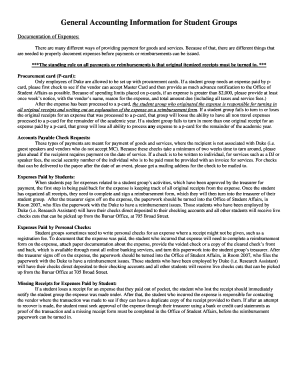

General Accounting Information for Student Groups

What is the General Accounting Information For Student Groups

The General Accounting Information For Student Groups serves as a comprehensive resource designed to assist student organizations in managing their financial activities. This information typically includes guidelines on budgeting, record-keeping, and reporting, ensuring that student groups adhere to accounting principles and institutional policies. By understanding these guidelines, student groups can maintain transparency and accountability in their financial dealings, which is essential for fostering trust among members and stakeholders.

Key Elements of the General Accounting Information For Student Groups

Several key elements are crucial for effective accounting within student groups. These include:

- Budgeting: Establishing a clear budget helps in planning and controlling financial resources.

- Record-Keeping: Maintaining accurate records of all financial transactions is essential for accountability.

- Reporting: Regular financial reports provide insights into the group's financial health and are often required by institutions.

- Compliance: Understanding and adhering to institutional policies and legal requirements is critical for avoiding penalties.

How to Use the General Accounting Information For Student Groups

Utilizing the General Accounting Information involves several steps. First, student groups should familiarize themselves with the guidelines provided. Next, they should implement a budgeting process that aligns with their goals and activities. Regularly updating financial records and preparing reports will help in monitoring the group's financial status. Lastly, staying informed about compliance requirements ensures that the group operates within legal and institutional frameworks.

Steps to Complete the General Accounting Information For Student Groups

Completing the General Accounting Information involves a systematic approach:

- Review the accounting guidelines specific to your institution.

- Set up a budget that outlines expected income and expenses.

- Document all financial transactions meticulously.

- Prepare periodic financial statements to assess the group's financial position.

- Submit necessary reports to the appropriate institutional authorities as required.

Legal Use of the General Accounting Information For Student Groups

Understanding the legal aspects of accounting is vital for student groups. This includes compliance with federal and state regulations, as well as institutional policies. Student organizations must ensure that their financial practices meet these legal requirements to avoid potential penalties. Engaging with a financial advisor or campus financial office can provide additional guidance on legal compliance.

Examples of Using the General Accounting Information For Student Groups

Practical examples of using the General Accounting Information include:

- Creating a budget for an event, such as a fundraiser or conference.

- Tracking expenses related to club activities to ensure spending aligns with the budget.

- Preparing an end-of-year financial report to present to the membership or university.

Quick guide on how to complete general accounting information for student groups

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, amend, and electronically sign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

Edit and eSign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the available tools to fill out your document.

- Highlight key sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether via email, text message (SMS), invitation link, or download it directly to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require reprinting documents. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Revise and eSign [SKS], ensuring outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to General Accounting Information For Student Groups

Create this form in 5 minutes!

How to create an eSignature for the general accounting information for student groups

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is general information about accounting?

What Is Accounting? Accounting is the process of recording financial transactions pertaining to a business. The accounting process includes summarizing, analyzing, and reporting these transactions to oversight agencies, regulators, and tax collection entities.

-

What are the general basics of accounting?

Accounting basics assets – assets are items that are acquired or purchased but not immediately consumed. ... liabilities – liabilities are business obligations that are intended to be paid at a later date. ... equity – you can figure out equity by calculating your assets minus liabilities.

-

What are the 5 main in accounting?

There are five main account type categories that all transactions can fall into on a standard COA. These are asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts. These categories are universal to all businesses.

-

What is the 5 concept in accounting?

There are ten main accounting concepts, or principles of accounting that we will discuss in this article: the going concern concept, accrual basis of accounting, revenue recognition principle, matching principle, full disclosure principle, conservatism principle, materiality principle, income measurement objective and ...

-

What are the 5 main components of an accounting system?

There are five main components in an accounting system. Each part has a different job and accomplishes different step in the financial reporting process. The five components are source documents, input devices, information processors, information storage, and output devices.

-

What is general purpose accounting information?

General purpose financial statements (GPFS) are a set of financial reports that are intended to be used by a wide range of users, including investors, creditors, regulators, and management. The most common general purpose financial statements are: the balance sheet. income statement.

-

What are the 5 basic accounting elements?

The 5 primary account categories are assets, liabilities, equity, expenses, and income (revenue)

-

What are the 5 basic accounting principles?

What are the 5 basic principles of accounting? Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle. ... Cost Principle. ... Matching Principle. ... Full Disclosure Principle. ... Objectivity Principle.

Get more for General Accounting Information For Student Groups

- Compost sample submittal form

- Child safety seat registration form for your child39s transportation nebraska

- Form 123 physician39s initial report of work injury or occupational laborcommission utah

- Form 1099 patr 1099 fire

- Bfsfcu visa debit card application form

- Dear prospective nursing student thank you for your interest in cleveland state university and the school of nursing csuohio form

- Dear doctoral candidate thank you for your interest in our doctor of ngu form

- The hyogo international summer school pitzer college pitzer form

Find out other General Accounting Information For Student Groups

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors