Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement Form

What is the Residential Mortgage Interest Rate Lock Agreement

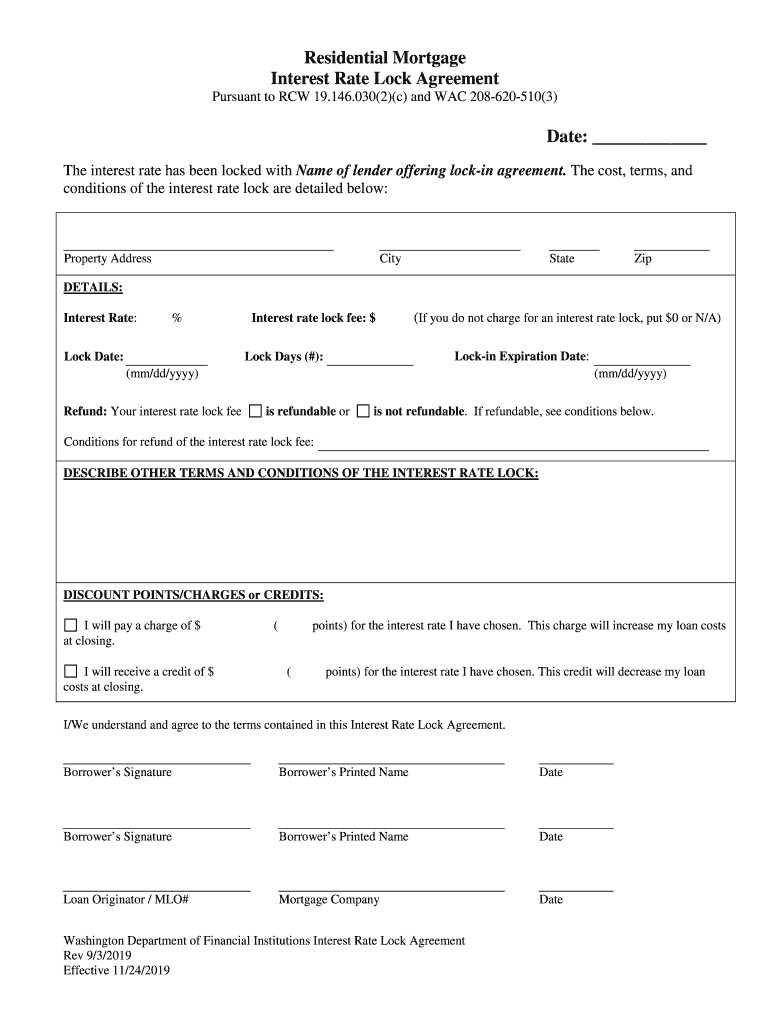

The Residential Mortgage Interest Rate Lock Agreement is a crucial document in the home financing process. It allows borrowers to secure a specific interest rate on their mortgage for a predetermined period. This agreement protects borrowers from interest rate fluctuations during the loan processing period, ensuring that they can complete their home purchase at a stable rate. Typically, the lock period can range from a few weeks to several months, depending on the lender's policies and the borrower's needs.

Key elements of the Residential Mortgage Interest Rate Lock Agreement

Several key elements define the Residential Mortgage Interest Rate Lock Agreement. These include:

- Lock Period: The duration for which the interest rate is secured.

- Interest Rate: The specific rate that will apply to the mortgage loan.

- Loan Type: The type of mortgage for which the rate is being locked, such as fixed-rate or adjustable-rate.

- Fees: Any associated fees for locking the rate, which may vary by lender.

- Expiration Terms: Conditions under which the agreement may expire or be extended.

How to use the Residential Mortgage Interest Rate Lock Agreement

Using the Residential Mortgage Interest Rate Lock Agreement involves several steps. Initially, borrowers should discuss their options with their lender to determine the best time to lock in a rate. Once a decision is made, the borrower will complete the agreement, specifying the desired interest rate and lock period. It is essential to review the terms carefully, as any changes in the loan application may affect the locked rate. After signing, the lender will provide confirmation of the lock.

Steps to complete the Residential Mortgage Interest Rate Lock Agreement

Completing the Residential Mortgage Interest Rate Lock Agreement typically involves the following steps:

- Consult with your lender to understand the current market rates and decide on the right time to lock.

- Fill out the rate lock agreement form, providing necessary details such as the loan amount and property information.

- Review the terms of the agreement, including the lock period and any fees.

- Sign the agreement and submit it to your lender for processing.

- Receive confirmation of the rate lock from your lender, ensuring all details are correct.

Legal use of the Residential Mortgage Interest Rate Lock Agreement

The Residential Mortgage Interest Rate Lock Agreement is legally binding once signed by both the borrower and lender. It serves as a formal commitment that the lender will honor the specified interest rate for the agreed-upon period. It is important for borrowers to understand their rights and obligations under this agreement, including any penalties for failing to close on the loan within the lock period. Legal advice may be beneficial to ensure compliance with state-specific regulations.

State-specific rules for the Residential Mortgage Interest Rate Lock Agreement

State-specific rules can significantly impact the Residential Mortgage Interest Rate Lock Agreement. Different states may have unique regulations regarding how long a rate can be locked, the fees that can be charged, and the disclosure requirements for lenders. Borrowers should familiarize themselves with their state's laws to ensure that their rights are protected and that they are fully informed about the terms of their agreement.

Quick guide on how to complete residential mortgage interest rate lock agreement residential mortgage interest rate lock agreement

Complete Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Manage Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement on any device with airSlate SignNow's Android or iOS applications and enhance your document-related tasks today.

How to modify and eSign Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement effortlessly

- Find Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose your preferred method for sharing your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the residential mortgage interest rate lock agreement residential mortgage interest rate lock agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What happens if my rate lock expires and rates go down?

If your rate lock expires before closing, you'll have to re-lock a rate to close the loan. If rates haven't moved, your new rate will likely be the same rate you originally qualified for. If rates increased during the lock period, your rate will likely go up. But if rates have fallen, you will not get a lower rate.

-

Is a mortgage rate lock worth it?

Locking in your mortgage rate is typically worth it when rates are rising, and you want to protect yourself from paying a higher rate at closing. If mortgage rates increase after you've locked in the rate, you still get to keep your lower rate.

-

Can you walk away from a mortgage rate lock?

Can you change mortgage lenders after locking your rate? A rate lock doesn't lock you into the deal. If you find better terms and lower closing costs from another lender, you can opt to go with that lender after your rate lock with the first lender begins.

-

What is the interest rate lock agreement?

Locking your interest rate means the rate will stay the same from the time of the rate lock until the rate lock expiration date, regardless of changing market conditions. Your final interest rate may be higher or lower than what was initially quoted to you if there are changes before your loan closes.

-

Is it worth locking in interest rates?

Locking in your mortgage rate is typically worth it when rates are rising, and you want to protect yourself from paying a higher rate at closing. If mortgage rates increase after you've locked in the rate, you still get to keep your lower rate.

-

What happens if the rate lock expires?

Impact of Rate Lock Expirations If your rate lock expires, it may cost you more money! Most lenders will charge a fee to extend your rate. The amount of that fee is typically calculated based on the interest rate at the time the extension is requested. It may cost you thousands of dollars to extend.

-

What happens if rates go down after I lock in?

On the other hand, if you lock your rate and interest rates fall, you can't take advantage of the lower rate unless your rate lock includes a float-down option. A float-down option allows you to take advantage of an interest rate decrease during your rate lock period.

-

How does an interest rate lock work?

Locking your interest rate means the rate will stay the same from the time of the rate lock until the rate lock expiration date, regardless of changing market conditions. Your final interest rate may be higher or lower than what was initially quoted to you if there are changes before your loan closes.

Get more for Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement

- Estate tax forms 2022maine revenue services

- 99 2206600 reconciliation of maine income tax form

- I 015i schedule h ez wisconsin homestead credit short form schedule h ez wisconsin homestead credit

- Wisconsin state fair official quilt entry form

- For estates of decedents dying during calendar year form

- Stec co rev 1114reset form tax ohio govsales and

- Employment tax returns 2023maine revenue services form

- 1099 g tax statement information wisconsin unemployment

Find out other Residential Mortgage Interest Rate Lock Agreement Residential Mortgage Interest Rate Lock Agreement

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form