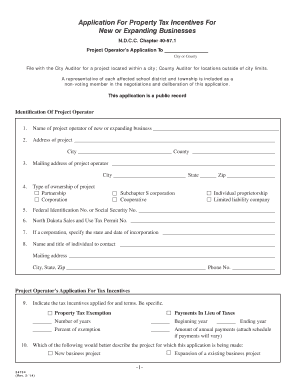

Application for Property Tax Incentives for New or Expanding Form

What is the Application For Property Tax Incentives For New Or Expanding

The Application For Property Tax Incentives For New Or Expanding is a formal request submitted by businesses seeking financial relief through property tax reductions or exemptions. This application is typically aimed at new businesses or those expanding their operations, allowing them to invest more resources into growth rather than tax liabilities. Various states in the U.S. offer these incentives to encourage economic development, job creation, and community revitalization.

Eligibility Criteria

To qualify for property tax incentives, applicants must meet specific criteria, which can vary by state. Generally, eligibility may depend on factors such as:

- The type of business and industry sector.

- The location of the business and its impact on the local economy.

- The number of jobs created or retained as a result of the expansion.

- Investment amounts in property or infrastructure.

It is essential for applicants to review their state’s guidelines to ensure they meet all necessary requirements before submitting their application.

Steps to complete the Application For Property Tax Incentives For New Or Expanding

Completing the application involves several key steps to ensure accuracy and compliance with local regulations. The typical process includes:

- Gathering necessary documentation, such as financial statements and business plans.

- Filling out the application form, providing detailed information about the business and its expansion plans.

- Submitting the application by the specified deadline, either online or via mail.

- Following up with local authorities to confirm receipt and address any additional inquiries.

Each state may have unique requirements, so it is important to consult local resources for specific instructions.

Required Documents

When applying for property tax incentives, businesses typically need to provide various documents to support their application. Commonly required documents include:

- Proof of business registration and ownership.

- Financial statements, including balance sheets and income statements.

- Detailed project plans outlining the expansion or new development.

- Evidence of job creation or retention plans.

Ensuring that all required documents are complete and accurate can significantly enhance the chances of approval.

Form Submission Methods

The Application For Property Tax Incentives For New Or Expanding can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state’s tax authority website.

- Mailing a physical copy of the application to the appropriate local office.

- In-person submission at designated government offices.

Choosing the correct submission method is crucial for meeting deadlines and ensuring the application is processed efficiently.

Application Process & Approval Time

The application process for property tax incentives can vary in length based on the complexity of the request and the specific state regulations. Generally, the process involves:

- Initial review of the application by local tax authorities.

- Possible requests for additional information or clarification.

- A formal decision made by the relevant governing body.

Approval times can range from a few weeks to several months, depending on the jurisdiction and the volume of applications being processed.

Quick guide on how to complete application for property tax incentives for new or expanding

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular with businesses and individuals alike. It offers an excellent eco-friendly option to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-centered process today.

How to edit and eSign [SKS] without breaking a sweat

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically designed for that purpose from airSlate SignNow.

- Generate your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow caters to your document administration needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Property Tax Incentives For New Or Expanding

Create this form in 5 minutes!

How to create an eSignature for the application for property tax incentives for new or expanding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to apply for NYC property tax rebate?

You may submit your additional information online. Applying online is the easiest way to apply, and if eligible you will receive your rebate more quickly. If you are not able to apply online, you can download and complete a paper application.

-

At what age do you stop paying property taxes in North Dakota?

If you are a homeowner age 65 or older you may qualify for the Homestead Property Tax Credit program. To be eligible for this program, you (the homeowner) must: Live at and be invested in the property.

-

At what age do you stop paying property taxes in California?

State Property Tax Postponement Program – Seniors The State Controller's Property Tax Postponement Program allows homeowners who are 62 and over and who meet other requirements to file for a postponement.

-

What is the property tax relief for 2024 in North Dakota?

The Primary Residence Credit amount is up to $500 for an approved application and cannot exceed the amount of property tax due.

-

What states have property tax breaks for seniors?

The following states offer partial exemption on property taxes for seniors and people over 65. Hawaii. In Hawaii, if you're 65 or older, you could knock $160,000 off your home's assessed value, reducing your property tax liability. ... Louisiana. ... Alaska. ... New York. ... Washington. ... Mississippi. ... Florida. ... South Dakota.

-

How do I get help with property taxes in Michigan?

Visit the Michigan Poverty Exemption from Property Taxes webpage from the Michigan State University Low-Income Taxpayer Clinic. Or see the Michigan Tax Tribunal's website or contact the MTT at 517-335-9760. Questions can also be directed to your Board of Review in the city or township where your property is located.

-

What is the property tax relief form in North Dakota?

By filing a special new form, called Form ND-3, you can obtain your property tax relief in the form of a property tax relief certificate. You can redeem this certificate at your county treasurer's office. The amount of the relief is equal to the residential property tax credit (as described earlier in this brochure).

-

Is there a property tax break for seniors in North Dakota?

If you are a homeowner age 65 or older you may qualify for the Homestead Property Tax Credit program. To be eligible for this program, you (the homeowner) must: Live at and be invested in the property.

Get more for Application For Property Tax Incentives For New Or Expanding

- Do not staple 6969 omb no irs form

- Contractor assistance loan program cap application package form

- Download the chicago plan registration form chicago police portal chicagopolice

- Irs building doc irs form

- Ca custodial acct appl web docx form

- Billing amp payment consumers energy form

- Small business energy savings comed form

- Institutional fund class i shares new account virtus form

Find out other Application For Property Tax Incentives For New Or Expanding

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy