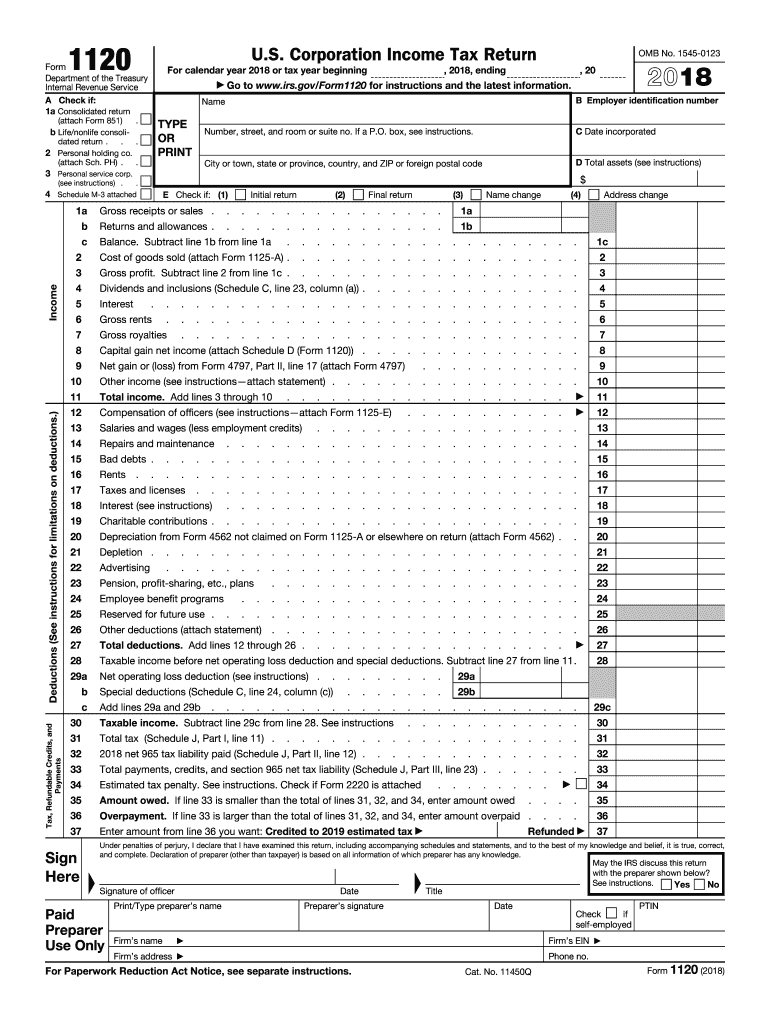

1120x 2018

What is the 1120X?

The 1120X form is an amended U.S. corporation income tax return. It allows corporations to correct errors or make changes to their previously filed IRS Form 1120. This form is essential for ensuring that the corporation's tax obligations are accurate and reflect any adjustments that may affect the tax liability. The 1120X can be used to amend various aspects of the original return, including income, deductions, and credits.

Steps to Complete the 1120X

Completing the 1120X involves several key steps:

- Obtain a copy of the original Form 1120 that you filed.

- Fill out the 1120X form, ensuring that you include the corrected information.

- Provide a clear explanation of the changes being made in the designated section.

- Attach any necessary supporting documentation that justifies the amendments.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the 1120X. Generally, the form must be filed within three years from the date the original return was due or filed, whichever is later. This timeline ensures that the IRS receives the amended return in a timely manner, allowing for any adjustments in tax liability.

Required Documents

When filing the 1120X, certain documents may be required to support the amendments. These documents can include:

- A copy of the original Form 1120.

- Any schedules or forms that were part of the original return.

- Documentation that supports the changes being made, such as receipts or statements.

Form Submission Methods (Online / Mail / In-Person)

The 1120X can be submitted through various methods. Corporations typically file the form by mail. However, it is essential to check the IRS guidelines for any updates regarding electronic filing options. Ensure that the form is sent to the correct address based on the corporation's location and the specific instructions provided by the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1120X. These guidelines detail the necessary information to include, the correct format for the form, and the required signatures. It is important to follow these guidelines closely to avoid delays or rejections of the amended return.

Penalties for Non-Compliance

Failure to file the 1120X or to correct errors in the original return can result in penalties. The IRS may impose fines for late filing or for inaccuracies that lead to underpayment of taxes. Understanding these penalties can help corporations prioritize the timely and accurate submission of their amended returns.

Quick guide on how to complete irs form 1120 2018 2019

Discover the most convenient method to complete and sign your 1120x

Are you still spending time creating your official paperwork on paper instead of doing it digitally? airSlate SignNow offers a superior approach to complete and sign your 1120x and related forms for public services. Our intelligent electronic signature system equips you with all necessary tools to manage documentation swiftly and comply with official standards - comprehensive PDF editing, organizing, securing, signing, and sharing features all readily available within an intuitive interface.

Only a few steps are needed to fill out and sign your 1120x:

- Insert the fillable template into the editor by using the Get Form button.

- Review the information you need to include in your 1120x.

- Navigate through the fields using the Next button to ensure nothing is missed.

- Employ Text, Check, and Cross tools to complete the sections with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal information that is no longer relevant.

- Press Sign to produce a legally valid electronic signature using your preferred method.

- Add the Date alongside your signature and conclude your task with the Done button.

Store your finalized 1120x in the Documents section of your profile, download it, or transfer it to your selected cloud storage. Our service also offers versatile form sharing options. There's no need to print your forms when you have to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “postal mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1120 2018 2019

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 1120 2018 2019

How to generate an eSignature for your Irs Form 1120 2018 2019 in the online mode

How to generate an electronic signature for the Irs Form 1120 2018 2019 in Google Chrome

How to create an eSignature for signing the Irs Form 1120 2018 2019 in Gmail

How to generate an eSignature for the Irs Form 1120 2018 2019 right from your mobile device

How to make an electronic signature for the Irs Form 1120 2018 2019 on iOS

How to make an eSignature for the Irs Form 1120 2018 2019 on Android devices

People also ask

-

What is the 1120x form and how can airSlate SignNow help?

The 1120x form is used to amend a corporate tax return. Utilizing airSlate SignNow, businesses can easily electronically sign and send the 1120x document, streamlining the amendment process and ensuring compliance. Our platform simplifies document management, making it a cost-effective solution for those filing amendments.

-

How does airSlate SignNow ensure the security of my 1120x documents?

airSlate SignNow prioritizes document security by employing advanced encryption methods and secure cloud storage for all your 1120x forms and other sensitive documents. We comply with industry standards to ensure that your data remains confidential and protected against unauthorized access.

-

What are the pricing options for using airSlate SignNow for 1120x filings?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses filing 1120x forms. Our cost-effective solutions provide various features, allowing companies to choose a plan that best fits their budget and requirements, ensuring they get the most value out of our eSigning services.

-

Can I integrate airSlate SignNow with other software for managing 1120x forms?

Yes, airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and CRM systems, making it easy to manage your 1120x forms alongside your existing workflows. This integration enhances productivity and allows for a more streamlined document handling process.

-

What features does airSlate SignNow offer for managing 1120x documents?

airSlate SignNow provides a range of features specifically designed for managing 1120x documents, including customizable templates, bulk sending options, and real-time tracking of document status. These features help ensure timely completion and improve overall efficiency in handling your tax amendments.

-

Is airSlate SignNow user-friendly for filing 1120x forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and use for filing 1120x forms. Our intuitive interface allows users to quickly upload, sign, and send documents without any technical expertise.

-

What benefits can I expect from using airSlate SignNow for 1120x filing?

Using airSlate SignNow for your 1120x filing offers several benefits, including faster processing times, reduced paperwork, and enhanced accuracy. By going digital, you can minimize errors and ensure that your amendments are submitted promptly, ultimately saving time and resources.

Get more for 1120x

- Form 8233 rev december 2001 fill in capable

- Form 4506 t request for transcript of tax return omb no

- Form 911 rev march 2000 not fill in capable application for taxpayer assistance order atao

- Homeownersamp039 property tax credit application form htc

- Maryland form 515

- Maryland form 505x nonresident amended tax return 505x non resident amended tax return

- Dr110 25 fillable pdf form

- For a duplicate title refer to the application for missouri title and license form 108

Find out other 1120x

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF