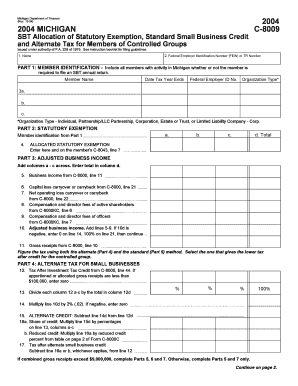

C 8009, SBT Allocation of Statutory Exemption, Standard Small Business Credit and Alternate Tax for Members of Controlled Groups Form

Understanding the C 8009 Form

The C 8009 form, known as the SBT Allocation of Statutory Exemption, Standard Small Business Credit, and Alternate Tax for Members of Controlled Groups, is a crucial document for businesses operating within the United States. It is primarily used to allocate statutory exemptions and credits among members of controlled groups, ensuring compliance with state tax regulations. This form helps businesses optimize their tax liabilities by accurately reporting their eligibility for various credits and exemptions.

Steps to Complete the C 8009 Form

Completing the C 8009 form involves several key steps:

- Gather necessary financial documents, including income statements and tax returns.

- Identify all members of the controlled group and their respective tax identification numbers.

- Calculate the statutory exemptions and credits applicable to each member based on their financial performance.

- Fill out the C 8009 form with accurate data, ensuring all calculations are correct.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria for the C 8009 Form

To qualify for the C 8009 form, businesses must meet specific eligibility criteria, including:

- Being part of a controlled group as defined by IRS regulations.

- Meeting the revenue thresholds set for small businesses to claim the statutory exemption.

- Maintaining accurate records of financial transactions and tax obligations.

Required Documents for Filing the C 8009 Form

When filing the C 8009 form, businesses must provide several supporting documents:

- Previous tax returns for all members of the controlled group.

- Financial statements that detail income, expenses, and credits.

- Documentation proving eligibility for any claimed exemptions or credits.

Filing Deadlines for the C 8009 Form

It is essential to adhere to the filing deadlines associated with the C 8009 form to avoid penalties. Typically, the form must be submitted along with the business's annual tax return. Businesses should check the IRS guidelines for specific dates, which may vary each tax year.

Legal Use of the C 8009 Form

The C 8009 form serves a legal purpose by ensuring that businesses comply with tax laws regarding statutory exemptions and credits. Proper completion and submission of this form can protect businesses from potential audits and penalties, reinforcing their commitment to regulatory compliance.

Quick guide on how to complete c 8009 sbt allocation of statutory exemption standard small business credit and alternate tax for members of controlled groups

Effortlessly Prepare [SKS] on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize important sections of the documents or redact sensitive details with the features provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

No more dealing with lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign [SKS] to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c 8009 sbt allocation of statutory exemption standard small business credit and alternate tax for members of controlled groups

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the C 8009, SBT Allocation Of Statutory Exemption?

The C 8009, SBT Allocation Of Statutory Exemption is a tax form used by businesses to allocate statutory exemptions under the Small Business Tax (SBT) framework. This form is essential for members of controlled groups to ensure compliance with tax regulations while maximizing their benefits. Understanding this allocation can signNowly impact your business's tax strategy.

-

How does the Standard Small Business Credit work?

The Standard Small Business Credit allows eligible businesses to reduce their tax liability based on specific criteria set by tax authorities. This credit is particularly beneficial for small businesses, as it can lead to substantial savings. Utilizing the C 8009, SBT Allocation Of Statutory Exemption can enhance your eligibility for this credit.

-

What are the benefits of using airSlate SignNow for document signing?

airSlate SignNow offers a user-friendly platform for sending and eSigning documents, making it an ideal choice for businesses. With features like customizable templates and secure storage, it streamlines the signing process. This efficiency can be particularly advantageous when dealing with forms like the C 8009, SBT Allocation Of Statutory Exemption.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With flexible pricing plans, it provides essential features without breaking the bank. This affordability is crucial for businesses looking to manage their tax forms, including the C 8009, SBT Allocation Of Statutory Exemption.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This integration capability is beneficial for businesses that need to manage documents related to the C 8009, SBT Allocation Of Statutory Exemption alongside other business processes.

-

How secure is airSlate SignNow for sensitive documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect sensitive documents. This level of security is essential when handling important tax forms like the C 8009, SBT Allocation Of Statutory Exemption.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for effective document management, including templates, reminders, and tracking. These tools help streamline the signing process and ensure that important documents, such as the C 8009, SBT Allocation Of Statutory Exemption, are handled efficiently.

Get more for C 8009, SBT Allocation Of Statutory Exemption, Standard Small Business Credit And Alternate Tax For Members Of Controlled Groups

- Series circuit calculations worksheet form

- 100 monkeys llc bylaws form

- Retail power of attorney form

- Small business guide to provincial sales tax pst rev gov bc form

- Wreckers bill forms

- Kansas department of revenue bill of sale form

- Automobile wrecker tow car operator instruction guide nsla nevadaculture form

- Enf 12 search seizure fingerprinting and photographing form

Find out other C 8009, SBT Allocation Of Statutory Exemption, Standard Small Business Credit And Alternate Tax For Members Of Controlled Groups

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online