Tax Supplement M BURR KEIM AGENCY Form

What is the Tax Supplement M BURR KEIM AGENCY

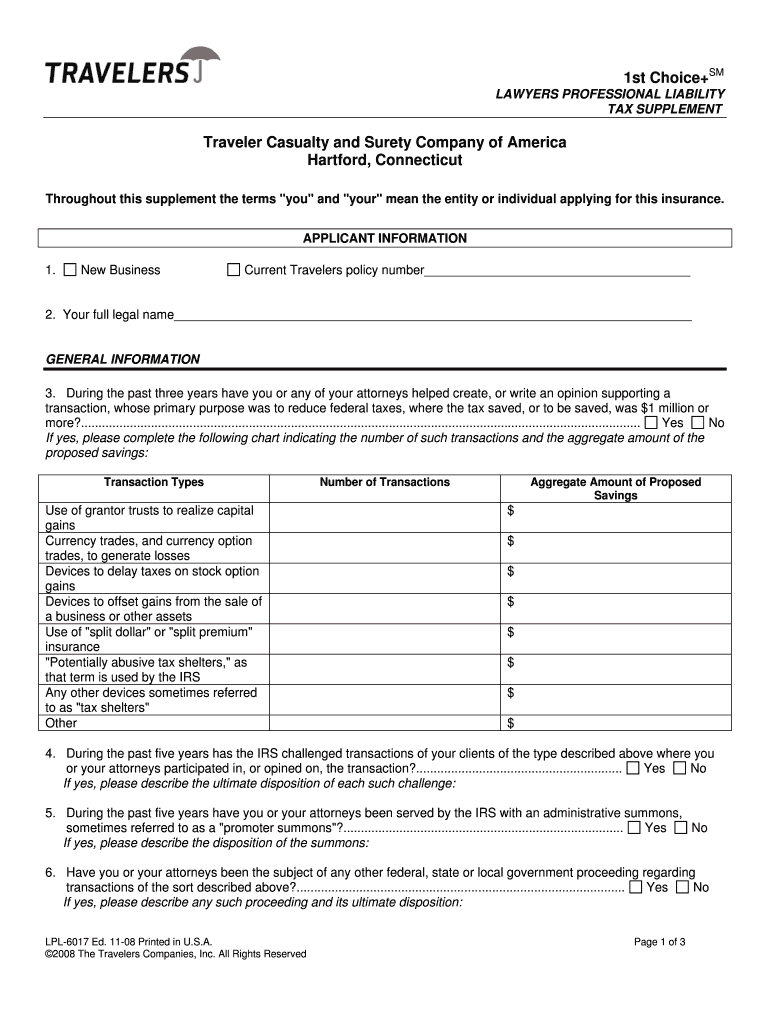

The Tax Supplement M BURR KEIM AGENCY is a specific form used to provide additional information related to tax filings. This supplement is typically utilized by taxpayers to clarify certain aspects of their financial situation that may not be fully captured in standard tax forms. It is essential for ensuring compliance with tax regulations and may be required by the IRS or state tax authorities.

How to use the Tax Supplement M BURR KEIM AGENCY

Using the Tax Supplement M BURR KEIM AGENCY involves filling out the form accurately to reflect your financial details. Taxpayers should gather all necessary financial documents, such as income statements and deduction records, before starting. Ensure that all information is complete and correct to avoid delays in processing. Once completed, the supplement should be submitted alongside your primary tax return to the appropriate tax authority.

Steps to complete the Tax Supplement M BURR KEIM AGENCY

Completing the Tax Supplement M BURR KEIM AGENCY requires careful attention to detail. Follow these steps for accurate submission:

- Gather all relevant financial documents.

- Fill out each section of the form, ensuring accuracy.

- Double-check all entries for completeness.

- Sign and date the form where required.

- Submit the completed supplement with your main tax return.

Required Documents

To complete the Tax Supplement M BURR KEIM AGENCY, you will need several key documents. These may include:

- W-2 forms from employers.

- 1099 forms for additional income.

- Receipts for deductible expenses.

- Any prior year tax returns for reference.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines when submitting the Tax Supplement M BURR KEIM AGENCY. Typically, tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Always check for any specific deadlines related to your state or local jurisdiction to ensure timely submission.

Penalties for Non-Compliance

Failing to submit the Tax Supplement M BURR KEIM AGENCY when required can result in penalties. These penalties may include fines, interest on unpaid taxes, and potential audits by tax authorities. It is important to ensure compliance to avoid these consequences and maintain good standing with the IRS and state tax agencies.

Quick guide on how to complete tax supplement m burr keim agency

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Tax Supplement M BURR KEIM AGENCY

Create this form in 5 minutes!

How to create an eSignature for the tax supplement m burr keim agency

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for Tax Supplement M BURR KEIM AGENCY

- Application for apartment applicant name djfj applicant name address city zip phone social security date of birth employer how form

- Mail to dsm capital funds form

- Application for radiation technology oregon health amp science ohsu form

- Form w 3c pr rev february

- Document object model dom level 2 events specification w3 form

- Making web sites accessible with its training cal poly training calpoly form

- Blackberry java application svg animation sample application overview form

- Personal assistant voiceobjects the phone application server form

Find out other Tax Supplement M BURR KEIM AGENCY

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy