FIN 492, Certificate of Exemption Production Machinery and Equipment Completion of This Certificate Allows an Eligible Person to 2024-2026

Understanding the FIN 492 Certificate of Exemption

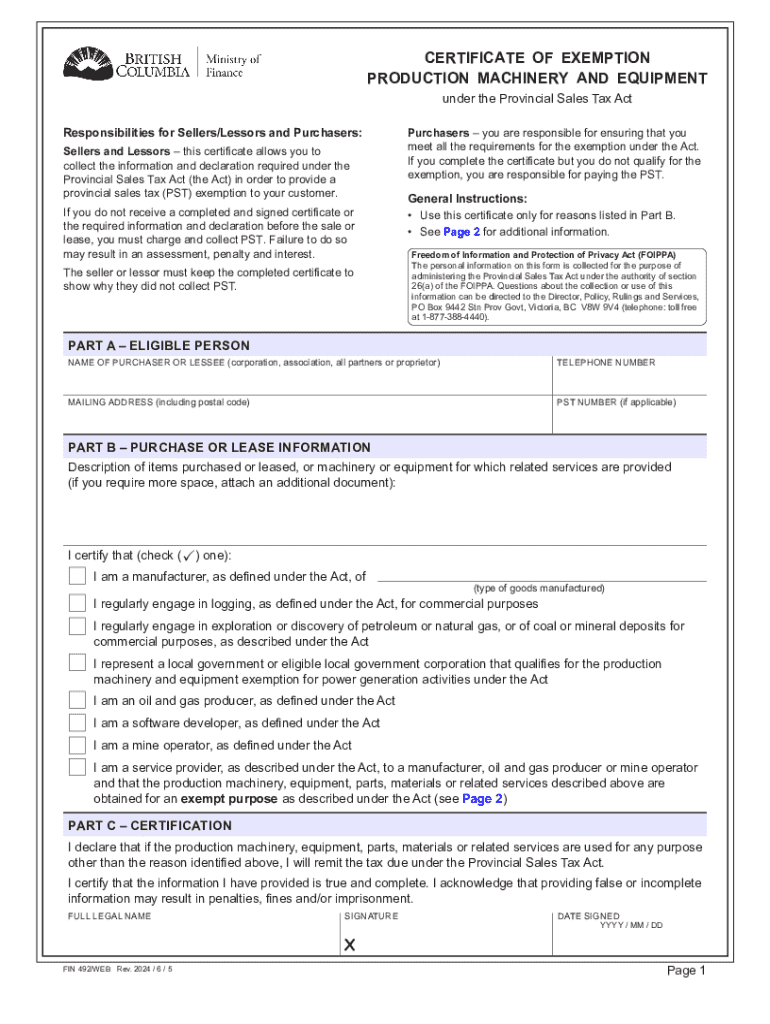

The FIN 492, Certificate of Exemption for Production Machinery and Equipment, is a crucial document for eligible individuals and businesses in the United States. This certificate allows the holder to purchase or lease production machinery, equipment, parts, materials, or related services without incurring Provincial Sales Tax (PST). The exemption is designed to support businesses that invest in machinery and equipment essential for production processes, thereby promoting economic growth and efficiency.

Eligibility Criteria for the FIN 492

To qualify for the FIN 492 certificate, applicants must meet specific eligibility criteria. Generally, these include being engaged in manufacturing, processing, or other production activities. The items purchased or leased must be directly used in these operations. Additionally, the applicant should ensure that the intended use of the machinery or equipment aligns with the exemption guidelines set forth by state regulations.

Steps to Complete the FIN 492

Completing the FIN 492 certificate involves several straightforward steps:

- Gather necessary information, including business details and descriptions of the machinery or equipment.

- Fill out the certificate form accurately, ensuring all required fields are completed.

- Provide any supporting documentation that may be required to demonstrate eligibility.

- Review the completed form for accuracy before submission.

How to Obtain the FIN 492

The FIN 492 certificate can typically be obtained through the state’s revenue or taxation department. Applicants may find the form available online for download or may need to request a physical copy. It is essential to check the specific requirements and procedures for obtaining the certificate in the relevant state, as these can vary.

Legal Use of the FIN 492

The legal use of the FIN 492 certificate is strictly regulated. Holders must ensure that the exemption is applied only to qualifying purchases or leases. Misuse of the certificate, such as using it for non-qualifying items or services, can result in penalties. Therefore, it is important to maintain accurate records and documentation to support the use of the exemption.

Examples of Using the FIN 492

Practical examples of using the FIN 492 certificate include:

- A manufacturing company purchasing new machinery that will be used directly in production processes.

- A business leasing equipment that is essential for manufacturing goods.

- Acquiring parts and materials that will be incorporated into products for sale.

Form Submission Methods

Submitting the FIN 492 certificate can be done through various methods, depending on state regulations. Options may include online submission through the state’s tax portal, mailing a physical copy to the appropriate department, or delivering it in person. It is advisable to confirm the preferred submission method to ensure timely processing.

Create this form in 5 minutes or less

Find and fill out the correct fin 492 certificate of exemption production machinery and equipment completion of this certificate allows an eligible person to

Create this form in 5 minutes!

How to create an eSignature for the fin 492 certificate of exemption production machinery and equipment completion of this certificate allows an eligible person to

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FIN 492, Certificate Of Exemption for Production Machinery and Equipment?

The FIN 492, Certificate Of Exemption for Production Machinery and Equipment is a document that allows eligible individuals or businesses to purchase or lease items related to production machinery, equipment, parts, materials, or services without paying Provincial Sales Tax (PST). Completion of this certificate is essential for those looking to save on costs associated with these purchases.

-

Who is eligible for the FIN 492, Certificate Of Exemption?

Eligibility for the FIN 492, Certificate Of Exemption is typically granted to businesses engaged in manufacturing or production activities. To qualify, the applicant must demonstrate that the items purchased or leased are directly used in the production process, ensuring compliance with the exemption criteria.

-

How can I apply for the FIN 492, Certificate Of Exemption?

To apply for the FIN 492, Certificate Of Exemption, you need to complete the application form provided by your local tax authority. Ensure that you provide all necessary documentation that proves your eligibility, as this will facilitate a smoother approval process.

-

What items are covered under the FIN 492, Certificate Of Exemption?

The FIN 492, Certificate Of Exemption covers a wide range of items including production machinery, equipment, parts, materials, and related services. It is crucial to ensure that the items purchased are directly used in production to qualify for the exemption from PST.

-

What are the benefits of using the FIN 492, Certificate Of Exemption?

Utilizing the FIN 492, Certificate Of Exemption allows businesses to signNowly reduce their operational costs by avoiding PST on eligible purchases. This financial relief can enhance cash flow and enable reinvestment into other areas of the business, promoting growth and efficiency.

-

Is there a cost associated with obtaining the FIN 492, Certificate Of Exemption?

There is typically no direct cost to obtain the FIN 492, Certificate Of Exemption itself; however, businesses should consider any administrative costs related to the application process. It is advisable to consult with a tax professional to understand any potential fees or requirements.

-

How does airSlate SignNow assist with the FIN 492, Certificate Of Exemption process?

airSlate SignNow provides an easy-to-use platform for businesses to manage and eSign documents related to the FIN 492, Certificate Of Exemption. Our solution streamlines the documentation process, ensuring that all necessary forms are completed accurately and efficiently.

Get more for FIN 492, Certificate Of Exemption Production Machinery And Equipment Completion Of This Certificate Allows An Eligible Person To

- Reactjs formik how to reset form after confirmation

- Printable 2020 missouri form mo 2210 underpayment of estimated tax

- How to resetclear microsoft forms if it reached the

- Mississippi individual income tax interest and penalty worksheet form

- Instructions for form 8867 2020internal revenue service

- Printable 2020 mississippi form 80 315 re forestation tax credit

- Form 8001 medicaid estate recovery program receipt

- 80 155 form

Find out other FIN 492, Certificate Of Exemption Production Machinery And Equipment Completion Of This Certificate Allows An Eligible Person To

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself