New York State Department of Taxation and Finance Yonkers Nonresident Earnings Tax Return for the Full Year January 1, , through Form

Understanding the New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return

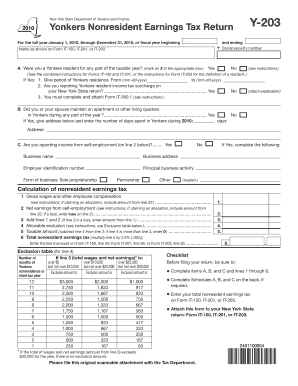

The New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return is a crucial document for individuals who earn income in Yonkers but reside outside of New York State. This return is specifically for the full year, covering the period from January 1 through December 31, or for a fiscal year beginning on a specified date. It allows nonresidents to report their Yonkers earnings and calculate the appropriate taxes owed to the city. Understanding this form is essential for compliance with local tax laws and to avoid potential penalties.

Steps to Complete the Yonkers Nonresident Earnings Tax Return

Completing the Yonkers Nonresident Earnings Tax Return involves several steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Review the instructions provided with the form to understand the specific requirements.

- Fill out the form accurately, ensuring all income earned in Yonkers is reported.

- Calculate the tax owed based on the provided tax rates for nonresidents.

- Double-check all entries for accuracy before submitting the form.

Required Documents for Filing

When filing the Yonkers Nonresident Earnings Tax Return, certain documents are essential to ensure a smooth process. These include:

- W-2 forms from all employers that report income earned in Yonkers.

- 1099 forms for any freelance or contract work performed in the city.

- Records of any other income sources that may be subject to Yonkers tax.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines for the Yonkers Nonresident Earnings Tax Return. Typically, the return is due on April 15 of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates helps avoid late penalties and ensures timely compliance with tax obligations.

Form Submission Methods

The Yonkers Nonresident Earnings Tax Return can be submitted through various methods, providing flexibility for taxpayers. These methods include:

- Online submission through the New York State Department Of Taxation And Finance website.

- Mailing a completed paper form to the designated tax office.

- In-person submission at local tax offices, if available.

Penalties for Non-Compliance

Failure to file the Yonkers Nonresident Earnings Tax Return or inaccuracies in the submitted information can result in penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes that accrues over time.

- Potential legal action for continued non-compliance.

Quick guide on how to complete new york state department of taxation and finance yonkers nonresident earnings tax return for the full year january 1 through

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or conceal sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return For The Full Year January 1, , Through

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance yonkers nonresident earnings tax return for the full year january 1 through

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How many allowances should I put?

Many people would take an allowance for every single person that they were responsible for financially. So if you had yourself, a spouse and two children, you may claim four allowances.

-

What does New York State and Yonkers allowances mean?

A larger number of withholding allowances means a smaller New York income tax deduction from your paycheck, and a smaller number of allowances means a larger New York income tax deduction from your paycheck. Changes effective beginning 2023.

-

Is it better to claim 1 or 0 allowances?

Claiming more allowances will lower the amount of income tax that's taken out of your check. Conversely, if the total number of allowances you're claiming is zero, that means you'll have the most income tax withheld from your take-home pay.

-

What is Yonkers nonresident tax?

A tax is hereby imposed at a rate of 1/2 of 1% on the wages earned, and net earnings from self employment, within the City of Yonkers of every nonresident, individual, estate and trust.

-

Do I have to file NY state tax return for nonresident?

You must file Form IT-203, Nonresident and Part-Year Resident Income Tax Return, if you: were not a resident of New York State and received income during the tax year from New York State sources, or. moved into or out of New York State during the tax year.

-

Why is TurboTax asking me about Yonkers?

Yonkers residents and non-residents who work in Yonkers are subject to the Yonkers Resident Income Tax or the Yonkers Nonresident Income Tax, respectively. In fact, the NY individual income tax return directly asks whether you lived in Yonkers during the year.

-

How many allowances should I claim for a NYC single?

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

-

What are NY state allowances?

Allowances: A withholding allowance is an exemption that lowers the amount of income tax your employer must deduct from your paycheck.

Get more for New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return For The Full Year January 1, , Through

- How much time does it take to get a wire transfer which is form

- Section i hardship withdrawal instructions cuna mutual group form

- Ssa 89 form

- Mortgage document checklist pdf form

- Forms equity trust company

- Pension fund forms ampamp notices retirement

- Va bsp truist form

- Notary service invoice template form

Find out other New York State Department Of Taxation And Finance Yonkers Nonresident Earnings Tax Return For The Full Year January 1, , Through

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement