View InstructionsForm OW3ACITY of OREGON INCOME TA

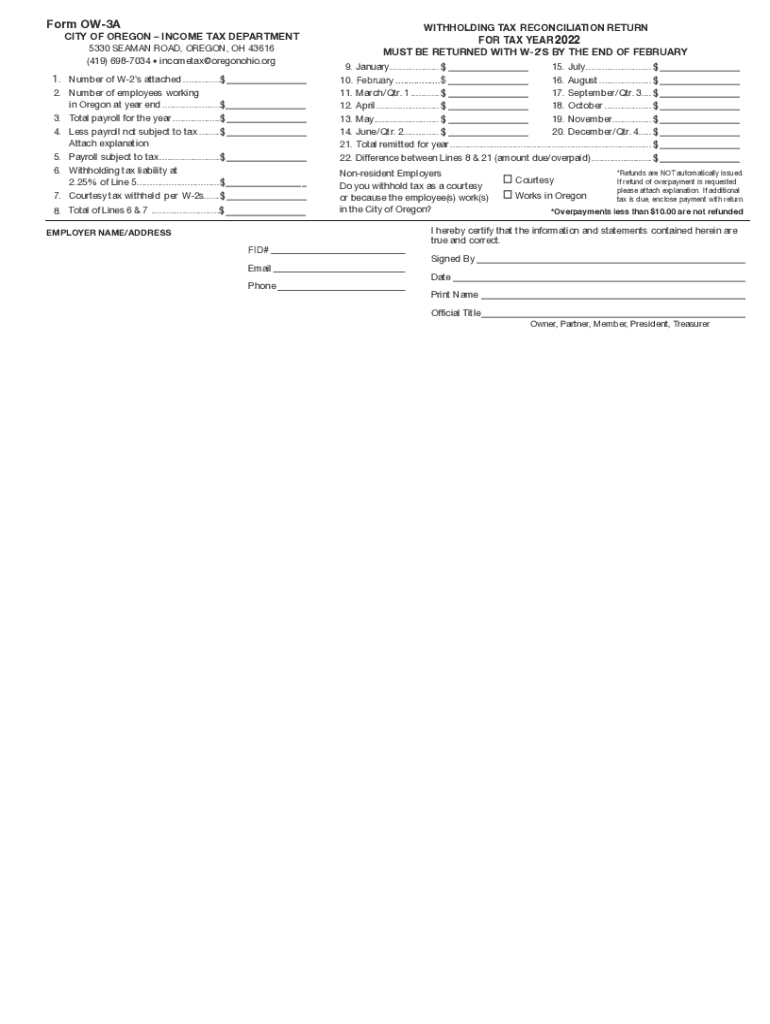

Understanding the City of Oregon Income Tax Form

The City of Oregon Income Tax Form, often referred to as the OW-3A, is essential for residents and businesses to report their income accurately. This form is used to calculate the local income tax owed to the city. It is important to understand the specific requirements and instructions associated with this form to ensure compliance with local tax regulations.

Steps to Complete the City of Oregon Income Tax Form

Completing the City of Oregon Income Tax Form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information accurately, including your name, address, and Social Security number.

- Report all sources of income as required, ensuring you include both earned and unearned income.

- Calculate the total tax owed based on the city's tax rates.

- Review the form for accuracy before submission.

Required Documents for the City of Oregon Income Tax Form

To complete the City of Oregon Income Tax Form, you will need the following documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income, such as rental income or investment earnings

- Previous year’s tax return for reference

Form Submission Methods

The City of Oregon Income Tax Form can be submitted in various ways:

- Online: Many residents opt to file electronically through the city’s tax portal.

- By Mail: Completed forms can be mailed to the City of Oregon Tax Department.

- In-Person: You may also submit your form directly at the tax department office.

Penalties for Non-Compliance

Failing to file the City of Oregon Income Tax Form on time can result in penalties. These may include:

- Late filing fees

- Interest on unpaid taxes

- Potential legal action for severe non-compliance

Important Filing Deadlines

It is crucial to be aware of the filing deadlines for the City of Oregon Income Tax Form. Typically, the deadline aligns with the federal tax return deadline, which is April 15. However, it is advisable to check for any specific local extensions or changes each tax year.

Quick guide on how to complete view instructionsform ow3acity of oregon income ta

Complete View InstructionsForm OW3ACITY OF OREGON INCOME TA effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents promptly without any delays. Handle View InstructionsForm OW3ACITY OF OREGON INCOME TA on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign View InstructionsForm OW3ACITY OF OREGON INCOME TA with ease

- Find View InstructionsForm OW3ACITY OF OREGON INCOME TA and click Get Form to commence.

- Utilize the resources we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to store your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Wave goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign View InstructionsForm OW3ACITY OF OREGON INCOME TA and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the view instructionsform ow3acity of oregon income ta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does the W3 show?

A W-3 form reports the total salary and wages paid to all of your employees, along with total income and FICA taxes withheld throughout the prior year. Every employer who files one or more W-2 forms must also file Form W-3.

-

What is the w3 summary?

Form W-3 is a tax form used by employers to report combined employee income to the Internal Revenue Service (IRS) and the Social Security Administration. Employers who send out more than one Form W-2 to employees must complete and send this form to summarize their total salary payment and withholding amounts.

-

What gets reported on w3?

Form W-3 is a document used by the IRS and the Social Security Administration (SSA) to summarize and transmit an employer's W-2 forms. A W-3 form reports the total employee wages, taxable wages, and taxes your business withheld throughout the year.

-

How do I fill out a w3 form?

How to complete Form W-3. Box a—Control number. Box b—Kind of Payer. 941. Military. 943. 944. ... Box b—Kind of Employer. None apply. 501c non-govt. State/local non-501c. State/local 501c. ... Box b—Third-party sick pay. Box c—Total number of Forms W-2. Box d—Establishment number. Box e—Employer identification number (EIN).

-

Where can I find my w3?

To order official IRS information returns such as Forms W-2 and W-3, which include a scannable Copy A for filing, go to IRS' Online Ordering for Information Returns and Employer Returns page, or visit .irs.gov/orderforms and click on Employer and Information returns.

-

What does W3 mean?

The World Wide Web, abbreviated 'W3' on the earliest web pages. World Wide Web Consortium, international standards organization for the World Wide Web (abbreviated or W3) Windows 3.0, a Microsoft operating system.

-

What is difference between W-2 and W3?

What's the difference between Form W-2 and Form W-3? Employees use the information provided by their employer on the Form W-2 to complete and file their personal income tax returns. Employers use Form W-3 to report employee income to the IRS and Social Security Administration.

-

How do I complete my W3?

How do I fill out a W-3? Box a: Control number. ... Box b: Kind of Payer. ... Box b: Kind of Employer. ... Box b: Third-party sick pay. ... Box c: Provide the total number of W-2 forms that you are transmitting with this Form W-3. ... Box d: Establishment number. ... Box e: Employer identification number (EIN).

Get more for View InstructionsForm OW3ACITY OF OREGON INCOME TA

- Masonic grant application maryland form

- Maryland cds license verification 2012 form

- Tools feral cat colony tracking system caregiving information hicatfriends

- Sallie mae forbearance limit form

- Patient financial statement uw health uwhealth form

- Usea horse registration form

- Certificate of occupancy authorization form to act

- Form 966 instructions

Find out other View InstructionsForm OW3ACITY OF OREGON INCOME TA

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document