R 3, Change to a Registered Business Andor Tax Account 2024-2026

Understanding the Virginia Form R-3

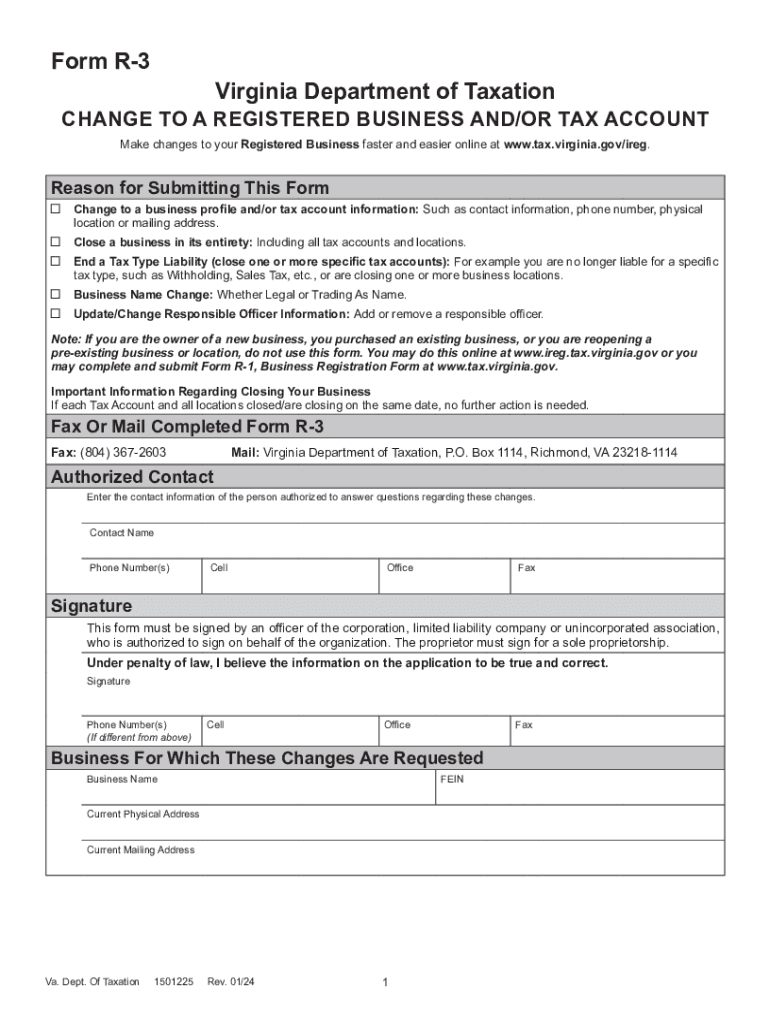

The Virginia Form R-3 is a crucial document used for changing the registration of a business or tax account. This form is typically required when a business undergoes changes that affect its registration status, such as a change in ownership, structure, or tax classification. Understanding the purpose and requirements of the R-3 form is essential for maintaining compliance with state tax regulations.

Steps to Complete the Virginia Form R-3

Completing the Virginia Form R-3 involves several key steps:

- Gather necessary information about your business, including the current registration details and the nature of the changes.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review the form for any errors or omissions to prevent processing delays.

- Submit the completed form through the appropriate channels, which may include online submission or mailing it to the designated address.

Required Documents for the Virginia Form R-3

When submitting the Virginia Form R-3, certain documents may be required to support your request. These typically include:

- Proof of identity for the business owner or authorized representative.

- Documentation outlining the changes being made, such as partnership agreements or articles of incorporation.

- Any prior registration documents that may be relevant to the changes.

Filing Deadlines for the Virginia Form R-3

It is important to be aware of the filing deadlines associated with the Virginia Form R-3. Generally, changes should be reported as soon as they occur to avoid penalties or complications. Specific deadlines may vary based on the nature of the change, so checking the latest guidelines from the Virginia Department of Taxation is advisable.

Legal Use of the Virginia Form R-3

The Virginia Form R-3 must be used in accordance with state laws and regulations governing business registrations. Failure to use the form properly can result in legal repercussions, including fines or the invalidation of the business's registration status. Ensuring compliance with legal requirements is essential for all businesses operating in Virginia.

Examples of Changes Requiring the Virginia Form R-3

Several scenarios may necessitate the filing of the Virginia Form R-3. Common examples include:

- Changing the ownership structure of a business, such as converting from a sole proprietorship to a partnership.

- Altering the business name or trade name.

- Updating the business address or contact information.

Quick guide on how to complete r 3 change to a registered business andor tax account

Effortlessly Prepare R 3, Change To A Registered Business Andor Tax Account on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Handle R 3, Change To A Registered Business Andor Tax Account on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign R 3, Change To A Registered Business Andor Tax Account Without Any Hassle

- Locate R 3, Change To A Registered Business Andor Tax Account and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow fulfills your document management needs within a few clicks from your preferred device. Modify and eSign R 3, Change To A Registered Business Andor Tax Account and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct r 3 change to a registered business andor tax account

Create this form in 5 minutes!

How to create an eSignature for the r 3 change to a registered business andor tax account

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I change my address with the Virginia Department of Taxation?

If you have moved or changed your address since you last filed a return, log in to your individual account to update your address with us. Don't have an individual account? Enroll here. You'll need a copy of your most recently filed Virginia tax return to enroll.

-

How do I change my address with Virginia Bar?

Sign in to the bar's website to change an address of record. Changes also may be submitted in writing by mail or email to the Regulatory Compliance Department. For all other issues contact Fastcase directly at 1-866-773-2782 (8:00 am-8:00 pm ET.)

-

How do I change my address on my taxes?

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party — Business and send them to the address shown on the forms.

-

How to update address with Virginia Tax?

If you have moved or changed your address since you last filed a return, log in to your individual account to update your address with us. Don't have an individual account? Enroll here. You'll need a copy of your most recently filed Virginia tax return to enroll.

-

How do I change my address for personal property tax in Virginia?

18. Personal Property Taxes - How do I change my mailing address? Contact the Commissioner of the Revenue at (757) 727-6183 or by e-mail or change your address online.

-

How do I change the ownership of a business in Virginia?

Changes in ownership To report a change in ownership of an existing business, the current owner will need to close their business, and the new owner will need to register as a new business.

Get more for R 3, Change To A Registered Business Andor Tax Account

Find out other R 3, Change To A Registered Business Andor Tax Account

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF