1120x 2018

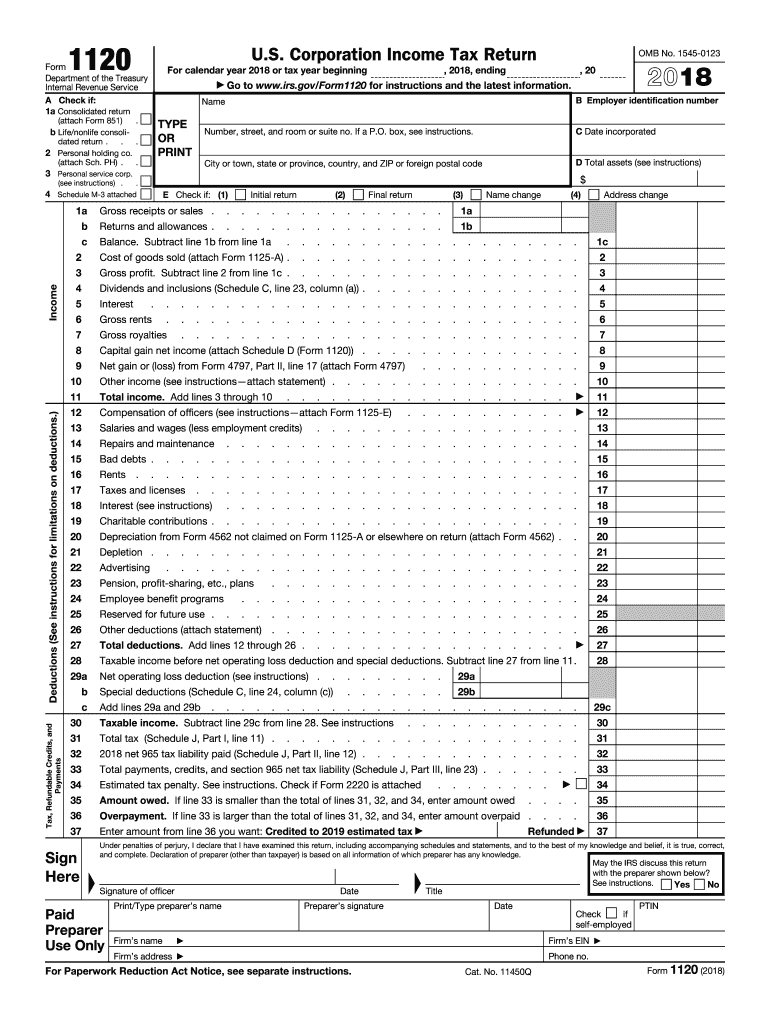

What is the 1120X?

The 1120X form is an amended U.S. corporation income tax return. It allows corporations to correct errors or make changes to their previously filed IRS Form 1120. This form is essential for ensuring that the corporation's tax obligations are accurate and reflect any adjustments that may affect the tax liability. The 1120X can be used to amend various aspects of the original return, including income, deductions, and credits.

Steps to Complete the 1120X

Completing the 1120X involves several key steps:

- Obtain a copy of the original Form 1120 that you filed.

- Fill out the 1120X form, ensuring that you include the corrected information.

- Provide a clear explanation of the changes being made in the designated section.

- Attach any necessary supporting documentation that justifies the amendments.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the 1120X. Generally, the form must be filed within three years from the date the original return was due or filed, whichever is later. This timeline ensures that the IRS receives the amended return in a timely manner, allowing for any adjustments in tax liability.

Required Documents

When filing the 1120X, certain documents may be required to support the amendments. These documents can include:

- A copy of the original Form 1120.

- Any schedules or forms that were part of the original return.

- Documentation that supports the changes being made, such as receipts or statements.

Form Submission Methods (Online / Mail / In-Person)

The 1120X can be submitted through various methods. Corporations typically file the form by mail. However, it is essential to check the IRS guidelines for any updates regarding electronic filing options. Ensure that the form is sent to the correct address based on the corporation's location and the specific instructions provided by the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1120X. These guidelines detail the necessary information to include, the correct format for the form, and the required signatures. It is important to follow these guidelines closely to avoid delays or rejections of the amended return.

Penalties for Non-Compliance

Failure to file the 1120X or to correct errors in the original return can result in penalties. The IRS may impose fines for late filing or for inaccuracies that lead to underpayment of taxes. Understanding these penalties can help corporations prioritize the timely and accurate submission of their amended returns.

Quick guide on how to complete irs form 1120 2018 2019

Discover the most convenient method to complete and sign your 1120x

Are you still spending time creating your official paperwork on paper instead of doing it digitally? airSlate SignNow offers a superior approach to complete and sign your 1120x and related forms for public services. Our intelligent electronic signature system equips you with all necessary tools to manage documentation swiftly and comply with official standards - comprehensive PDF editing, organizing, securing, signing, and sharing features all readily available within an intuitive interface.

Only a few steps are needed to fill out and sign your 1120x:

- Insert the fillable template into the editor by using the Get Form button.

- Review the information you need to include in your 1120x.

- Navigate through the fields using the Next button to ensure nothing is missed.

- Employ Text, Check, and Cross tools to complete the sections with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Conceal information that is no longer relevant.

- Press Sign to produce a legally valid electronic signature using your preferred method.

- Add the Date alongside your signature and conclude your task with the Done button.

Store your finalized 1120x in the Documents section of your profile, download it, or transfer it to your selected cloud storage. Our service also offers versatile form sharing options. There's no need to print your forms when you have to submit them to the relevant public office - do it via email, fax, or by requesting a USPS “postal mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 1120 2018 2019

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the irs form 1120 2018 2019

How to generate an eSignature for your Irs Form 1120 2018 2019 in the online mode

How to generate an electronic signature for the Irs Form 1120 2018 2019 in Google Chrome

How to create an eSignature for signing the Irs Form 1120 2018 2019 in Gmail

How to generate an eSignature for the Irs Form 1120 2018 2019 right from your mobile device

How to make an electronic signature for the Irs Form 1120 2018 2019 on iOS

How to make an eSignature for the Irs Form 1120 2018 2019 on Android devices

People also ask

-

What is the process to file 1120 form 2016 using airSlate SignNow?

To file 1120 form 2016 with airSlate SignNow, simply upload your document to our platform, sign it electronically, and then submit it. Our user-friendly interface guides you through each step, ensuring a seamless experience. Once completed, you can easily save or send your filed form directly from the application.

-

Is there a subscription fee to file 1120 form 2016 with airSlate SignNow?

Yes, airSlate SignNow offers various subscription plans, allowing you to choose one that suits your needs for filing 1120 form 2016. Pricing is competitive and designed to provide value by enhancing your document signing workflow. Visit our pricing page for detailed options and to determine the best fit for your business.

-

What are the benefits of using airSlate SignNow to file 1120 form 2016?

Using airSlate SignNow to file 1120 form 2016 provides numerous benefits, including time-saving automation, enhanced security features, and easy tracking of document status. Our platform ensures that you can manage your filings efficiently without the hassle of traditional paper processes. Enjoy peace of mind knowing your forms are filed correctly and on time.

-

Can I integrate airSlate SignNow with other software for filing 1120 form 2016?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions such as CRM systems and accounting tools, facilitating a smooth workflow when filing 1120 form 2016. This allows you to manage your documents in one place, further enhancing productivity and efficiency. Check out our integrations page for more details.

-

How does airSlate SignNow ensure the security of my 1120 form 2016 data?

airSlate SignNow prioritizes the security of your data while you file 1120 form 2016. We utilize encryption, secure cloud storage, and multi-factor authentication to keep your sensitive information safe. With us, you can trust that your compliance and security requirements are met every step of the way.

-

Is it easy to correct errors on the 1120 form 2016 using airSlate SignNow?

Yes, if you need to correct errors on your 1120 form 2016, airSlate SignNow makes it easy. Our platform allows you to edit documents directly and resend them for signatures quickly. This flexibility ensures that filing deadlines can be met without unnecessary delays.

-

What features does airSlate SignNow provide for filing 1120 form 2016?

airSlate SignNow offers features tailored for filing 1120 form 2016, including template creation, automatic reminders, and status tracking for document signatures. These functionalities streamline your filing process, making it easier to manage multiple documents and signatures in a timely manner. Experience how these tools can enhance your efficiency today.

Get more for 1120x

- Form 8233 rev december 2001 fill in capable

- Form 4506 t request for transcript of tax return omb no

- Form 911 rev march 2000 not fill in capable application for taxpayer assistance order atao

- Homeownersamp039 property tax credit application form htc

- Maryland form 515

- Maryland form 505x nonresident amended tax return 505x non resident amended tax return

- Dr110 25 fillable pdf form

- For a duplicate title refer to the application for missouri title and license form 108

Find out other 1120x

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile