Ny Resale Certificate St 120 2018-2026

What is the NY Resale Certificate ST-120?

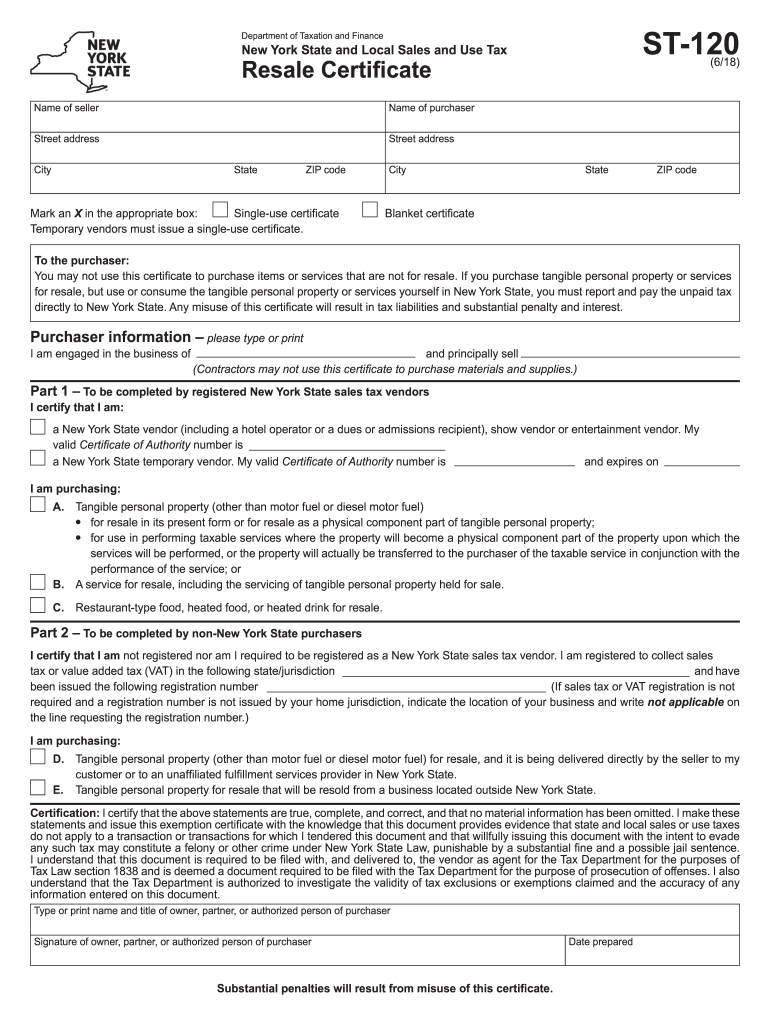

The NY Resale Certificate ST-120 is a crucial document used in New York State for tax-exempt purchases. This form allows businesses to buy goods without paying sales tax, provided those goods are intended for resale. The ST-120 serves as proof that the buyer is purchasing items for resale rather than personal use, which is essential for compliance with state tax regulations. It is important for retailers and wholesalers to understand the implications of using this certificate to ensure they adhere to the legal requirements set forth by the New York State Department of Taxation and Finance.

Steps to Complete the NY Resale Certificate ST-120

Completing the NY Resale Certificate ST-120 involves several straightforward steps:

- Obtain the form: Download the ST-120 from the New York State Department of Taxation and Finance website or request a physical copy.

- Fill in your business information: Include your name, address, and sales tax identification number. Accurate information is vital for validity.

- Detail the seller's information: Provide the name and address of the seller from whom you are purchasing the goods.

- Describe the items: Clearly list the items being purchased for resale, ensuring they are eligible for tax exemption.

- Sign and date the form: The certificate must be signed by an authorized representative of the purchasing business to be considered valid.

Once completed, the ST-120 should be presented to the seller at the time of purchase to avoid sales tax charges.

Legal Use of the NY Resale Certificate ST-120

The legal use of the NY Resale Certificate ST-120 is strictly defined by New York State tax laws. The certificate can only be used for purchases of tangible personal property intended for resale. Misuse of the ST-120, such as using it for personal purchases or for items not intended for resale, can lead to penalties and back taxes. Sellers are required to keep the certificate on file as proof of the tax-exempt status of the sale. It is essential for both buyers and sellers to understand the legal implications of this certificate to ensure compliance with state regulations.

How to Obtain the NY Resale Certificate ST-120

Obtaining the NY Resale Certificate ST-120 is a straightforward process. Businesses can access the form through the New York State Department of Taxation and Finance website. It is available as a downloadable PDF that can be printed and filled out. Additionally, businesses may request a physical copy from the department or consult with a tax professional for assistance. Ensuring that you have the most current version of the ST-120 is vital for compliance, as outdated forms may not be accepted by sellers.

Examples of Using the NY Resale Certificate ST-120

There are various scenarios where the NY Resale Certificate ST-120 can be utilized effectively:

- A retailer purchasing clothing items from a wholesaler to sell in their store can present the ST-120 to avoid paying sales tax on those items.

- A restaurant buying kitchen supplies intended for use in preparing meals for customers can use the certificate to purchase those supplies tax-free.

- A contractor purchasing materials for a construction project that will be billed to a client can apply the ST-120 to avoid upfront sales tax costs.

These examples illustrate the practical applications of the ST-120 in everyday business transactions, highlighting its importance in maintaining cash flow and reducing costs.

Eligibility Criteria for the NY Resale Certificate ST-120

To be eligible to use the NY Resale Certificate ST-120, a business must meet specific criteria:

- The business must be registered with the New York State Department of Taxation and Finance and possess a valid sales tax identification number.

- The items purchased must be intended for resale in the regular course of business, not for personal use.

- The buyer must be an authorized representative of the business, capable of signing the certificate.

Understanding these eligibility criteria is essential for businesses to ensure they comply with state tax laws and avoid potential penalties.

Quick guide on how to complete st 120 2018 2019 form

Your assistance manual on how to prepare your Ny Resale Certificate St 120

If you’re curious about how to complete and submit your Ny Resale Certificate St 120, here are a few brief pointers on how to simplify tax processing.

To begin, you only need to register your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and robust document solution that enables you to edit, generate, and finalize your income tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and go back to modify details as necessary. Streamline your tax management with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Ny Resale Certificate St 120 in no time:

- Establish your account and start working on PDFs within moments.

- Utilize our catalog to access any IRS tax form; review various versions and schedules.

- Select Get form to launch your Ny Resale Certificate St 120 in our editor.

- Populate the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Make the most of this guide to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can increase errors in returns and delay refunds. Certainly, before e-filing your taxes, refer to the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct st 120 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

Create this form in 5 minutes!

How to create an eSignature for the st 120 2018 2019 form

How to make an eSignature for the St 120 2018 2019 Form online

How to generate an electronic signature for the St 120 2018 2019 Form in Google Chrome

How to generate an eSignature for putting it on the St 120 2018 2019 Form in Gmail

How to create an electronic signature for the St 120 2018 2019 Form straight from your smartphone

How to make an electronic signature for the St 120 2018 2019 Form on iOS

How to create an eSignature for the St 120 2018 2019 Form on Android OS

People also ask

-

What is form st 120 and how is it used?

Form ST 120 is a New York State tax exemption certificate used by purchasers to claim exemption from sales tax. It is commonly utilized when buying items that are intended for resale or further manufacturing. Using form st 120 can streamline the sales process for businesses, allowing them to save costs on applicable taxes.

-

How does airSlate SignNow facilitate the signing of form st 120?

With airSlate SignNow, users can easily upload and manage form st 120 for electronic signatures. Our platform allows multiple parties to sign the document securely and efficiently from anywhere. This simplifies the process, ensuring that form st 120 is completed quickly and accurately.

-

Is there a fee associated with using airSlate SignNow for form st 120?

airSlate SignNow offers competitive pricing plans that cater to different business needs, including the processing of form st 120. Users can choose from various subscription options, making it an affordable solution for managing documents. Additionally, trial options are available, allowing you to evaluate the service before committing.

-

What features does airSlate SignNow offer for working with form st 120?

airSlate SignNow includes features such as template creation, secure electronic signatures, and document tracking for form st 120. Users can customize templates to suit their specific needs and streamline the signing process, enhancing overall efficiency. This makes it easier to handle multiple transactions requiring form st 120.

-

What are the benefits of using airSlate SignNow for form st 120?

Using airSlate SignNow for form st 120 reduces paperwork, speeds up the approval process, and enhances compliance with state regulations. The electronic signing process increases security and verification, thereby reducing the risk of errors. Businesses can save time and resources by digitizing the management of form st 120.

-

Can I integrate airSlate SignNow with other tools to manage form st 120?

Yes, airSlate SignNow offers integrations with various third-party applications, enabling seamless management of form st 120 alongside your existing workflow. Whether you use CRM systems, project management tools, or cloud storage solutions, our platform can work in conjunction with your preferred tools for increased efficiency.

-

Is it safe to use airSlate SignNow for processing form st 120?

Absolutely, airSlate SignNow takes security seriously and adheres to industry-standard protocols to protect your documents, including form st 120. Our platform uses encryption and secure storage features to ensure your data remains confidential. You can trust airSlate SignNow for secure electronic transactions.

Get more for Ny Resale Certificate St 120

- Abp 1676 4 grmh department of public social services form

- Form hud 9539 portal hud

- A47 025 2014 corporation tax returnvsd government of barbados form

- I noticed my cell phone bill was higher than usual and found a apps fcc form

- Fl all form

- Hud 92577 form

- Cc001144doc cdpr ca form

- Acceptable use policy aup fort bragg army bragg army form

Find out other Ny Resale Certificate St 120

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT