Form 5677 Instructions for Composite Individual Return for Nonresident Partners or Shareholders 2023

Understanding Form 5677

Form 5677 is a crucial document used for filing a composite individual return for nonresident partners or shareholders. This form allows partnerships or S corporations to report income earned by nonresident partners or shareholders in a single return, simplifying the tax process for both the entity and its members. It is particularly beneficial for those who may not have a tax filing requirement in the United States but still need to report their income from U.S. sources.

Steps to Complete Form 5677

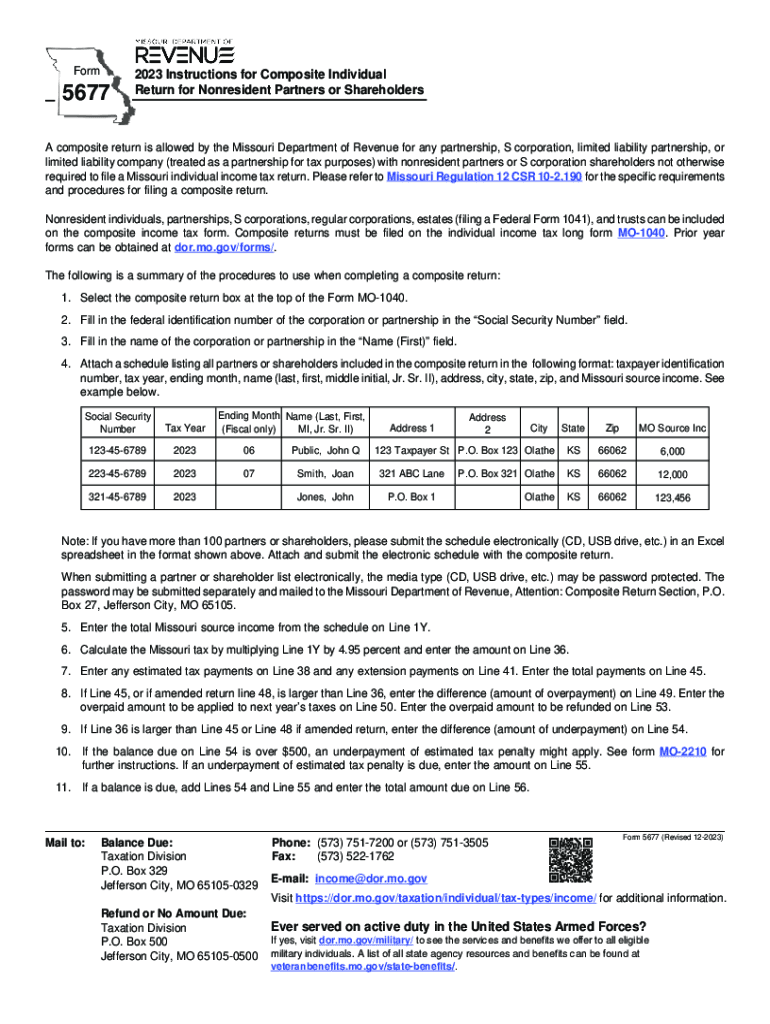

Completing Form 5677 involves several key steps:

- Gather all necessary financial documents, including income statements and any relevant tax documents.

- Provide accurate information about the partnership or S corporation, including the name, address, and employer identification number (EIN).

- Detail the income earned by each nonresident partner or shareholder, ensuring that all amounts are correctly reported.

- Calculate the total income and any applicable deductions to determine the net income subject to tax.

- Review the form for accuracy and completeness before submission.

Legal Use of Form 5677

The legal use of Form 5677 is primarily for tax compliance. It allows partnerships and S corporations to fulfill their tax obligations on behalf of nonresident partners or shareholders. By filing this form, entities ensure that they are reporting income accurately and adhering to IRS regulations, thereby minimizing the risk of penalties for non-compliance.

Filing Deadlines and Important Dates

Timely filing of Form 5677 is essential to avoid penalties. The form is typically due on the 15th day of the fourth month following the end of the tax year. For entities operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to deadlines that may occur due to IRS announcements or changes in tax law.

Required Documents for Form 5677

To complete Form 5677, several documents are required:

- Income statements for the partnership or S corporation.

- Records of any deductions that may apply.

- Identification information for all nonresident partners or shareholders, including their names and tax identification numbers.

- Any prior year tax returns that may provide context or necessary information.

Who Issues Form 5677

Form 5677 is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. This form is part of the IRS's efforts to streamline the tax reporting process for partnerships and S corporations with nonresident members.

Quick guide on how to complete form 5677 instructions for composite individual return for nonresident partners or shareholders

Complete Form 5677 Instructions For Composite Individual Return For Nonresident Partners Or Shareholders effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without delays. Handle Form 5677 Instructions For Composite Individual Return For Nonresident Partners Or Shareholders on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to alter and eSign Form 5677 Instructions For Composite Individual Return For Nonresident Partners Or Shareholders with ease

- Obtain Form 5677 Instructions For Composite Individual Return For Nonresident Partners Or Shareholders and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 5677 Instructions For Composite Individual Return For Nonresident Partners Or Shareholders to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 5677 instructions for composite individual return for nonresident partners or shareholders

Create this form in 5 minutes!

How to create an eSignature for the form 5677 instructions for composite individual return for nonresident partners or shareholders

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who must file a Missouri partnership return?

What is Missouri partnership tax and who must file? A Missouri Partnership Return of Income (Form MO-1065) must be filed if Federal Form 1065 is required to be filed and the partnership has (1) a partner that is a Missouri resident or (2) any income derived from Missouri sources, Section 143.581, RSMo.

-

How does a composite return work?

A composite return is a unique type of income tax return filed on behalf of a group of nonresident individuals by a pass-through entity. Instead of each member managing their own state income responsibilities individually, the entity takes charge of a composite filing.

-

Who has to file a Missouri state tax return?

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.

-

Who can file a GA composite return?

As an alternative to withholding on nonresident partners, shareholders or members, the Partnership, S Corporation or Limited Liability Company may file a composite return. Permission is not required. Only nonresidents who are not otherwise required to file a return may be included in the computation.

-

Who can be included in the Missouri Composite Return?

A composite return is allowed by the Missouri Department of Revenue for any partnership, S corporation, limited liability partnership, or limited liability company (treated as a partnership for tax purposes) with nonresident partners or S corporation shareholders not otherwise required to file a Missouri individual ...

-

Where do I mail my Missouri composite return?

When submitting a partner or shareholder list electronically, the media type (CD, USB drive, etc.) may be password protected. The password may be submitted separately, mail to the Missouri Department of Revenue, P.O. Box 27, Attention: Composite Return Section, Jefferson City, MO 65105.

-

Who is eligible for MO PTE?

For tax years ending on or after December 31, 2022, Missouri partnerships and S corporations can elect to pay pass-through entity (PTE) tax. PTE tax, sometimes referred to as a SALT workaround, allows qualifying members of a PTE to pay tax at the entity level and claim a credit for the taxes paid on their own returns.

-

What is a nonresident composite return?

A composite return is a unique type of income tax return filed on behalf of a group of nonresident individuals by a pass-through entity. Instead of each member managing their own state income responsibilities individually, the entity takes charge of a composite filing.

Get more for Form 5677 Instructions For Composite Individual Return For Nonresident Partners Or Shareholders

Find out other Form 5677 Instructions For Composite Individual Return For Nonresident Partners Or Shareholders

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer