State of Oregon Child Care Contribution Tax Credit Refund Form

What is the State Of Oregon Child Care Contribution Tax Credit Refund Form

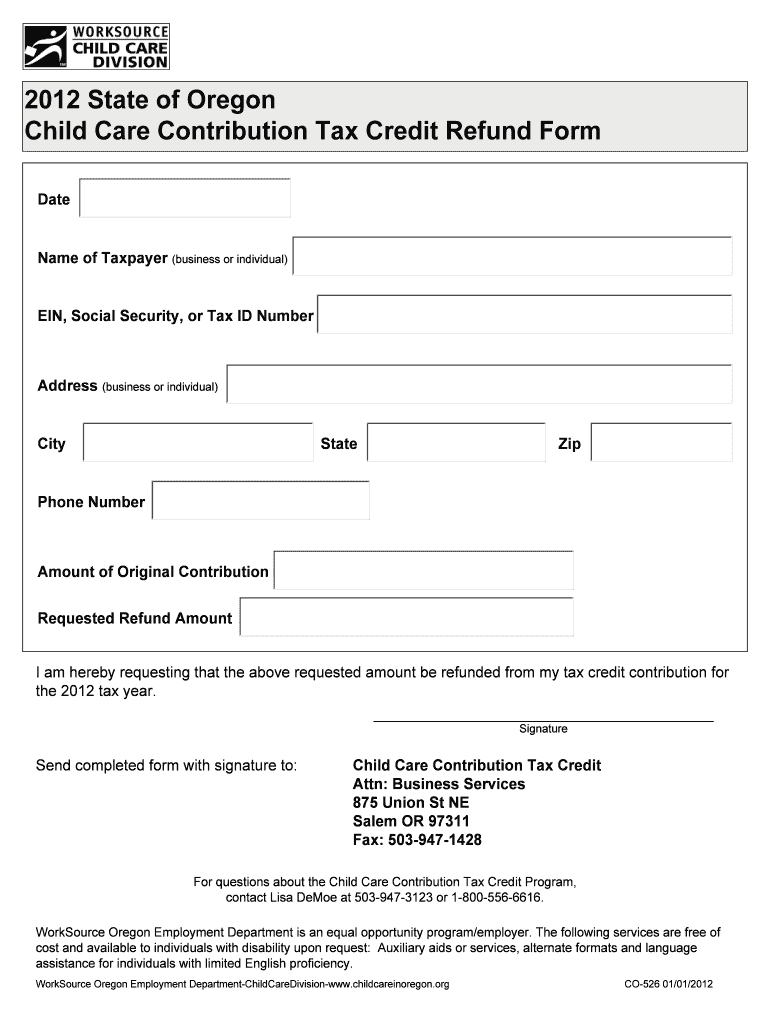

The State Of Oregon Child Care Contribution Tax Credit Refund Form is a tax document that allows individuals and businesses to claim a tax credit for contributions made to qualified child care facilities. This form is specifically designed for those who have made donations that support child care services in Oregon, providing a financial incentive to enhance the availability of quality child care. By completing this form, taxpayers can receive a refund or credit against their state tax obligations, thus encouraging investment in child care programs.

Steps to complete the State Of Oregon Child Care Contribution Tax Credit Refund Form

Completing the State Of Oregon Child Care Contribution Tax Credit Refund Form involves several key steps:

- Gather necessary documentation, including proof of contributions made to qualified child care facilities.

- Obtain the form from the appropriate state tax authority or download it from an official source.

- Fill out the form accurately, ensuring all required information is provided, such as your personal details and contribution amounts.

- Review the completed form for any errors or omissions.

- Submit the form according to the specified submission methods, which may include online, by mail, or in person.

Eligibility Criteria

To qualify for the Child Care Contribution Tax Credit in Oregon, taxpayers must meet specific eligibility criteria. These criteria include:

- Making contributions to child care facilities that are recognized as qualified by the state.

- Providing documentation that verifies the contributions made.

- Filing the tax credit refund form within the designated time frame.

It is essential to ensure that all eligibility requirements are met to successfully claim the credit.

How to obtain the State Of Oregon Child Care Contribution Tax Credit Refund Form

The State Of Oregon Child Care Contribution Tax Credit Refund Form can be obtained through several methods:

- Visiting the official website of the Oregon Department of Revenue, where the form is typically available for download.

- Contacting the Oregon Department of Revenue directly to request a physical copy of the form.

- Checking with local tax preparation offices, as they may provide copies of the form for clients.

Form Submission Methods

Once the State Of Oregon Child Care Contribution Tax Credit Refund Form is completed, it can be submitted through various methods:

- Online submission through the Oregon Department of Revenue’s electronic filing system, if available.

- Mailing the completed form to the designated address provided on the form.

- Delivering the form in person to a local tax office or the Oregon Department of Revenue.

Required Documents

When filing the State Of Oregon Child Care Contribution Tax Credit Refund Form, certain documents are required to support your claim:

- Proof of contributions, such as receipts or acknowledgment letters from the child care facilities.

- Personal identification information, including your Social Security number or tax identification number.

- Any additional documentation that may be required by the Oregon Department of Revenue to verify eligibility.

Quick guide on how to complete state of oregon child care contribution tax credit refund form

Complete [SKS] effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents efficiently without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign [SKS] without effort

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require generating new copies of documents. airSlate SignNow meets your needs in document management within a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of oregon child care contribution tax credit refund form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Where can I find Oregon Form 40?

Forms OR-40, OR-40-P, and OR-40-N can be found at .oregon.gov/dor/forms or you can contact us to order it.

-

What is the $600 assistance payment in Oregon?

The Oregon Legislature's approved House Bill 4157 will provide a one-time $600 payment to Oregon households who received an Earned Income Tax Credit (EITC) on their 2020 tax filing. The one-time payment will be sent by July 31, 2022.

-

What is the current tax credit per child?

It also introduced phase out thresholds and rates for higher-income taxpayers. The act is temporary and will expire on Dec. 31, 2025. The American Rescue Plan Act of 2021 temporarily expanded the child tax credit for the 2021 tax year to $3,600 per child younger than age 6 and $3,000 per child up to age 17.

-

How much is the Oregon child tax credit?

The Oregon Kids' Credit is a fully refundable tax credit worth $1,000 per child aged 0 to 5. Families making between $0 and $25,000 can claim the full credit, before eligibility begins to phase out. A partial credit is available to families making up to $30,000.

-

What is the Oregon tax credit for 2024?

In 2024, eligible Oregon taxpayers will receive a “kicker" tax credit. Your kicker is either included in your refund or it will reduce the amount of tax you owe. The Oregon “kicker" tax credit is how the state returns money to taxpayers when there is a revenue surplus.

-

What is Form 8862 child tax credit?

Taxpayers complete Form 8862 and attach it to their tax return if: Their earned income credit (EIC), child tax credit (CTC)/additional child tax credit (ACTC), credit for other dependents (ODC) or American opportunity credit (AOTC) was reduced or disallowed for any reason other than a math or clerical error.

-

Does Oregon state have a child tax credit?

New for tax year 2023, the Oregon Kids Credit is a refundable credit for low-income people with young dependent children. For those with a modified adjusted gross income (AGI) of $25,000 or less, the full credit is $1,000 per child for up to five dependent children ages 0 to 5 at the end of the tax year.

-

What is the Oregon Child Care Contribution tax credit?

New for tax year 2023, the Oregon Kids Credit is a refundable credit for low-income people with young dependent children. For those with a modified adjusted gross income (AGI) of $25,000 or less, the full credit is $1,000 per child for up to five dependent children ages 0 to 5 at the end of the tax year.

Get more for State Of Oregon Child Care Contribution Tax Credit Refund Form

- Alaska pg 615 form

- Tf 935 form

- Civ 561 service instructions for writ of execution for garnishment of wages 8 10 civil forms

- In the district court for the state of alaska at anchorage form

- Application for services form

- Civ 645 notice of registration of foreign support order 611 pdf form

- Dr200 form

- Alaska stipulation form

Find out other State Of Oregon Child Care Contribution Tax Credit Refund Form

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document