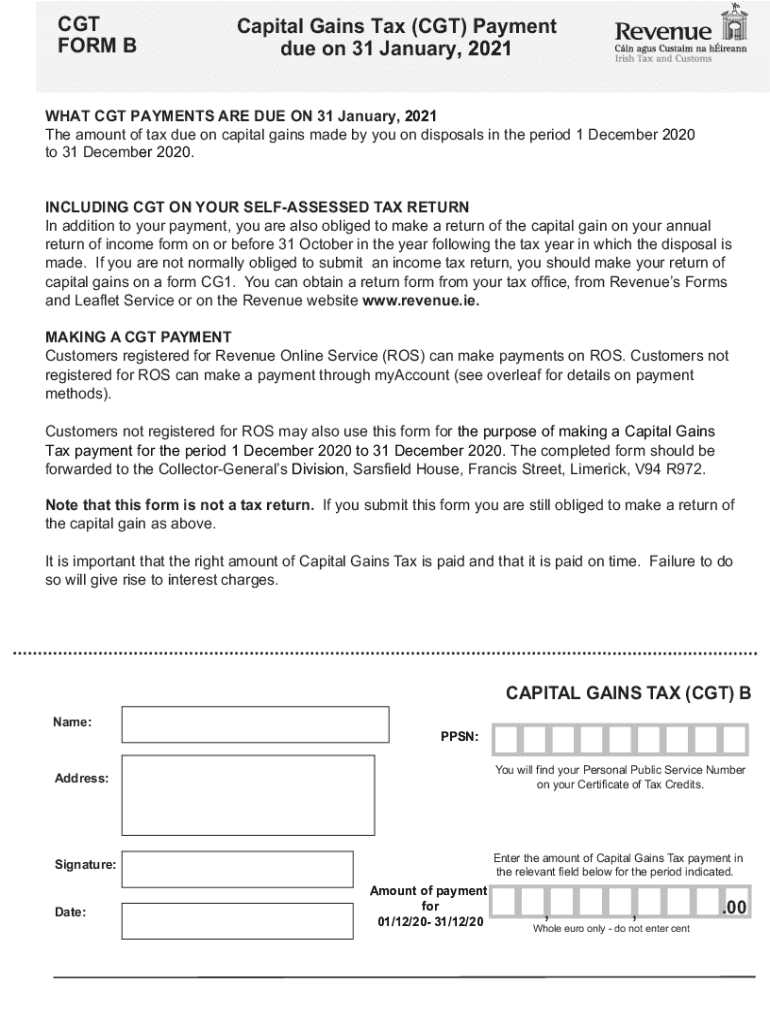

Capital Gains Tax CGT Payment Form B

What is the Capital Gains Tax CGT Payment Form B

The Capital Gains Tax CGT Payment Form B is a crucial document used by taxpayers in the United States to report and pay taxes on capital gains realized from the sale of assets. This form is specifically designed for reporting gains that exceed certain thresholds, ensuring compliance with federal tax regulations. Understanding this form is essential for individuals and businesses that engage in transactions involving the sale of property, stocks, or other investments that may generate taxable gains.

How to use the Capital Gains Tax CGT Payment Form B

Using the Capital Gains Tax CGT Payment Form B involves several key steps. First, gather all relevant financial documents that detail your capital gains, including sale receipts and purchase records. Next, accurately fill out the form by entering your personal information and detailing each transaction that resulted in a capital gain. Ensure that you calculate your total gains and any applicable deductions accurately. After completing the form, you can submit it either electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to complete the Capital Gains Tax CGT Payment Form B

Completing the Capital Gains Tax CGT Payment Form B requires careful attention to detail. Follow these steps:

- Collect all necessary documentation related to your capital gains.

- Enter your personal information at the top of the form.

- List each asset sold, including the date of sale, purchase price, sale price, and any associated costs.

- Calculate your total capital gains and any losses that can offset these gains.

- Review the form for accuracy and completeness.

- Submit the form by the designated deadline, ensuring you retain a copy for your records.

Key elements of the Capital Gains Tax CGT Payment Form B

The Capital Gains Tax CGT Payment Form B includes several key elements that are essential for accurate reporting. These elements typically consist of:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Transaction Details: Information about each asset sold, including dates, amounts, and costs.

- Calculation of Gains: A section to compute total capital gains and any allowable deductions or losses.

- Signature: A declaration that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Capital Gains Tax CGT Payment Form B are crucial to avoid penalties. Generally, the form must be submitted by the tax return deadline, which is typically April fifteenth of each year for individual taxpayers. If you require an extension, be aware that this does not extend the deadline for tax payments. It is essential to mark your calendar with these important dates to ensure timely compliance with tax obligations.

Penalties for Non-Compliance

Failure to file the Capital Gains Tax CGT Payment Form B accurately and on time can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on unpaid taxes, increasing the total amount due. It is advisable to take the necessary steps to ensure compliance to avoid these financial repercussions.

Quick guide on how to complete capital gains tax cgt payment form b

Prepare Capital Gains Tax CGT Payment Form B effortlessly on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Handle Capital Gains Tax CGT Payment Form B on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to edit and eSign Capital Gains Tax CGT Payment Form B seamlessly

- Find Capital Gains Tax CGT Payment Form B and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Capital Gains Tax CGT Payment Form B and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the capital gains tax cgt payment form b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to avoid capital gains tax in Turkey?

If you sell your property within the first five years of the initial purchase, you will be subject to paying capital gains tax in Turkey. However, you will not need to pay this after the five years have lapsed.

-

How do I pay my CGT in the UK?

Sign into your Capital Gains Tax on UK property account to pay online. You can pay by: debit or corporate credit card. approving a payment through your online bank account - you'll be asked to sign in to your online bank account.

-

What is tax form B?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

-

How do you pay CGT?

You must register for CGT and then pay online using Revenue Online Service (ROS) or myAccount. To register for CGT: If you have a tax registration number, send a request through MyEnquiries. If you have never been registered for tax, complete Form TR1 (pdf) (if you are non-resident, use Form TR1 FT (pdf) instead)

-

What is the 6 year rule for capital gains tax?

If you use your former home to produce income (for example, you rent it out or make it available for rent), you can choose to treat it as your main residence for up to 6 years after you stop living in it. This is sometimes called the '6-year rule'. You can choose when to stop the period covered by your choice.

-

What is a 1099-B form for capital gains transactions?

Form 1099-B is sent by brokers to their customers for tax filing purposes. The form itemizes all transactions made during a tax year. Individuals use the information to fill out Schedule D listing their gains and losses for the tax year. The sum total is the individual's taxable gain (or loss) for the year.

-

How is CGT payable?

Capital gains tax is payable as part of your income tax assessment for the relevant income year. It's not a separate tax, instead, it forms part of your assessable income. This means you'll pay capital gains tax at the same time as you pay your income tax.

-

What is capital gain type B?

Type B – Term deposit :Type B account is similar to a fixed deposit account of a bank which offers interest at the rate applicable to term deposit and has restrictions similar to a term deposit. Maximum term allowed for a Type B account is 3 years.

Get more for Capital Gains Tax CGT Payment Form B

- Ocf 9 form

- United grand lodge of englander provided under rul form

- Www jtltraining comwp contentuploadscolour vision certificate jtl form

- Kyneton district horse and pony club inc form

- Anm cognitive decline request form

- Medical certificate for maternity benefit social w form

- Rf111 form 622920837

- Canada plan care child form

Find out other Capital Gains Tax CGT Payment Form B

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement