Instructions for Form DTF716 Tax NY Gov 2013-2026

Understanding the DTF 716 Form

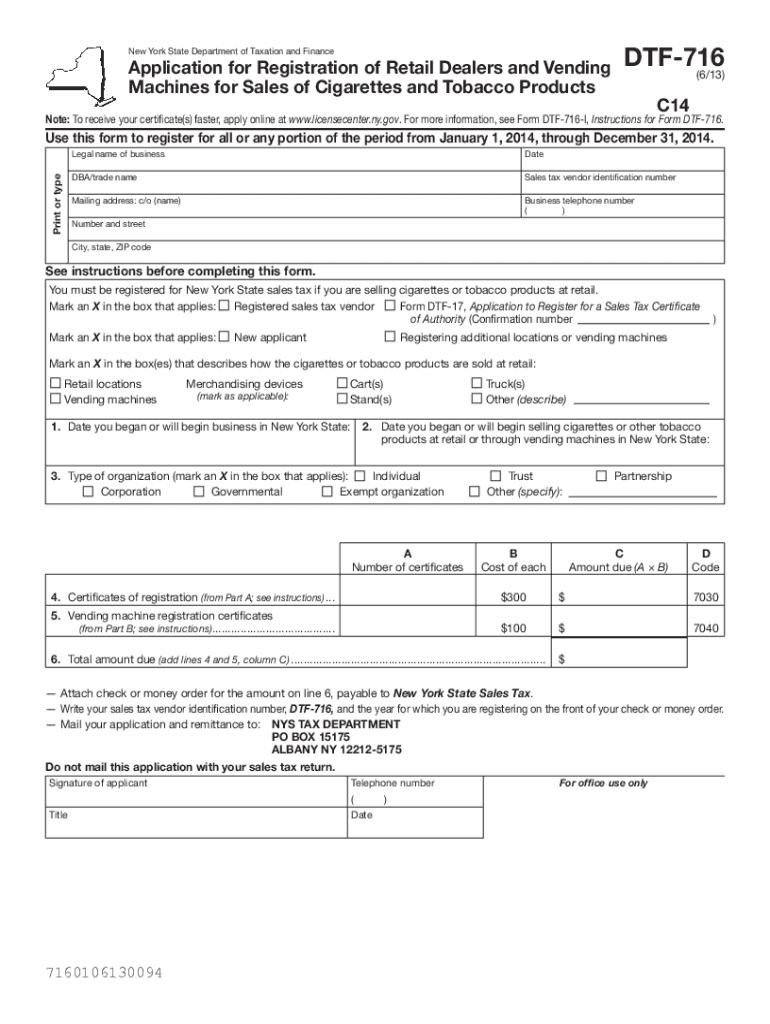

The DTF 716 form is a crucial document used for tax purposes in the state of New York. It primarily serves as a request for a refund of overpaid sales tax. Taxpayers can utilize this form to claim refunds for sales tax that was incorrectly charged or paid. Understanding the specific use of this form is essential for individuals and businesses looking to navigate the tax landscape effectively.

Steps to Complete the DTF 716 Form

Completing the DTF 716 form requires careful attention to detail. Here are the steps to guide you through the process:

- Gather all necessary documentation, including receipts and proof of payment for sales tax.

- Fill out the form accurately, ensuring all required fields are completed.

- Calculate the total amount of sales tax you are claiming as a refund.

- Attach any supporting documents that validate your claim.

- Review the form for accuracy before submission.

Key Elements of the DTF 716 Form

Several key elements must be included when filling out the DTF 716 form:

- Taxpayer Information: Include your name, address, and taxpayer identification number.

- Refund Amount: Clearly state the amount you are claiming for refund.

- Reason for Refund: Provide a brief explanation of why you are requesting the refund.

- Supporting Documentation: Attach all necessary documents that substantiate your claim.

Form Submission Methods

The DTF 716 form can be submitted through various methods, making it accessible for taxpayers. You can choose to submit the form online via the New York State Department of Taxation and Finance website, or you can mail it directly to the appropriate address provided on the form. In-person submission is also an option at designated tax offices.

Legal Use of the DTF 716 Form

The DTF 716 form is legally recognized for requesting sales tax refunds in New York. Taxpayers must ensure they meet all eligibility criteria and follow the instructions provided to avoid any potential legal issues. Misuse of the form can lead to penalties or denial of the refund request.

Filing Deadlines for the DTF 716 Form

It is important to be aware of the filing deadlines associated with the DTF 716 form. Generally, taxpayers must file their refund requests within three years from the date the tax was paid. Missing this deadline may result in the inability to claim the refund, so timely submission is crucial for successful processing.

Quick guide on how to complete instructions for form dtf716 tax ny gov

Accomplish Instructions For Form DTF716 Tax NY gov seamlessly on any gadget

Digital document administration has become increasingly favored by businesses and individuals alike. It offers a perfect green substitute to conventional printed and signed documentation, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Instructions For Form DTF716 Tax NY gov on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The simplest way to modify and eSign Instructions For Form DTF716 Tax NY gov without hassle

- Obtain Instructions For Form DTF716 Tax NY gov and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your revisions.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Instructions For Form DTF716 Tax NY gov and ensure efficient communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form dtf716 tax ny gov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form dtf716 tax ny gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I order federal tax forms and instructions?

Get the current filing year's forms, instructions, and publications for free from the IRS. Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

-

Which 1040x form do I use?

Use Form 1040-X to correct a previously filed Form 1040, 1040-SR, or 1040-NR, or to change amounts previously adjusted by the IRS. You can also use Form 1040-X to make a claim for a carryback due to a loss or unused credit or make certain elections after the deadline.

-

Can I amend my tax return electronically?

Amending Returns Electronically Select the period for which you want to submit an amended return for under "Recent Periods" tab. Select "File, Amend, or Print a Return" under the "I Want To" column. Select "Amend Return" under the "I Want To" column. Complete the online tax return with your amended figures.

-

What form do I fill out to amend my tax return?

If you didn't claim the correct filing status or you need to change your income, deductions, or credits, you should file an amended or corrected return using Form 1040-X, Amended U.S. Individual Income Tax Return.

-

How can I fill out tax forms online?

E-file options File with an IRS Free File partner. Get free IRS help. Use tax preparation software. Find a tax preparer authorized to e-file. IRS Direct File.

-

Where can I get NYS tax forms and booklets?

The fastest way to obtain forms and instructions is to download them from our website. Current and prior-year forms are available as standard PDFs, and select forms are available as enhanced fill-in PDFs. For detailed instructions on downloading our forms, see Forms-user instructions.

-

What form do I use to amend my New York tax return?

To file an amended return, complete all six pages of Form IT-201-X, using your original return as a guide, and make any necessary changes to income, deductions, and credits. Use 2023 Form IT-201-I, Instructions for Form IT-201, and the specific instructions below to complete Form IT-201-X.

-

How do I amend my New York state tax return?

You can amend your New York State income tax return by filing a paper form and mailing it in. Per New York State's instructions for amending a tax return: Complete your amended return as if you are filing the return for the first time.

Get more for Instructions For Form DTF716 Tax NY gov

Find out other Instructions For Form DTF716 Tax NY gov

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors