Corporations Required to File Estimated Tax Payments Form

Understanding the Corporations Required to File Estimated Tax Payments

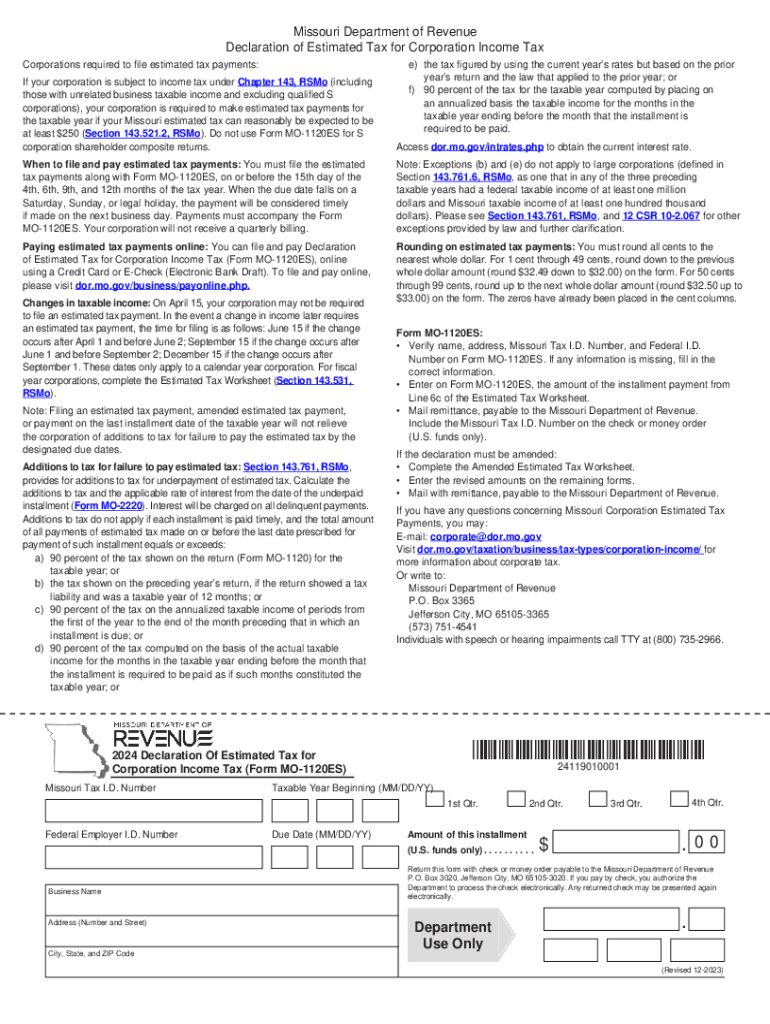

The form MO 1120ES is specifically designed for corporations in Missouri that are required to make estimated tax payments. Corporations must file this form if they expect to owe a certain amount in taxes for the year. This requirement ensures that businesses contribute to state revenue throughout the year rather than waiting until the annual tax filing deadline. Generally, corporations must make estimated payments if they expect to owe more than five hundred dollars in state taxes.

Steps to Complete the Corporations Required to File Estimated Tax Payments

Completing the MO 1120ES involves several key steps:

- Determine your corporation's expected tax liability for the year.

- Calculate the estimated tax payments due for each quarter. This typically involves dividing the total expected tax by four.

- Fill out the MO 1120ES form with the calculated amounts for each quarter.

- Submit the form along with the payment through the designated channels, either online or by mail.

Filing Deadlines and Important Dates

Corporations must adhere to specific deadlines for submitting the MO 1120ES. Payments are generally due on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. It is crucial to mark these dates on your calendar to avoid penalties for late payments. Additionally, ensure that you check for any changes in deadlines that may occur due to state regulations or holidays.

Key Elements of the Corporations Required to File Estimated Tax Payments

The MO 1120ES form includes essential information such as the corporation's name, address, and federal employer identification number (EIN). It also requires the corporation to report the estimated tax amounts due for each quarter. Understanding these key elements is vital for accurate completion and compliance with state tax laws.

Penalties for Non-Compliance

Failure to file the MO 1120ES or make timely payments can result in penalties. The state of Missouri may impose fines based on the amount owed and the duration of the delay. It is important for corporations to stay informed about their tax obligations to avoid unnecessary financial burdens.

Digital vs. Paper Version of the Form

The MO 1120ES can be submitted in both digital and paper formats. Digital submissions are often quicker and can help streamline the filing process. However, some corporations may prefer the paper version for record-keeping purposes. Understanding the advantages of each method can help businesses choose the best option for their needs.

IRS Guidelines for Estimated Tax Payments

While the MO 1120ES is a state-specific form, corporations should also be aware of the IRS guidelines regarding estimated tax payments. The IRS sets forth rules that may affect how state payments are calculated and reported. Familiarity with these guidelines ensures that corporations remain compliant with both state and federal tax requirements.

Quick guide on how to complete corporations required to file estimated tax payments

Complete Corporations Required To File Estimated Tax Payments effortlessly on any device

Virtual document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Corporations Required To File Estimated Tax Payments on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Corporations Required To File Estimated Tax Payments with ease

- Locate Corporations Required To File Estimated Tax Payments and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize necessary sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you choose. Modify and eSign Corporations Required To File Estimated Tax Payments and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the corporations required to file estimated tax payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What corporations are required to file form CT 1120?

Every corporation (or association taxable as a corporation) that carries on business or has the right to carry on business in Connecticut must complete a registration application and file Form CT‑1120, Corporation Business Tax Return.

-

Which of the following corporations are required to file form 1120 Schedule M 3?

Who must file the Schedule M-3? Corporations and S corporations with assets of $10 million or greater. Partnerships must file Schedule M-3 if any of the following are true: The amount of total assets at the end of the tax year reported on Schedule L, line 14, column (d), is equal to $10 million or more.

-

Does CT require S Corp election?

Connecticut automatically recognizes your S Corp status once you file Form 2553 to elect S Corp tax treatment with the IRS.

-

What corporations are exempt from filing form 1120?

Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an income tax return whether or not they have taxable income. Domestic corporations must file Form 1120, unless they are required, or elect to file a special return.

-

Are corporations required to file tax returns?

A domestic corporation must file Form 1120, U.S. Corporation Income Tax Return, whether it has taxable income or not, unless it's exempt from filing under section 501.

-

What is the minimum tax in CT for corporations?

The surtax does not apply to the minimum tax of $250. You may qualify for tax credits that can reduce your Corporation Business Tax liability. In general, credits cannot reduce your corporation's tax by more than 50.01%. The Guide to Business Tax Credits provides information on credits available to corporations.

-

Is an S corporation required to make estimated tax payments?

Who must pay estimated tax. Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

-

What corporations must pay estimated taxes?

All corporations incorporated, qualified, or doing business in California, whether active or inactive, must make franchise or income estimated tax payments.

Get more for Corporations Required To File Estimated Tax Payments

Find out other Corporations Required To File Estimated Tax Payments

- Help Me With eSign Kentucky Government Job Offer

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile