Fin 492 2013

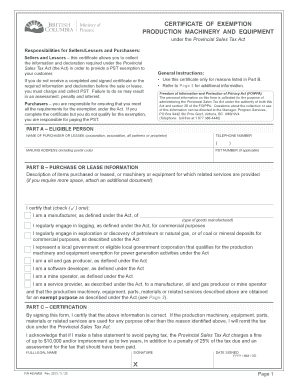

What is the Fin 492

The Fin 492 is a specific form used within the United States for financial reporting purposes. It is primarily utilized by businesses to disclose certain financial information to the Internal Revenue Service (IRS). This form is essential for ensuring compliance with federal regulations and helps in maintaining transparency in financial dealings. Understanding the purpose of the Fin 492 is crucial for businesses to avoid penalties and ensure accurate reporting.

How to use the Fin 492

Using the Fin 492 involves filling out the required sections accurately to report financial information. Businesses must gather all necessary data before starting the form. Each section of the Fin 492 corresponds to specific financial details, such as income, expenses, and deductions. It is important to follow the instructions provided with the form carefully to ensure that all information is reported correctly and completely. After completing the form, it should be submitted to the IRS by the designated deadline.

Steps to complete the Fin 492

Completing the Fin 492 requires several key steps:

- Gather all necessary financial documents, including income statements and expense records.

- Carefully read the instructions that accompany the Fin 492 to understand what information is required.

- Fill out each section of the form, ensuring accuracy and completeness.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the specified deadline, either electronically or by mail.

Legal use of the Fin 492

The Fin 492 must be used in accordance with IRS regulations. Businesses are legally obligated to provide accurate information on this form to avoid potential penalties. Misrepresentation or failure to file the Fin 492 can lead to serious consequences, including fines and audits. It is essential for businesses to understand their legal responsibilities when using this form to ensure compliance with federal laws.

Filing Deadlines / Important Dates

Filing deadlines for the Fin 492 are critical for compliance. Businesses must be aware of the specific dates by which the form must be submitted to the IRS. Typically, the deadline falls on the fifteenth day of the fourth month following the end of the tax year. However, it is advisable to check for any updates or changes to the deadlines each year to avoid late filing penalties.

Required Documents

To complete the Fin 492, certain documents are required. These may include:

- Income statements that detail revenue generated during the reporting period.

- Expense records that outline all costs incurred by the business.

- Previous tax returns or financial statements for reference.

Having these documents ready will streamline the process of filling out the Fin 492 and help ensure accuracy.

Form Submission Methods

Businesses have several options for submitting the Fin 492 to the IRS. The form can be filed electronically through approved e-filing systems, which is often the fastest method. Alternatively, businesses can choose to mail a paper version of the form to the appropriate IRS address. It is important to ensure that the submission method chosen aligns with IRS guidelines to avoid delays or complications.

Quick guide on how to complete fin 492

Effortlessly prepare Fin 492 on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Fin 492 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and eSign Fin 492 with ease

- Find Fin 492 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Annotate pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fin 492 while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fin 492

Create this form in 5 minutes!

How to create an eSignature for the fin 492

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do services charge PST in BC?

Yes, you must charge PST on all taxable goods and services you sell in B.C., unless a specific exemption applies. There are no general exemptions that apply if you sell goods or services in B.C. to customers that live outside B.C. (e.g. tourists).

-

What services are exempt from PST in BC?

Exempt services, including: Boosting of a motor vehicle battery, other than recharging. Cleaning services, unless provided with taxable related services. Courier and mail services. Cutting goods in certain situations if no other related service (other than a related service that is exempt from PST) is provided to the goods.

-

Is PST charged on construction services in BC?

PST applies to taxable goods used to fulfil a contract in B.C. Contractors include builders, carpenters, electricians, plumbers, painters, landscapers and anyone else who installs goods that become part of buildings or land.

-

What is exempt from PST in BC?

The following exemptions are available to everyone and don't require any documentation: Food for human consumption (e.g. basic groceries and prepared food such as restaurant meals) Books, newspapers and magazines. Children-sized clothing.

-

What is the fin 48?

FIN 48 (mostly codified at ASC 740-10) is an official interpretation of United States accounting rules that requires businesses to analyze and disclose income tax risks. It was effective in 2007 for publicly traded entities, and is now effective for all entities adhering to US GAAP.

-

Is there PST on Legal services in BC?

Services provided by a person to that person's employer in the course of employment are not legal services for PST purposes. Legal services provided in B.C. to a person who resides, ordinarily resides or carries on business in B.C. are subject to PST, unless a specific exemption applies.

Get more for Fin 492

- Www allbusinesstemplates compagesample clientsample client list sample templates business templates form

- Pdf referral form dougherty laser vision

- Wellness health screening claim form

- Uftwelfarefund brochurelayout 1 62317 316 pm page 1 form

- Health care provider biometrics screening form

- Fidelis care reimbursement form 430804159

- State farm power of attorney form 608650854

- Hospital school transcript form

Find out other Fin 492

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement