St 120 1 2016

What is the ST-120.1?

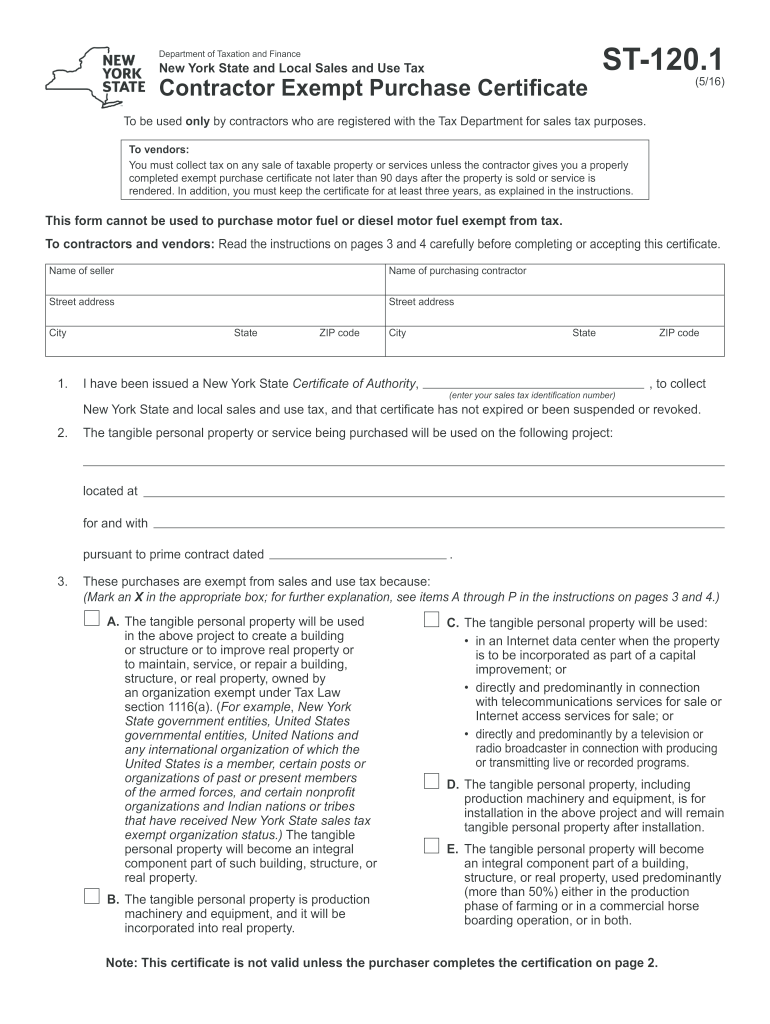

The ST-120.1 form, also known as the New York State Sales Tax Exempt Certificate, is a crucial document used by businesses and individuals in New York to claim sales tax exemptions. This form allows purchasers to buy goods or services without paying sales tax, provided the items are for exempt purposes. Common exemptions include purchases made by nonprofit organizations, government entities, and certain types of businesses. Understanding the ST-120.1 is essential for ensuring compliance with New York's tax regulations while maximizing potential savings.

How to Use the ST-120.1

Using the ST-120.1 form involves several steps to ensure it is filled out correctly and submitted appropriately. First, the purchaser must complete the form by providing their name, address, and the reason for the exemption. It is important to accurately describe the exempt use of the purchased items. Once completed, the form should be presented to the seller at the time of purchase. The seller must retain this form for their records to validate the tax-exempt transaction during audits.

Steps to Complete the ST-120.1

Completing the ST-120.1 form requires careful attention to detail. Follow these steps:

- Begin by entering the purchaser's name and address at the top of the form.

- Clearly indicate the type of exemption being claimed, such as for resale or for use by a tax-exempt organization.

- Provide a detailed description of the items being purchased and their intended use.

- Sign and date the form to certify that the information provided is accurate.

After filling out the form, present it to the seller to complete the tax-exempt purchase.

Legal Use of the ST-120.1

The ST-120.1 form is legally binding when used correctly. It is essential that the purchaser qualifies for the exemption claimed on the form. Misuse of the form, such as claiming exemptions for non-qualifying purchases, can lead to penalties and back taxes owed. Sellers are also responsible for verifying the legitimacy of the exemption and retaining the form as part of their sales records. Proper use of the ST-120.1 ensures compliance with New York State tax laws.

Eligibility Criteria for the ST-120.1

To be eligible to use the ST-120.1 form, the purchaser must meet specific criteria. These include:

- Being a recognized tax-exempt organization, such as a nonprofit or government agency.

- Purchasing items for resale in the regular course of business.

- Using the purchased items for exempt purposes, as defined by New York State tax regulations.

It is crucial for purchasers to verify their eligibility before using the ST-120.1 to avoid potential legal issues.

Form Submission Methods

The ST-120.1 form does not require formal submission to a government agency; instead, it is presented directly to the seller at the point of purchase. Sellers must keep the form on file for their records. In the event of an audit, the seller may be required to provide this documentation to demonstrate that the sale was exempt from sales tax. This process simplifies the transaction for both parties while ensuring compliance with state regulations.

Quick guide on how to complete 120 1 2016 2019 form

Your assistance manual on how to set up your St 120 1

If you’re curious about how to finalize and submit your St 120 1, here are some brief instructions to facilitate tax processing.

To begin, you simply need to create your airSlate SignNow account to change the way you manage documentation online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to modify, generate, and finalize your income tax documents effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures and return to revise responses as necessary. Streamline your tax management with superior PDF editing, eSigning, and intuitive sharing.

Adhere to the steps below to complete your St 120 1 in just a few minutes:

- Create your account and begin editing PDFs in moments.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Obtain form to access your St 120 1 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding electronic signature (if required).

- Examine your document and rectify any mistakes.

- Save changes, print out your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing by paper can boost return errors and delay refunds. It's important to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 120 1 2016 2019 form

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

-

Are there any chances to fill out the improvement form for 2019 of the RBSE board for 12 class?

Hari om, you are asking a question as to : “ Are there any chancesto fill out the improvement form for 2019 of the RBSE Board for 12 class?”. Hari om. Hari om.ANSWER :Browse through the following links for further details regarding the answers to your questions on the improvement exam for class 12 of RBSE 2019 :how to give improvement exams in rbse class 12is there a chance to fill rbse improvement form 2019 for a 12th class studentHari om.

Create this form in 5 minutes!

How to create an eSignature for the 120 1 2016 2019 form

How to generate an electronic signature for the 120 1 2016 2019 Form in the online mode

How to create an electronic signature for the 120 1 2016 2019 Form in Google Chrome

How to generate an electronic signature for signing the 120 1 2016 2019 Form in Gmail

How to generate an electronic signature for the 120 1 2016 2019 Form right from your mobile device

How to make an eSignature for the 120 1 2016 2019 Form on iOS

How to generate an electronic signature for the 120 1 2016 2019 Form on Android OS

People also ask

-

What is St 120 1 and how does it relate to airSlate SignNow?

St 120 1 is a key feature of airSlate SignNow that simplifies document management and electronic signatures. This functionality allows users to easily send, sign, and manage documents securely, making it a crucial tool for businesses looking to streamline their processes.

-

How much does airSlate SignNow with St 120 1 cost?

The pricing for airSlate SignNow that includes the St 120 1 feature is designed to be cost-effective, catering to various business sizes. Our plans start at competitive rates, ensuring that businesses can access powerful e-signature capabilities without breaking the bank.

-

What features does the St 120 1 offer for document signing?

The St 120 1 feature in airSlate SignNow includes advanced document signing capabilities, such as customizable templates and automated workflows. This helps businesses save time and maintain compliance, all while providing a seamless signing experience for customers.

-

How can St 120 1 benefit my business?

Utilizing the St 120 1 feature in airSlate SignNow can signNowly enhance your business's efficiency by reducing the time spent on manual paperwork. It also improves customer satisfaction through quick, hassle-free document signing, ultimately leading to faster transaction completions.

-

Does St 120 1 integrate with other software solutions?

Yes, airSlate SignNow’s St 120 1 feature seamlessly integrates with various software solutions, including CRM and document management systems. This integration capability allows businesses to create a cohesive workflow, enhancing productivity and operational efficiency.

-

Is St 120 1 secure for sensitive documents?

Absolutely. The St 120 1 feature in airSlate SignNow employs industry-standard encryption and security protocols to protect your sensitive documents. This ensures that your data remains confidential and secure throughout the signing process.

-

Can I use St 120 1 on mobile devices?

Yes, the St 120 1 feature is fully optimized for mobile use, allowing you to send and eSign documents on the go. This flexibility ensures that you can manage your documents anytime, anywhere, enhancing your business’s responsiveness and efficiency.

Get more for St 120 1

- Credit card authorization form for choice hotels

- Bank statement template download free forms amp samples for

- Form ssa 623 ocr sm

- Utility bill southern california gas company treasurer ca form

- Dea form 224a

- Imm5644epfd form

- Kansas referee workbook form

- Cook county economic disclosure statement and form

Find out other St 120 1

- eSign Utah Divorce Settlement Agreement Template Online

- eSign Vermont Child Custody Agreement Template Secure

- eSign North Dakota Affidavit of Heirship Free

- How Do I eSign Pennsylvania Affidavit of Heirship

- eSign New Jersey Affidavit of Residence Free

- eSign Hawaii Child Support Modification Fast

- Can I eSign Wisconsin Last Will and Testament

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy